Western Union 2010 Annual Report Download - page 41

Download and view the complete annual report

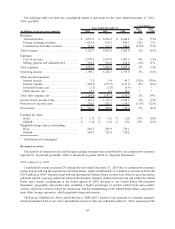

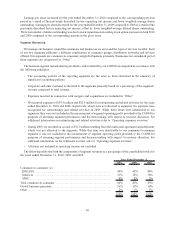

Please find page 41 of the 2010 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.operating activities during the year ended December 31, 2010 were cash payments of $71 million related to the

agreement and settlement with the State of Arizona and other states.

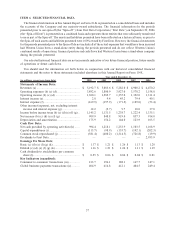

(i) Capital expenditures include capitalization of contract costs, capitalization of purchased and developed

software and purchases of property and equipment.

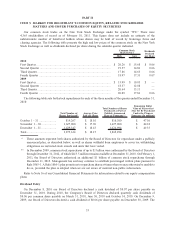

(j) At December 31, 2010, $415.5 million remains available under share repurchase authorizations approved by

our board of directors. On February 1, 2011, the Board of Directors authorized an additional $1 billion of

common stock repurchases through December 31, 2012. During the years ended December 31, 2010, 2009,

2008 and 2007 and the period from September 29, 2006 through December 31, 2006, we repurchased

35.6 million, 24.8 million, 58.1 million, 34.7 million and 0.9 million shares, respectively.

(k) For all periods prior to Spin-off Date, basic and diluted earnings per share were computed utilizing the basic

shares outstanding at September 29, 2006.

(l) During 2010, the Company’s Board of Directors declared quarterly cash dividends of $0.07 per common share

in the fourth quarter and $0.06 per common share in each of the first three quarters. During the fourth quarter

of 2009, the Company’s Board of Directors declared an annual cash dividend of $0.06 per common share.

During the fourth quarter of 2008, the Company’s Board of Directors declared an annual cash dividend of

$0.04 per common share.

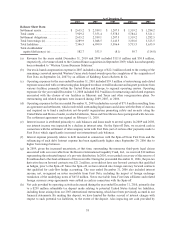

(m) Consumer-to-consumer transactions include Western Union, Vigo and Orlandi Valuta branded

consumer-to-consumer money transfer services worldwide.

(n) Global business payments transactions include the Western Union Payments service, formerly Quick Collect,

Convenience Pay, Speedpay, Equity Accelerator, Just in Time EFT, Pago Fácil and Western Union Business

Solutions transactions processed by us. Amounts include Pago Fácil and Western Union Business Solutions

transactions since their acquisitions in December 2006 and September 2009, respectively.

(o) In connection with the Spin-off, we reported a $4.1 billion dividend to First Data in the consolidated

statements of stockholders’ equity/(deficiency), consisting of notes issued to First Data of $3.4 billion and a

cash payment to First Data of $100.0 million. The remaining dividend was comprised of cash, consideration

for an ownership interest held by a First Data subsidiary in a Western Union agent, settlement of net

intercompany receivables, and transfers of certain liabilities, net of assets. Subsequent to the Spin-off date, we

had no outstanding borrowings to First Data. Since the amount of the dividend exceeded the historical cost of

our net assets as of September 29, 2006, a capital deficiency resulted.

39