Western Union 2010 Annual Report Download - page 92

Download and view the complete annual report

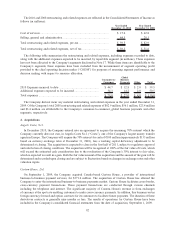

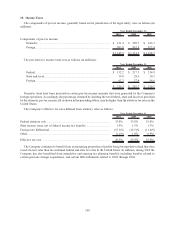

Please find page 92 of the 2010 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.All stock-based compensation to employees is required to be measured at fair value and expensed over the

requisite service period and also requires an estimate of forfeitures when calculating compensation expense. The

Company recognizes compensation expense on awards on a straight-line basis over the requisite service period for

the entire award. Refer to Note 16 for additional discussion regarding details of the Company’s stock-based

compensation plans.

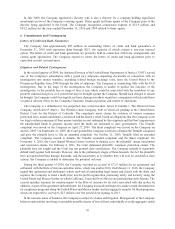

Restructuring and Related Expenses

The Company records severance-related expenses once they are both probable and estimable in accordance with

the provisions of the applicable accounting guidance for severance provided under an ongoing benefit arrangement.

One-time, involuntary benefit arrangements and other exit costs are generally recognized when the liability is

incurred. Expenses arising under the Company’s defined benefit pension plans from curtailing future service of

employees participating in the plans and providing enhanced benefits are recognized in earnings when it is probable

and reasonably estimable. The Company also evaluates impairment issues associated with restructuring activities

when the carrying amount of the assets may not be fully recoverable, in accordance with the appropriate accounting

guidance. Restructuring and related expenses consist of direct and incremental expenses associated with

restructuring and related activities, including severance, outplacement and other employee related benefits;

facility closure and migration of the Company’s IT infrastructure; and other expenses related to the relocation

of various operations to new or existing Company facilities and third-party providers, including hiring, training,

relocation, travel and professional fees. Also included in the facility closure expenses are non-cash expenses related

to fixed asset and leasehold improvement write-offs and the acceleration of depreciation and amortization. For more

information on the Company’s restructuring and related expenses see Note 3.

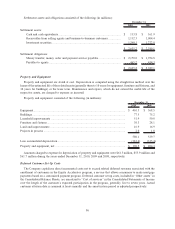

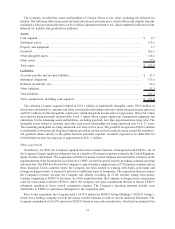

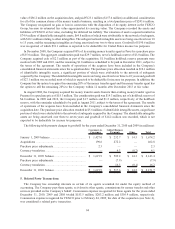

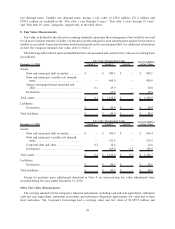

3. Restructuring and Related Expenses

2010 Plan

On May 25, 2010 and as subsequently revised, the Company’s Board of Directors approved a restructuring plan

(the “Restructuring Plan”) designed to reduce the Company’s overall headcount and migrate positions from various

facilities, primarily within the United States and Europe, to regional operating centers. Details of the estimated

expenses are included in the tables below. Included in these estimated expenses are approximately $2 million of

non-cash expenses related to fixed asset and leasehold improvement write-offs and accelerated depreciation at

impacted facilities. Subject to complying with and undertaking the necessary individual and collective employee

information and consultation obligations as may be required by local law for potentially affected employees, the

Company expects all of these activities to be completed by the end of the third quarter of 2011. The foregoing

figures are the Company’s estimates and are subject to change as the Restructuring Plan continues to be

implemented.

90