Western Union 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

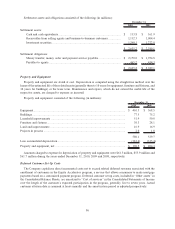

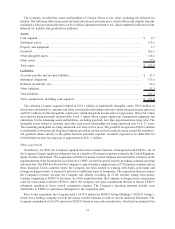

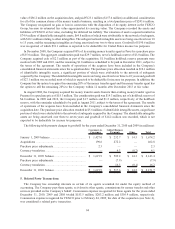

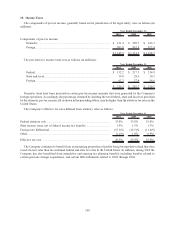

The Company recorded the assets and liabilities of Custom House at fair value, excluding the deferred tax

liability. The following table summarizes the final allocation of purchase price, which differs only slightly from the

preliminary allocation primarily due to an $8.3 million adjustment related to tax, which resulted in reductions to the

deferred tax liability and goodwill (in millions):

Assets:

Cash acquired............................................................................................................................. $ 2.5

Settlement assets ........................................................................................................................ 153.6

Property and equipment .............................................................................................................. 6.7

Goodwill .................................................................................................................................... 264.3

Other intangible assets ................................................................................................................ 118.1

Other assets................................................................................................................................ 77.6

Total assets................................................................................................................................. $ 622.8

Liabilities:

Accounts payable and accrued liabilities ...................................................................................... $ 23.3

Settlement obligations ................................................................................................................. 153.6

Deferred tax liability, net............................................................................................................. 23.6

Other liabilities........................................................................................................................... 51.3

Total liabilities ........................................................................................................................... 251.8

Total consideration, including cash acquired ................................................................................. $ 371.0

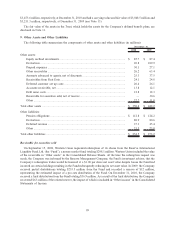

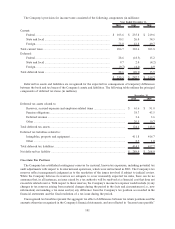

The valuation of assets acquired resulted in $118.1 million of identifiable intangible assets, $99.8 million of

which were attributable to customer and other contractual relationships and were valued using an income approach

and $18.3 million of other intangibles, which were valued using both income and cost approaches. These fair values

were derived using primarily unobservable Level 3 inputs which require significant management judgment and

estimation. For the remaining assets and liabilities, excluding goodwill, fair value approximated carrying value. The

intangible assets related to customer and other contractual relationships are being amortized over 10 to 12 years.

The remaining intangibles are being amortized over three to five years. The goodwill recognized of $264.3 million

is attributable to the projected long-term business growth in current and new markets and an assembled workforce.

All goodwill relates entirely to the global business payments segment. Goodwill expected to be deductible for

United States income tax purposes is approximately $231.3 million.

Other acquisitions

On February 24, 2009, the Company acquired the money transfer business of European-based FEXCO, one of

the Company’s largest agents providing services in a number of European countries, primarily the United Kingdom,

Spain, Sweden and Ireland. The acquisition of FEXCO’s money transfer business has assisted the Company in the

implementation of the Payment Services Directive (“PSD”) in the European Union by providing an initial operating

infrastructure. The PSD has allowed the Company to operate under a single license in 27 European countries and, in

those European Union countries where the Company has been limited to working with banks, post-banks and

foreign exchange houses, to expand its network to additional types of businesses. The acquisition does not impact

the Company’s revenue, because the Company was already recording all of the revenue arising from money

transfers originating at FEXCO’s locations. As of the acquisition date, the Company no longer incurs commission

costs for transactions related to FEXCO; rather, the Company now pays commissions directly to former FEXCO

subagents, resulting in lower overall commission expense. The Company’s operating expenses include costs

attributable to FEXCO’s operations subsequent to the acquisition date.

Prior to the acquisition, the Company held a 24.65% interest in FEXCO Group Holdings (“FEXCO Group”),

which was a holding company for both the money transfer business as well as various unrelated businesses. The

Company surrendered its 24.65% interest in FEXCO Group as non-cash consideration, which had an estimated fair

93