Western Union 2010 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2010 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

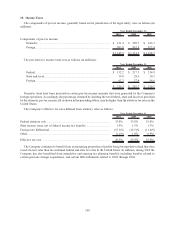

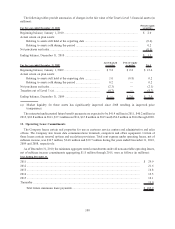

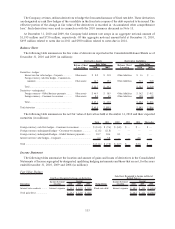

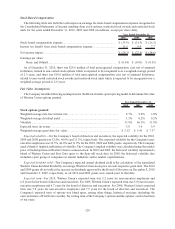

The income tax effects allocated to and the cumulative balance of each component of accumulated other

comprehensive loss were as follows (in millions):

2010 2009 2008

Beginning balance, January 1 .................................................................. $ (127.3) $ (30.0) $ (68.8)

Unrealized gains/(losses) on investment securities:

Unrealized gains/(losses) .................................................................. (0.5) 11.5 (2.4)

Tax (expense)/benefit ................................................................... 0.1 (4.3) 0.9

Reclassification of (gains)/losses into earnings .................................. (4.7) (2.7) 4.3

Tax expense/(benefit) ................................................................... 1.8 1.0 (1.6)

Net unrealized gains/(losses) on investment securities ................. (3.3) 5.5 1.2

Unrealized gains/(losses) on hedging activities:

Unrealized gains/(losses) .................................................................. 15.8 (43.6) 82.6

Tax (expense)/benefit ................................................................... 0.7 8.9 (15.0)

Reclassification of (gains)/losses into earnings .................................. (23.0) (32.9) 25.1

Tax expense/(benefit) ................................................................... 1.6 5.1 (3.5)

Net unrealized gains/(losses) on hedging activities ...................... (4.9) (62.5) 89.2

Foreign currency translation adjustments:

Foreign currency translation adjustments ........................................... 8.4 (21.6) (8.0)

Tax (expense)/benefit ................................................................... (1.8) 7.6 2.8

Reclassification of gains into earnings (a) ......................................... — (23.1) —

Tax expense (a) ............................................................................ — 8.1 —

Net foreign currency translation adjustments .............................. 6.6 (29.0) (5.2)

Pension liability adjustments:

Unrealized losses ............................................................................. (13.7) (22.2) (76.1)

Tax benefit .................................................................................. 5.9 8.7 28.0

Reclassification of losses into earnings ............................................. 6.2 3.6 2.7

Tax benefit .................................................................................. (2.3) (1.4) (1.0)

Net pension liability adjustments ............................................... (3.9) (11.3) (46.4)

Other comprehensive (loss)/income .......................................................... (5.5) (97.3) 38.8

Ending balance, December 31 ................................................................. $ (132.8) $ (127.3) $ (30.0)

(a) The year ended December 31, 2009 includes the impact to the foreign currency translation account of the

surrender of the Company’s interest in FEXCO Group. See Note 4.

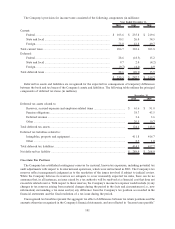

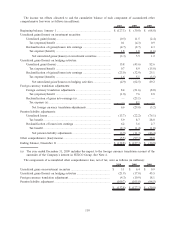

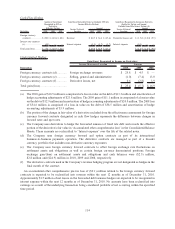

The components of accumulated other comprehensive loss, net of tax, were as follows (in millions):

2010 2009 2008

Unrealized gains on investment securities ............................................... $ 3.1 $ 6.4 $ 0.9

Unrealized gains/(losses) on hedging activities ........................................ (21.9) (17.0) 45.5

Foreign currency translation adjustment .................................................. (4.3) (10.9) 18.1

Pension liability adjustment ................................................................... (109.7) (105.8) (94.5)

$ (132.8) $ (127.3) $ (30.0)

110