Western Union 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.related to our money order services business as we no longer receive a fixed return of 5.5% from IPS on outstanding

money order balances as we did for the first three quarters of 2009. We now derive investment income from interest

generated on our money order settlement assets, which are primarily held in United States tax exempt state and

municipal debt securities. These securities generally have a lower rate of return than we were receiving under our

previous agreement with IPS. In 2008, we entered into interest rate swaps on certain of our fixed rate notes to reduce

our exposure to fluctuations in interest rates. Through a combination of the revenue generated from the new

investment securities and the anticipated interest expense savings resulting from the interest rate swaps, we estimate

that we should be able to retain a materially comparable after-tax rate of return through 2011 as we had been

receiving under the agreement with IPS.

2009 compared to 2008

Revenue remained relatively consistent with prior year and is comprised primarily of our money order services

business. In the fourth quarter of 2009, we experienced a decrease in the amount of revenue earned related to our

money order services business due to the change in our agreement with IPS described above.

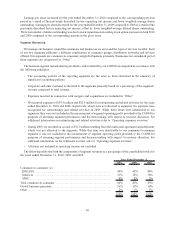

Operating income

2010 compared to 2009

During the year ended December 31, 2010, the decrease in operating income was due to the decrease in revenue

from our money order services business, as described above, and an increase in promotional marketing activities

related to our prepaid business in the United States. In 2009, we also incurred additional costs associated with

evaluating and closing acquisitions compared to 2010.

2009 compared to 2008

During the year ended December 31, 2009, the decrease in operating income was primarily due to increased costs

related to acquisitions and a decline in our money order services business due to the decrease in revenue in the

fourth quarter of 2009 as described above.

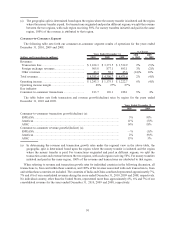

Further financial information relating to each of our segments’ external revenue, operating profit measures and

total assets is set forth in Note 17 to our consolidated financial statements.

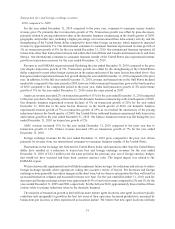

Capital Resources and Liquidity

Our primary source of liquidity has been cash generated from our operating activities, primarily from net income

and fluctuations in working capital. Our working capital is affected by the timing of interest payments on our

outstanding borrowings, timing of income tax payments, including our refundable tax deposit described further in

“Cash Flows from Operating Activities” and collections on receivables, among other items. The majority of our

interest payments are due in the second and fourth quarters which results in a decrease in the amount of cash

provided by operating activities in those quarters, and a corresponding increase to the first and third quarters.

Our future cash flows could be impacted by a variety of factors, some of which are out of our control, including

changes in economic conditions, especially those impacting the migrant population, and changes in income tax laws

or the status of income tax audits, including the resolution of outstanding tax matters.

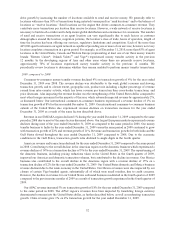

A significant portion of our cash flows from operating activities has been generated from subsidiaries, some of

which are regulated entities. These subsidiaries may transfer all excess cash to the parent company for general

corporate use, except for assets subject to legal or regulatory restrictions. The assets subject to legal or regulatory

restrictions of approximately $210 million include those located in countries outside of the United States containing

restrictions from being transferred outside of those countries and cash and investment balances that are maintained

by a regulated subsidiary to secure certain money transfer obligations initiated in the United States in accordance

with applicable state regulations. Significant changes in the regulatory environment for money transmitters could

impact our primary source of liquidity.

55