Western Union 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States and competitive pressures, which resulted in lower cash and electronic volumes and a shift to lower

revenue per transaction products, also contributed to the revenue declines.

The transaction declines during the year ended December 31, 2010 compared to the same period in 2009 were

due to declines in our United States bill payments businesses.

2009 compared to 2008

During the year ended December 31, 2009, the global business payments segment revenue was adversely

impacted by the weak economic situation in the United States, which resulted in a revenue decline in our United

States cash and electronic bill payments businesses, partially offset by $30.8 million in revenue generated from our

September 1, 2009 acquisition of Custom House and slight growth in the Pago Fácil business. The segment’s

revenues were primarily generated in the United States for the year ended December 31, 2009.

Transaction growth during the year ended December 31, 2009 compared to 2008 was driven by our Pago Fácil

cash-based and United States electronic-based bill payments businesses. Both of these businesses carry a lower

revenue per transaction than our United States cash-based bill payment business. The transaction growth was offset

by a decline in the United States cash-based bill payments business.

Operating income

2010 compared to 2009

For the year ended December 31, 2010, operating income decreased compared to the same period in the prior

year primarily due to declines related to the United States-based bill payments business, and investing and operating

costs, including amortization expense, associated with the acquisition of Custom House.

The decline in operating income margin in the segment is primarily due to the increased costs associated with the

acquisition of Custom House and declines in our United States bill payments businesses.

2009 compared to 2008

For the year ended December 31, 2009, operating income decreased compared to the same period in the prior

year primarily due to operating income declines related to the United States-based bill payments business and

operating and integration costs associated with the acquisition of Custom House, offset slightly by the savings

generated from the 2008 restructurings.

The decline in operating income margin in the segment is due to the factors described above and continues to be

impacted by the decline in the United States cash-based bill payments business which has a higher operating income

margin than our South America and electronic businesses.

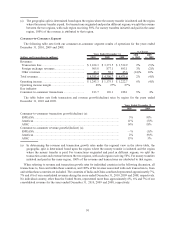

Other

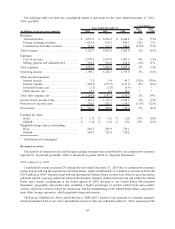

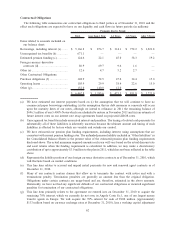

The following table sets forth other results for the years ended December 31, 2010, 2009 and 2008.

(dollars in millions) 2010 2009 2008

2010

vs. 2009

2009

vs. 2008

Years Ended December 31,

% Change

Revenues ............................................................... $ 87.6 $ 91.2 $ 90.6 (4)% 1%

Operating income ................................................... $ (6.2) $ 6.3 $ 15.8 * (60)%

Operating income margin........................................ * 7% 17%

* Calculation not meaningful

Revenues

2010 compared to 2009

Revenue, generated primarily from our money order services business, declined for the year ended December 31,

2010 compared to the same period in the prior year. We experienced a decrease in the amount of revenue earned

54