Western Union 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

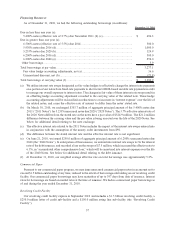

Our Revolving Credit Facility contains an interest rate margin, facility fee and utilization fee, all of which are

determined based on certain of our credit ratings. In addition, we are subject to certain provisions in our 2014 Notes,

2040 Notes and certain of our derivative contracts which would require settlement or collateral posting in the event

of a change in control combined with a downgrade below investment grade. We do not have any other terms within

our debt agreements or other contracts that are tied to changes in our credit ratings. The table below summarizes our

credit ratings as of December 31, 2010:

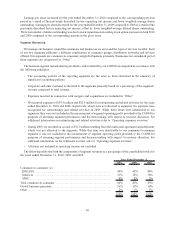

S&P Moody’s Fitch

December 31, 2010

Short-term rating............................................................................................... A-2 P-2 F2

Senior unsecured ............................................................................................... A- A3 A-

Ratings outlook ................................................................................................. Stable Stable Stable

These ratings are not a recommendation to buy, sell or hold any of our securities. Our credit ratings may be

subject to revision or withdrawal at any time by the assigning rating organization, and each rating should be

evaluated independently of any other rating. We cannot ensure that a rating will remain in effect for any given period

of time or that a rating will not be lowered or withdrawn entirely by a rating agency if, in its judgment, circumstances

so warrant. A downgrade or a negative outlook provided by the rating agencies could result in the following:

• Our access to the commercial paper market may be limited, and if we were downgraded below investment

grade, our access to the commercial paper market would likely be eliminated;

• We may be required to pay a higher interest rate in future financings;

• Our potential pool of investors and funding sources may decrease;

• Regulators may impose additional capital and other requirements on us, including imposing restrictions on

the ability of our regulated subsidiaries to pay dividends; and

• Our agent relationships may be adversely impacted, particularly those agents that are financial institutions or

post offices.

The Revolving Credit Facility contains covenants which, among other things, limit or restrict our ability to sell or

transfer assets or enter into a merger or consolidate with another company, grant certain types of security interests,

incur certain types of liens, impose restrictions on subsidiary dividends, enter into sale and leaseback transactions or

incur certain subsidiary level indebtedness. Our notes are subject to similar covenants except that only the 2011

Notes, 2016 Notes, 2020 Notes and the 2036 Notes contain covenants limiting or restricting subsidiary indebtedness

and none of our notes are subject to a covenant that limits our ability to impose restrictions on subsidiary dividends.

In addition, the Revolving Credit Facility requires us to maintain a consolidated adjusted EBITDA interest coverage

ratio of greater than 2:1 (ratio of consolidated adjusted EBITDA, defined as net income plus the sum of (a) interest

expense, (b) income tax expense, (c) depreciation expense, (d) amortization expense, (e) any other non-cash

deductions, losses or changes made in determining net income for such period and (f) extraordinary losses or

charges, minus extraordinary gains, in each case determined in accordance with United States GAAP for such

period, to interest expense) for each period comprising the four most recent consecutive fiscal quarters. Our

consolidated interest coverage ratio was 9:1 for the year ended December 31, 2010.

As of December 31, 2010, we were in compliance with our debt covenants. A violation of our debt covenants

could impair our ability to borrow, and outstanding amounts borrowed could become due, thereby restricting our

ability to use our excess cash for other purposes.

Cash Priorities

Liquidity

Our objective is to maintain strong liquidity and a capital structure consistent with our current credit ratings. We

have existing cash balances, cash flows from operating activities, access to the commercial paper markets and our

$1.5 billion revolving credit facility available to support the needs of our business.

59