Western Union 2010 Annual Report Download - page 62

Download and view the complete annual report

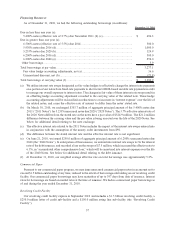

Please find page 62 of the 2010 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Capital Expenditures

The total aggregate amount paid for contract costs, purchases of property and equipment, and purchased and

developed software was $113.7 million, $98.9 million and $153.7 million in 2010, 2009 and 2008, respectively.

Amounts paid for new and renewed agent contracts vary depending on the terms of existing contracts as well as the

timing of new and renewed contract signings. Other capital expenditures during 2010, 2009 and 2008 included

investments in our information technology infrastructure and purchased and developed software.

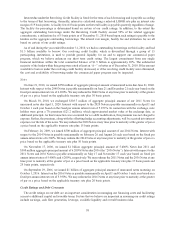

Acquisition of Businesses

In December 2010, we entered into an agreement to acquire the remaining 70% interest which we currently do

not own in Angelo Costa S.r.l. (“Costa”), one of our largest money transfer agents in Europe. We will acquire the

70% interest for cash of A100 million (approximately $133 million based on currency exchange rates at

December 31, 2010), less a working capital deficiency adjustment to be determined at closing. The acquisition

is expected to close in the first half of 2011, subject to regulatory approval and satisfaction of closing conditions.

On September 1, 2009, we acquired Canada-based Custom House, a provider of international

business-to-business payment services, for cash consideration of $371.0 million for all of the common shares

of this business and acquired cash of $2.5 million.

On February 24, 2009, we acquired the money transfer business of European-based FEXCO Group Holdings

(“FEXCO Group”), one of our largest agents providing services in a number of European countries, primarily the

United Kingdom, Spain, Sweden and Ireland. We surrendered our 24.65% interest in FEXCO Group and paid

A123.1 million ($157.4 million) as consideration for all of the common shares of the money transfer business and

acquired cash of $11.8 million.

In December 2008, we acquired 80% of our existing money transfer agent in Peru for a purchase price of

$35.0 million. The aggregate consideration paid was $29.7 million, net of a holdback reserve of $3.0 million and

cash acquired of $2.3 million.

On August 1, 2008, we acquired the money transfer assets from our existing money transfer agent in Panama for

a purchase price of $18.3 million, which is net of cash acquired. The consideration paid was $14.3 million, net of a

holdback reserve of $4.0 million.

We expect that we will continue to pursue opportunities to acquire companies, particularly outside of the United

States, to further complement and strengthen our existing businesses worldwide.

Share Repurchases and Dividends

During the years ended December 31, 2010, 2009 and 2008, 35.6 million, 24.8 million and 58.1 million,

respectively, of shares were repurchased for $584.5 million, $400.0 million and $1,313.9 million, respectively,

excluding commissions, at an average cost of $16.44, $16.10 and $22.60 per share, respectively. At December 31,

2010, $415.5 million remains available under share repurchase authorizations approved by our Board of Directors.

On February 1, 2011, the Board of Directors authorized an additional $1 billion of common stock repurchases

through December 31, 2012.

During the year ended December 31, 2010, our Board of Directors declared quarterly cash dividends of $0.07 per

common share in the fourth quarter and $0.06 per common share in each of the first three quarters representing

$165.3 million in total dividends. During the fourth quarter of 2009, our Board of Directors declared a cash dividend

of $0.06 per common share representing $41.2 million in total dividends. During the fourth quarter of 2008, our

Board of Directors declared an annual cash dividend of $0.04 per common share representing $28.4 million in total

dividends. These amounts were paid to shareholders of record in the respective month the dividend was declared,

except for the September 2010 declared dividend, which was paid in October 2010.

Debt Service Requirements

Our 2011 debt service requirements will include $696.3 million of our 5.400% notes maturing in November

2011, payments on future borrowings under our commercial paper program, if any, and interest payments on all

60