Western Union 2010 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2010 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 6. SELECTED FINANCIAL DATA

The financial information in this Annual Report on Form 10-K is presented on a consolidated basis and includes

the accounts of the Company and our majority-owned subsidiaries. The financial information for the periods

presented prior to our spin-off (the “Spin-off ”) from First Data Corporation (“First Data”) on September 29, 2006

(the “Spin-off Date”) is presented on a combined basis and represents those entities that were ultimately transferred

to us as part of the Spin-off. The assets and liabilities presented have been reflected on a historical basis, as prior to

the Spin-off such assets and liabilities presented were 100% owned by First Data. However, the financial statements

for the periods presented prior to the Spin-off do not include all of the actual expenses that would have been incurred

had Western Union been a stand-alone entity during the periods presented and do not reflect Western Union’s

combined results of operations, financial position and cash flows had Western Union been a stand-alone company

during the periods presented.

Our selected historical financial data are not necessarily indicative of our future financial position, future results

of operations or future cash flows.

You should read the information set forth below in conjunction with our historical consolidated financial

statements and the notes to those statements included elsewhere in this Annual Report on Form 10-K.

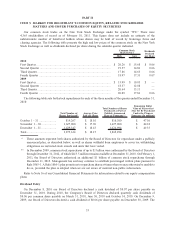

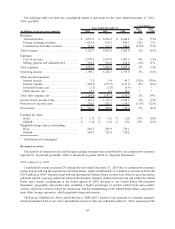

(in millions, except per share data) 2010 2009 2008 2007 2006

Year ended December 31,

Statements of Income Data:

Revenues (a) .................................................... $ 5,192.7 $ 5,083.6 $ 5,282.0 $ 4,900.2 $ 4,470.2

Operating expenses (b) (c) (d) ........................... 3,892.6 3,800.9 3,927.0 3,578.2 3,158.8

Operating income (b) (c) (d) ............................. 1,300.1 1,282.7 1,355.0 1,322.0 1,311.4

Interest income (e)............................................ 2.8 9.4 45.2 79.4 40.1

Interest expense (f) ........................................... (169.9) (157.9) (171.2) (189.0) (53.4)

Other income/(expense), net, excluding interest

income and interest expense (g) ..................... 12.2 (2.7) 9.7 10.0 37.0

Income before income taxes (b) (c) (d) (e) (f) (g) .. 1,145.2 1,131.5 1,238.7 1,222.4 1,335.1

Net income (b) (c) (d) (e) (f) (g) ....................... 909.9 848.8 919.0 857.3 914.0

Depreciation and amortization ........................... 175.9 154.2 144.0 123.9 103.5

Cash Flow Data:

Net cash provided by operating activities (h) ...... 994.4 1,218.1 1,253.9 1,103.5 1,108.9

Capital expenditures (i) ..................................... (113.7) (98.9) (153.7) (192.1) (202.3)

Common stock repurchased (j) .......................... (581.4) (400.2) (1,314.5) (726.8) (19.9)

Dividends to First Data ..................................... ————2,953.9

Earnings Per Share Data:

Basic (c) (d) (e) (f) (g) (k) ................................ $ 1.37 $ 1.21 $ 1.26 $ 1.13 $ 1.20

Diluted (c) (d) (e) (f) (g) (k).............................. $ 1.36 $ 1.21 $ 1.24 $ 1.11 $ 1.19

Cash dividends to stockholders per common

share (l)........................................................ $ 0.25 $ 0.06 $ 0.04 $ 0.04 $ 0.01

Key Indicators (unaudited):

Consumer-to-consumer transactions (m) ............. 213.7 196.1 188.1 167.7 147.1

Global business payments transactions (n) .......... 404.9 414.8 412.1 404.5 249.4

37