Western Union 2010 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2010 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

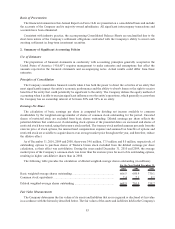

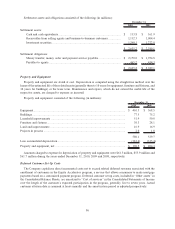

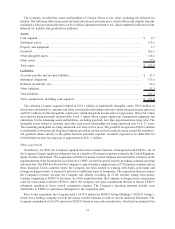

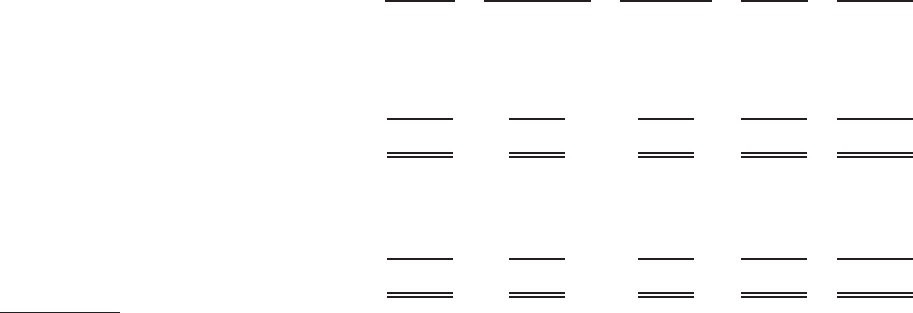

The following table summarizes the activity for the restructuring and related expenses discussed above and the

related restructuring accruals for the year ended December 31, 2010 (in millions):

Severance

and

Employee

Related

Fixed Asset

Write-Offs and

Accelerated

Depreciation

Lease

Terminations Other (b) Total

Balance, December 31, 2009 ...................... $ — $ — $ — $ — $ —

Expenses (a) .............................................. 48.7 0.9 — 9.9 59.5

Cash payments ........................................... (13.7) — — (8.8) (22.5)

Non-cash charges (a) .................................. (0.7) (0.9) — — (1.6)

Balance, December 31, 2010 ...................... $ 34.3 $ — $ — $ 1.1 $ 35.4

Cumulative expenses incurred to date .......... $ 48.7 $ 0.9 $ — $ 9.9 $ 59.5

Additional expenses expected to be

incurred ................................................. 31.3 1.1 8.0 10.1 50.5

Total expenses ........................................... $ 80.0 $ 2.0 $ 8.0 $ 20.0 $ 110.0

(a) Expenses include non-cash write-offs and accelerated depreciation of fixed assets and leasehold

improvements. However, these amounts were recognized outside of the restructuring accrual.

(b) Other expenses related to the relocation of various operations to new and existing Company facilities

including expenses for hiring, training, relocation, travel and professional fees. All such expenses will be

recorded when incurred.

2008 Plans

During 2008, the Company closed substantially all of its facilities in Missouri and Texas and did not renew the

Company’s collective bargaining agreement with the unionized workers employed at these locations. The decision

also resulted in the elimination of certain management positions in these same facilities and resulted, along with

other actions, in the Company no longer having employees working in the United States under a collective

bargaining agreement. The Company also restructured some of its operations and relocated or eliminated certain

shared service and call center positions. The relocated positions were moved to the Company’s existing facilities or

outsourced service providers in 2008.

The Company incurred severance and employee related benefit expenses for all union and certain affected

management employees, facility closure expenses and other expenses associated with the relocation of these

operations to existing Company facilities and third-party providers, including costs related to hiring, training,

relocation, travel and professional fees.

The Company incurred cumulative total expenses of $82.9 million comprised of $44.3 million, $7.9 million,

$7.8 million and $22.9 million in severance and other employee related costs, asset write-offs and incremental

depreciation, lease terminations and other restructuring expenses, respectively, through December 31, 2008. No

additional restructuring and related expenses were incurred in the year ended December 31, 2009.

At December 31, 2008, the Company had a restructuring accrual of $25.8 million related to these plans, of which

$24.8 million represented an accrual for severance and employee related expenses. During 2009, substantially all of

the accruals were paid resulting in a remaining restructuring accrual which was immaterial at December 31, 2009.

91