Western Union 2010 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2010 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our ability to remain competitive depends in part on our ability to protect our brands and our other intellectual

property rights and to defend ourselves against potential patent infringement claims.

The Western Union brand, which is protected by trademark registrations in many countries, is material to our

Company. The loss of the Western Union trademark or a diminution in the perceived quality associated with the

name would harm our business. Similar to the Western Union trademark, the Vigo, Orlandi Valuta, Speedpay,

Paymap, Equity Accelerator, Just in Time EFT, Pago Fácil, Western Union Payments, Western Union Quick Collect,

Quick Pay, Quick Cash, Convenience Pay, Western Union Business Solutions and other trademarks and service

marks are also important to our Company and a loss of the service mark or trademarks or a diminution in the

perceived quality associated with these names could harm our business.

Our intellectual property rights are an important element in the value of our business. Our failure to take

appropriate actions against those who infringe upon our intellectual property could adversely affect our business,

financial position and results of operations.

The laws of certain foreign countries in which we do business either do not recognize intellectual property rights

or do not protect them to the same extent as do the laws of the United States. Adverse determinations in judicial or

administrative proceedings in the United States or in foreign countries could impair our ability to sell our services or

license or protect our intellectual property, which could adversely affect our business, financial position and results

of operations.

We have been, are and in the future may be, subject to claims alleging that our technology or business methods

infringe patents owned by others, both inside and outside the United States. Unfavorable resolution of these claims

could require us to change how we deliver a service, result in significant financial consequences, or both, which

could adversely affect our business, financial position and results of operations.

We receive services from third-party vendors that would be difficult to replace if those vendors ceased providing

such services which could cause temporary disruption to our business.

Some services relating to our business, such as software application support, the development, hosting and

maintenance of our operating systems, check clearing, and processing of returned checks are outsourced to third-

party vendors, which would be difficult to replace quickly. If our third-party vendors were unwilling or unable to

provide us with these services in the future, our business and operations could be adversely affected.

Material changes in the market value or liquidity of the securities we hold may adversely affect our results of

operations and financial condition.

As of December 31, 2010, we held $1.4 billion in investment securities, substantially all of which are high quality

investment grade state and municipal debt securities. The majority of this money represents the principal of money

transfers sent by consumers and money orders issued by us to consumers in the United States. Under the PSD in the

EU, we expect to have a similar portfolio of investment securities, which we will manage in a similar manner and

under similar guidelines as our current portfolio. We regularly monitor our credit risk and attempt to mitigate our

exposure by making high quality investments and by diversifying our investments. At December 31, 2010, the

majority of our investment securities had credit ratings of “AA-” or better from a major credit rating agency. Despite

those ratings, it is possible that the value of our portfolio may decline in the future due to any number of factors,

including general market conditions, credit issues, the viability of the issuer of the security, failure by a fund

manager to manage the investment portfolio consistently with the fund prospectus or increases in interest rates. Any

such decline in value may adversely affect our results of operations and financial condition.

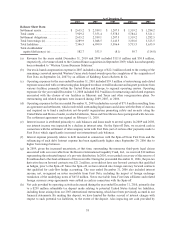

The trust holding the assets of our pension plans has assets totaling approximately $290.1 million as of

December 31, 2010. The fair value of these assets held in the trust are compared to the plans’ projected benefit

obligation to determine the pension liability of $112.8 million recorded within “Other liabilities” in our

consolidated balance sheet as of December 31, 2010. We attempt to mitigate risk through diversification, and

we regularly monitor investment risk on our portfolio through quarterly investment portfolio reviews and periodic

asset and liability studies. Despite these measures, it is possible that the value of our portfolio may decline in the

31