Western Union 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

You should read the following discussion in conjunction with the consolidated financial statements and the notes

to those statements included elsewhere in this Annual Report on Form 10-K. This Annual Report on Form 10-K

contains certain statements that are forward-looking within the meaning of the Private Securities Litigation Reform

Act of 1995. Certain statements contained in the Management’s Discussion and Analysis of Financial Condition and

Results of Operations are forward-looking statements that involve risks and uncertainties. The forward-looking

statements are not historical facts, but rather are based on current expectations, estimates, assumptions and

projections about our industry, business and future financial results. Our actual results could differ materially from

the results contemplated by these forward-looking statements due to a number of factors, including those discussed

in other sections of this Annual Report on Form 10-K. See “Risk Factors” and “Forward-looking Statements.”

Overview

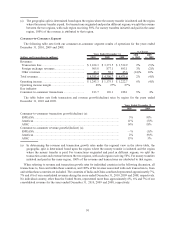

We are a leading provider of money movement services, operating in two business segments:

• Consumer-to-consumer—money transfer services between consumers, primarily through a global network of

third-party agents using our multi-currency, real-time money transfer processing systems. This service is

available for international cross-border transfers—that is, the transfer of funds from one country to another—

and, in certain countries, intra-country transfers—that is, money transfers from one location to another in the

same country.

• Global business payments—the processing of payments from consumers or businesses to other businesses.

Our business payments services allow consumers to make payments to a variety of organizations, including

utilities, auto finance companies, mortgage servicers, financial service providers, government agencies and

other businesses. In September 2009, we acquired Canada-based Custom House, Ltd. (“Custom House”), a

provider of international business-to-business payment services, which is included in this segment. Custom

House, which has been rebranded “Western Union Business Solutions” (“Business Solutions”) in September

2010, facilitates cross-border, cross-currency payment transactions. The international expansion and other

key strategic initiatives have resulted in international revenue continuing to increase in this segment.

However, the majority of the segment’s revenue was generated in the United States during all periods

presented.

Businesses not considered part of the segments described above are categorized as “Other” and primarily include

our money order services, and represented 2% or less of consolidated revenue during the years ended December 31,

2010, 2009 and 2008. Prior to October 1, 2009, the Company’s money orders were issued by Integrated Payment

Systems Inc. (“IPS”), a subsidiary of First Data Corporation (“First Data”), to consumers at retail locations

primarily in the United States and Canada. Effective October 1, 2009, we assumed the responsibility for issuing

money orders.

Also included in “Other” are expenses incurred in connection with the development of certain new service

offerings, including costs to develop mobile money transfer services, new prepaid service offerings and costs

incurred in connection with mergers and acquisitions.

Significant Financial and Other Highlights

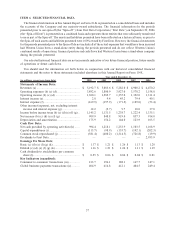

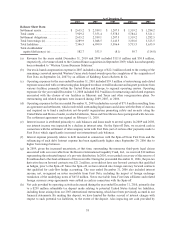

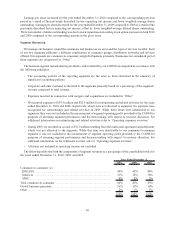

Significant financial and other highlights for the year ended December 31, 2010 included:

• We generated $5,192.7 million in total consolidated revenues compared to $5,083.6 million in the prior year,

representing a year-over-year increase of 2%. The acquisition of Custom House contributed $111.0 million

and $30.8 million to revenue for 2010 and 2009, respectively.

• We incurred $59.5 million of restructuring and related expenses as described within “Operating expenses

overview.” We expect to incur approximately $50 million in additional expenses in 2011 for a total of

approximately $110 million related to the actions announced on May 27, 2010 and as subsequently revised.

No restructuring and related expenses were recognized in 2009.

40