Western Union 2010 Annual Report Download - page 111

Download and view the complete annual report

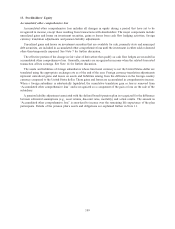

Please find page 111 of the 2010 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.13. Stockholders’ Equity

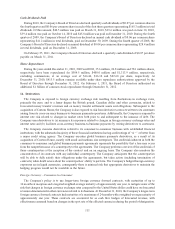

Accumulated other comprehensive loss

Accumulated other comprehensive loss includes all changes in equity during a period that have yet to be

recognized in income, except those resulting from transactions with shareholders. The major components include

unrealized gains and losses on investment securities, gains or losses from cash flow hedging activities, foreign

currency translation adjustments and pension liability adjustments.

Unrealized gains and losses on investment securities that are available for sale, primarily state and municipal

debt securities, are included in accumulated other comprehensive loss until the investment is either sold or deemed

other-than-temporarily impaired. See Note 7 for further discussion.

The effective portion of the change in fair value of derivatives that qualify as cash flow hedges are recorded in

accumulated other comprehensive loss. Generally, amounts are recognized in income when the related forecasted

transaction affects earnings. See Note 14 for further discussion.

The assets and liabilities of foreign subsidiaries whose functional currency is not the United States dollar are

translated using the appropriate exchange rate as of the end of the year. Foreign currency translation adjustments

represent unrealized gains and losses on assets and liabilities arising from the difference in the foreign country

currency compared to the United States dollar. These gains and losses are accumulated in comprehensive income.

When a foreign subsidiary is substantially liquidated, the cumulative translation gain or loss is removed from

“Accumulated other comprehensive loss” and is recognized as a component of the gain or loss on the sale of the

subsidiary.

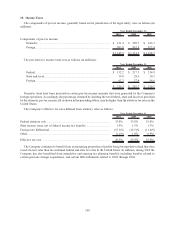

A pension liability adjustment associated with the defined benefit pension plan is recognized for the difference

between estimated assumptions (e.g., asset returns, discount rates, mortality) and actual results. The amount in

“Accumulated other comprehensive loss” is amortized to income over the remaining life expectancy of the plan

participants. Details of the pension plan’s assets and obligations are explained further in Note 11.

109