Western Union 2010 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2010 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

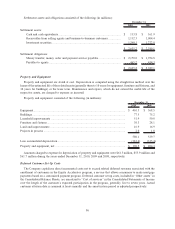

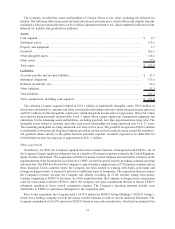

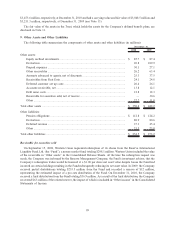

The 2010 and 2008 restructuring and related expenses are reflected in the Consolidated Statements of Income as

follows (in millions):

Year Ended

December 31, 2010

Year Ended

December 31, 2008

Cost of services ................................................................................... $ 15.0 $ 62.8

Selling, general and administrative........................................................ 44.5 20.1

Total restructuring and related expenses, pre-tax .................................... $ 59.5 $ 82.9

Total restructuring and related expenses, net of tax ................................ $ 39.3 $ 51.6

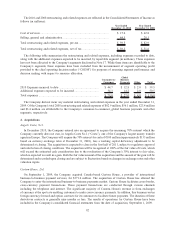

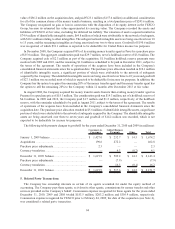

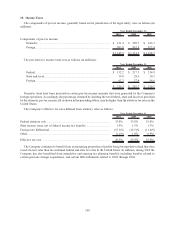

The following table summarizes the restructuring and related expenses, including expenses recorded to date,

along with the additional expenses expected to be incurred, by reportable segment (in millions). These expenses

have not been allocated to the Company’s segments disclosed in Note 17. While these items are identifiable to the

Company’s segments, these expenses have been excluded from the measurement of segment operating profit

provided to the chief operating decision maker (“CODM”) for purposes of assessing segment performance and

decision making with respect to resource allocation.

Consumer-to-

Consumer

Global

Business

Payments Other Total

2010 Expenses incurred to date ................................................ $ 44.7 $ 12.8 $ 2.0 $ 59.5

Additional expenses expected to be incurred .............................. 34.3 14.2 2.0 50.5

Total expenses ......................................................................... $ 79.0 $ 27.0 $ 4.0 $ 110.0

The Company did not incur any material restructuring and related expenses in the year ended December 31,

2009. Of the Company’s total 2008 restructuring and related expenses of $82.9 million; $56.1 million, $23.4 million

and $3.4 million are attributable to the Company’s consumer-to-consumer, global business payments and other

segments, respectively.

4. Acquisitions

Angelo Costa, S.r.l.

In December 2010, the Company entered into an agreement to acquire the remaining 70% interest which the

Company currently does not own, in Angelo Costa S.r.l. (“Costa”), one of the Company’s largest money transfer

agents in Europe. The Company will acquire the 70% interest for cash of A100 million (approximately $133 million

based on currency exchange rates at December 31, 2010), less a working capital deficiency adjustment to be

determined at closing. The acquisition is expected to close in the first half of 2011, subject to regulatory approval

and satisfaction of closing conditions. The acquisition will be recognized at 100% of the fair value of Costa, which

will exceed the estimated cash consideration due to the revaluation of the Company’s 30% interest to fair value,

which is expected to result in a gain. Both the fair value amount of the acquisition and the amount of the gain will be

determined and recorded upon closing and are subject to fluctuation based on changes in exchange rates and other

valuation inputs.

Custom House, Ltd.

On September 1, 2009, the Company acquired Canada-based Custom House, a provider of international

business-to-business payment services, for $371.0 million. The acquisition of Custom House has allowed the

Company to enter the international business-to-business payments market. Custom House facilitates cross-border,

cross-currency payment transactions. These payment transactions are conducted through various channels

including the telephone and internet. The significant majority of Custom House’s revenue is from exchanges

of currency at the spot rate enabling customers to make cross-currency payments. In addition, this business writes

foreign currency forward and option contracts for its customers to facilitate future payments. The duration of these

derivatives contracts is generally nine months or less. The results of operations for Custom House have been

included in the Company’s consolidated financial statements from the date of acquisition, September 1, 2009.

92