Western Union 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Earnings per share increased for the year ended December 31, 2010 compared to the corresponding previous

period as a result of the previously described factors impacting net income and lower weighted-average shares

outstanding. Earnings per share decreased for the year ended December 31, 2009 compared to 2008 as a result of the

previously described factors impacting net income, offset by lower weighted-average diluted shares outstanding.

The lower number of shares outstanding was due to stock repurchases exceeding stock option exercises in both 2010

and 2009 compared to the corresponding periods in the prior years.

Segment Discussion

We manage our business around the consumers and businesses we serve and the types of services we offer. Each

of our two segments addresses a different combination of consumer groups, distribution networks and services

offered. Our segments are consumer-to-consumer and global business payments. Businesses not considered part of

these segments are categorized as “Other.”

The business segment measurements provided to, and evaluated by, our CODM are computed in accordance with

the following principles:

• The accounting policies of the reporting segments are the same as those described in the summary of

significant accounting policies.

• Corporate and other overhead is allocated to the segments primarily based on a percentage of the segments’

revenue compared to total revenue.

• Expenses incurred in connection with mergers and acquisitions are included in “Other.”

• We incurred expenses of $59.5 million and $82.9 million for restructuring and related activities for the years

ended December 31, 2010 and 2008, respectively, which were not allocated to segments. No expenses were

recognized for restructurings and related activities in 2009. While these items were identifiable to our

segments, they were not included in the measurement of segment operating profit provided to the CODM for

purposes of assessing segment performance and decision making with respect to resource allocation. For

additional information on restructuring and related activities refer to “Operating expenses overview.”

• During 2009, we recorded an accrual of $71.0 million resulting from the multi-state agreement and settlement,

which was not allocated to the segments. While this item was identifiable to our consumer-to-consumer

segment, it was not included in the measurement of segment operating profit provided to the CODM for

purposes of assessing segment performance and decision making with respect to resource allocation. For

additional information on the settlement accrual, refer to “Operating expenses overview.”

• All items not included in operating income are excluded.

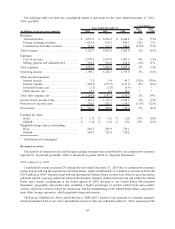

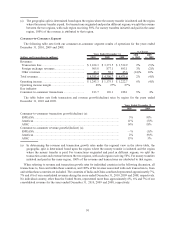

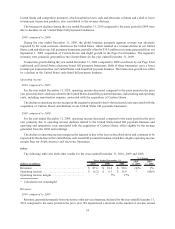

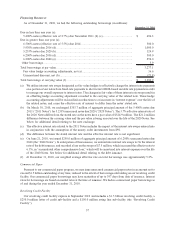

The following table sets forth the components of segment revenues as a percentage of the consolidated totals for

the years ended December 31, 2010, 2009 and 2008.

2010 2009 2008

Years Ended December 31,

Consumer-to-consumer (a)

EMEASA ............................................................................................. 44% 45% 44%

Americas .............................................................................................. 31% 32% 34%

APAC................................................................................................... 9% 8% 7%

Total consumer-to-consumer .................................................................... 84% 85% 85%

Global business payments........................................................................ 14% 14% 14%

Other ..................................................................................................... 2% 1% 1%

100% 100% 100%

49