Western Union 2010 Annual Report Download - page 53

Download and view the complete annual report

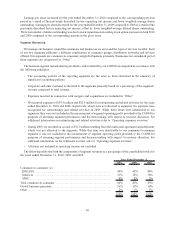

Please find page 53 of the 2010 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Transaction fees and foreign exchange revenues

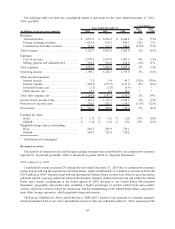

2010 compared to 2009

For the year ended December 31, 2010 compared to the prior year, consumer-to-consumer money transfer

revenue grew 2% primarily due to transaction growth of 9%. Transaction growth was offset by price decreases,

primarily related to pricing reductions taken in the domestic business commencing in the fourth quarter of 2009,

geographic and product mix, including a higher percentage of revenue earned from intra-country activity, and the

strengthening of the United States dollar compared to most other foreign currencies, which negatively impacted

revenue by approximately 1%. Our international consumer-to-consumer business experienced revenue growth of

3% on transaction growth of 8% for the year ended December 31, 2010. Our international business represents all

transactions other than transactions between and within the United States and Canada and transactions to and from

Mexico. Our international consumer-to-consumer business outside of the United States also experienced revenue

growth on transaction increases for the year ended December 31, 2010.

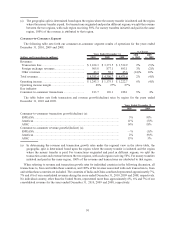

Revenue in our EMEASA region remained flat during the year ended December 31, 2010 compared to the prior

year despite transaction growth of 5%. Transaction growth was offset by the strengthening of the United States

dollar compared to most other foreign currencies in the region and many of the same factors described above. Our

European market experienced transaction growth during the year ended December 31, 2010 compared to the prior

year. In addition, for the full year ended December 31, 2010, revenue and transactions in the Gulf States declined

moderately compared to the same period in 2009, however, both revenue and transactions grew in the fourth quarter

of 2010 compared to the comparable period in the prior year. India had transaction growth of 4% and revenue

growth of 5% for the year ended December 31, 2010 versus the same period in 2009.

Americas revenue increased 2% on transaction growth of 11% for the year ended December 31, 2010 compared

to the prior year due to the pricing actions taken in the domestic business commencing in the fourth quarter of 2009.

Our domestic business experienced revenue declines of 6% on transaction growth of 28% for the year ended

December 31, 2010 due to the same factors. However, in the fourth quarter of 2010, our domestic business

experienced revenue growth of 7% on transaction growth of 29% as we reached the anniversary of the pricing

reductions taken in the fourth quarter of 2009. Our United States outbound business experienced both transaction

and revenue growth in the year ended December 31, 2010. Our Mexico business revenue was flat during the year

ended December 31, 2010 on transaction growth of 2%.

APAC revenue increased 13% for the year ended December 31, 2010 compared to the prior year due to

transaction growth of 14%. China’s revenue increased 10% on transaction growth of 7% for the year ended

December 31, 2010.

Foreign exchange revenues for the year ended December 31, 2010 grew compared to the prior year, driven

primarily by revenue from our international consumer-to-consumer business outside of the United States.

Fluctuations in the exchange rate between the United States dollar and currencies other than the United States

dollar have resulted in a reduction to transaction fees and foreign exchange revenues for the year ended

December 31, 2010 of $32.3 million over the same period in the previous year, net of foreign currency hedges,

that would not have occurred had there been constant currency rates. The largest impact was related to the

EMEASA region.

We have historically implemented and will likely implement future strategic fee reductions and actions to reduce

foreign exchange spreads, where appropriate, taking into account a variety of factors. Fee decreases and foreign

exchange actions generally can reduce margins in the short term, but are done in anticipation that they will result in

increased transaction volumes and increased revenues over time. For the year ended December 31, 2010, such fee

decreases and foreign exchange actions were approximately 4% of our total revenue compared to 2% and 1% for the

years ended December 31, 2009 and 2008, respectively. For the full year 2010, approximately three-fourths of these

actions relate to pricing reductions taken in the domestic business.

The majority of transaction growth is derived from more mature agent locations; new agent locations typically

contribute only marginally to growth in the first few years of their operation. Increased productivity, measured by

transactions per location, is often experienced as locations mature. We believe that new agent locations will help

51