Western Union 2010 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2010 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.in a material adverse effect on the Company’s financial position, results of operations and cash flows. The Company

accrues for loss contingencies as they become probable and estimable.

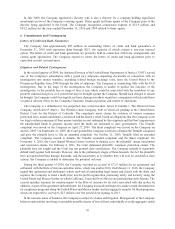

In May 2007, the Company initiated litigation against MoneyGram Payment Systems, Inc. (“MoneyGram”) for

infringement of the Company’s Money Transfer by Phone patents by MoneyGram’s FormFree service. On

September 24, 2009, a jury found that MoneyGram was liable for patent infringement and awarded the

Company $16.5 million in damages. On December 7, 2010, the United States Court of Appeals for the Federal

Circuit reversed the trial court’s judgment. On January 6, 2011, the Company filed a Combined Petition for Panel

Rehearing and Rehearing En Banc in the Federal Circuit, which was denied on February 8, 2011. In accordance with

its policies, the Company does not recognize gain contingencies in earnings until realization and collectability are

assured.

Pursuant to the separation and distribution agreement with First Data in connection with the Spin-off, First Data

and the Company are each liable for, and agreed to perform, all liabilities with respect to their respective businesses.

In addition, the separation and distribution agreement also provides for cross-indemnities principally designed to

place financial responsibility for the obligations and liabilities of the Company’s business with the Company and

financial responsibility for the obligations and liabilities of First Data’s retained businesses with First Data. The

Company also entered into a tax allocation agreement that sets forth the rights and obligations of First Data and the

Company with respect to taxes imposed on their respective businesses both prior to and after the Spin-off as well as

potential tax obligations for which the Company may be liable in conjunction with the Spin-off (see Note 10).

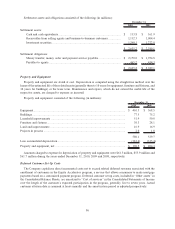

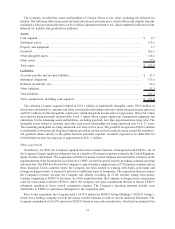

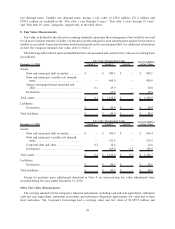

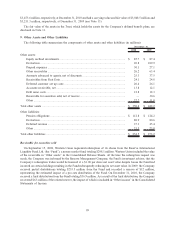

7. Investment Securities

Investment securities, classified within “Settlement assets” in the Consolidated Balance Sheets, consist

primarily of high-quality state and municipal debt securities. The Company is required to maintain specific

high-quality, investment grade securities and such investments are restricted to satisfy outstanding settlement

obligations in accordance with applicable state and foreign country requirements. The substantial majority of the

Company’s investment securities are classified as available-for-sale and recorded at fair value. Investment securities

are exposed to market risk due to changes in interest rates and credit risk. The Company regularly monitors credit

risk and attempts to mitigate its exposure by making high-quality investments and through investment

diversification. At December 31, 2010, the majority of the Company’s investment securities had credit ratings

of “AA-” or better from a major credit rating agency.

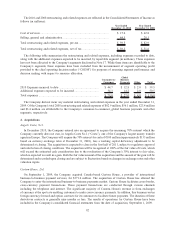

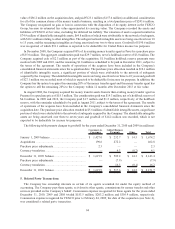

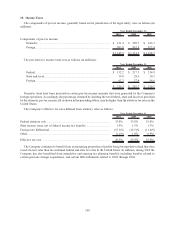

On October 1, 2009 (the “Transition Date”), the Company assumed IPS’s role as issuer of money orders and

terminated the existing agreement whereby IPS paid the Company a fixed return of 5.5% on the outstanding money

order balances. Following the Transition Date, the Company invested the cash received from IPS in high-quality,

investment grade securities, primarily tax exempt United States state and municipal debt securities, in accordance

with applicable regulations. Prior to the Transition Date, the Company had entered into interest rate swaps on

certain of its fixed rate notes to reduce its exposure to fluctuations in interest rates. Through a combination of the

revenue generated from these investment securities and the anticipated interest expense savings resulting from the

interest rate swaps, the Company estimates that it should be able to retain a materially comparable after-tax rate of

return through 2011 as it was receiving under its agreement with IPS. Refer to Note 14 for additional information on

the interest rate swaps.

Subsequent to the Transition Date, all revenue generated from the investment portfolio is being retained by the

Company. IPS continues to provide the Company with clearing services necessary for payment of the money orders

in exchange for the payment by the Company to IPS of a per-item processing fee. The Company no longer provides

to IPS the services required under the original money order agreement or receives from IPS the fee for such services.

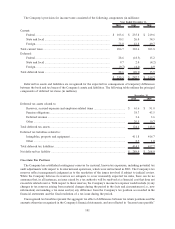

In 2008, the Company began increasing its investment levels in various state and municipal variable rate demand

note securities which can be put (sold at par) typically on a daily basis with settlement periods ranging from the

same day to one week, but that have varying maturities through 2042. Generally, these securities are used by the

Company for short-term liquidity needs and are held for short periods of time, typically less than 30 days. As a

result, this has increased the frequency of purchases and proceeds received by the Company.

96