Western Union 2010 Annual Report Download - page 90

Download and view the complete annual report

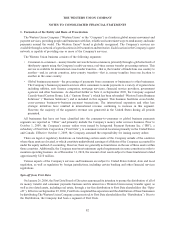

Please find page 90 of the 2010 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Revenue Recognition

The Company’s revenues are primarily derived from consumer money transfer transaction fees that are based on

the principal amount of the money transfer and the locations from and to which funds are transferred. The Company

also offers several global business payments services, including payments from consumers or businesses to other

businesses. Transaction fees are set by the Company and recorded as revenue at the time of sale.

In certain consumer money transfer and global business payments transactions involving different currencies,

the Company generates revenue based on the difference between the exchange rate set by the Company to the

customer and the rate at which the Company or its agents are able to acquire currency. This foreign exchange

revenue is recorded at the time the related consumer money transfer transaction fee revenue is recognized or at the

time a customer initiates a transaction through the Company’s cross-border, cross-currency international

business-to-business payment service operations.

The Company’s Equity Accelerator service generally requires a consumer to pay an upfront enrollment fee to

participate in this mortgage payment service. These enrollment fees are deferred and recognized into income over

the length of the customer’s expected participation in the program, generally five to seven years. Actual customer

attrition data is assessed at least annually and the period over which revenue is recognized is adjusted prospectively.

Many factors impact the duration of the expected customer relationship, including interest rates, refinance activity

and trends in consumer behavior.

Cost of Services

Cost of services primarily consists of agent commissions and expenses for call centers, settlement operations,

and related information technology costs. Expenses within these functions include personnel, software, equipment,

telecommunications, bank fees, depreciation and amortization and other expenses incurred in connection with

providing money transfer and other payment services.

Advertising Costs

Advertising costs are charged to operating expenses as incurred or at the time the advertising first takes place.

Advertising costs for the years ended December 31, 2010, 2009 and 2008 were $163.9 million, $201.4 million and

$247.1 million, respectively.

Income Taxes

The Company accounts for income taxes under the liability method, which requires that deferred tax assets and

liabilities be determined based on the expected future income tax consequences of events that have been recognized

in the consolidated financial statements. Deferred tax assets and liabilities are recognized based on temporary

differences between the financial statement carrying amounts and tax bases of assets and liabilities using enacted

tax rates in effect in the years in which the temporary differences are expected to reverse.

The Company recognizes the tax benefits from uncertain tax positions only when it is more likely than not, based

on the technical merits of the position, the tax position will be sustained upon examination, including the resolution

of any related appeals or litigation. The tax benefits recognized in the consolidated financial statements from such a

position are measured as the largest benefit that has a greater than fifty percent likelihood of being realized upon

ultimate resolution.

Foreign Currency Translation

The United States dollar is the functional currency for all of the Company’s businesses except global business

payments subsidiaries located primarily in Canada and South America. Revenues and expenses are translated at

average exchange rates prevailing during the period. Foreign currency denominated assets and liabilities for those

entities for which the local currency is the functional currency are translated into United States dollars based on

exchange rates at the end of the period. The effects of foreign exchange gains and losses arising from the translation

of assets and liabilities of these entities are included as a component of “Accumulated other comprehensive loss.”

Foreign currency denominated monetary assets and liabilities of operations in which the United States dollar is the

88