Western Union 2010 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2010 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

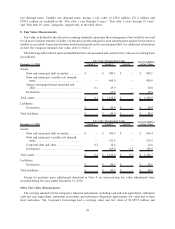

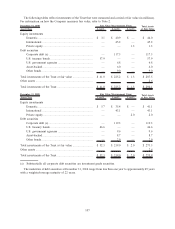

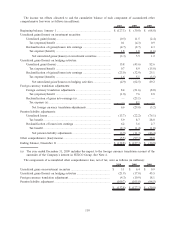

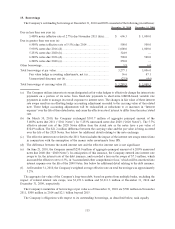

The following tables reflect investments of the Trust that were measured and carried at fair value (in millions).

For information on how the Company measures fair value, refer to Note 2.

Asset Class Level 1 Level 2 Level 3

Total Assets

at Fair Value

December 31, 2010 Fair Value Measurement Using

Equity investments

Domestic .................................................................. $ 3.1 $ 40.9 $ — $ 44.0

International ............................................................. — 45.2 — 45.2

Private equity ............................................................ — — 1.3 1.3

Debt securities

Corporate debt (a) ..................................................... — 117.3 — 117.3

U.S. treasury bonds ................................................... 57.9 — — 57.9

U.S. government agencies .......................................... — 6.8 — 6.8

Asset-backed............................................................. — 6.0 — 6.0

Other bonds .............................................................. — 9.0 — 9.0

Total investments of the Trust at fair value ........................ $ 61.0 $ 225.2 $ 1.3 $ 287.5

Other assets ..................................................................... 2.6

Total investments of the Trust ........................................... $ 61.0 $ 225.2 $ 1.3 $ 290.1

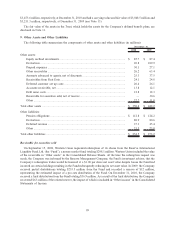

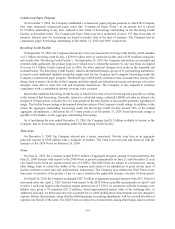

Asset Class Level 1 Level 2 Level 3

Total Assets

at Fair Value

December 31, 2009 Fair Value Measurement Using

Equity investments

Domestic .................................................................. $ 5.7 $ 35.4 $ — $ 41.1

International ............................................................. — 43.1 — 43.1

Private equity ............................................................ — — 2.0 2.0

Debt securities

Corporate debt (a) ..................................................... — 119.3 — 119.3

U.S. treasury bonds ................................................... 46.6 — — 46.6

U.S. government agencies .......................................... — 9.6 — 9.6

Asset-backed............................................................. — 8.7 — 8.7

Other bonds .............................................................. — 2.9 — 2.9

Total investments of the Trust at fair value ........................ $ 52.3 $ 219.0 $ 2.0 $ 273.3

Other assets ..................................................................... 2.6

Total investments of the Trust ........................................... $ 52.3 $ 219.0 $ 2.0 $ 275.9

(a) Substantially all corporate debt securities are investment grade securities.

The maturities of debt securities at December 31, 2010 range from less than one year to approximately 49 years

with a weighted-average maturity of 22 years.

107