Western Union 2010 Annual Report Download - page 45

Download and view the complete annual report

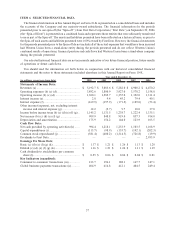

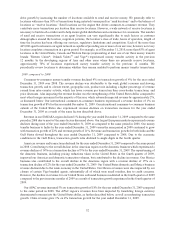

Please find page 45 of the 2010 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Derivative losses, net—Represents the portion of the change in fair value of foreign currency accounting hedges

that is excluded from the measurement of effectiveness, which includes (a) differences between changes in forward

rates and spot rates and (b) gains or losses on the contract and any offsetting positions during periods in which the

instrument is not designated as a hedge. Although the majority of changes in the value of our hedges are deferred in

accumulated other comprehensive income or loss until settlement (i.e., spot rate changes), the remaining portion of

changes in value are recognized in income as they occur. Derivative gains and losses do not include fluctuations in

foreign currency forward contracts intended to mitigate exposures on settlement activities of our

consumer-to-consumer money transfer business or on certain foreign currency denominated cash positions.

Gains and losses associated with those foreign currency forward contracts are included in selling, general and

administrative expenses. Derivative gains and losses also do not include fluctuations in foreign currency forward

and option contracts used in our international business-to-business payments operations. The impact of these

contracts is classified within foreign exchange revenues in the consolidated statements of income.

Other income, net—Other income, net is comprised primarily of equity earnings from equity method

investments and other income and expenses.

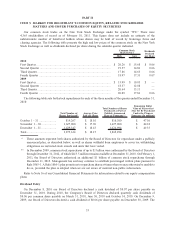

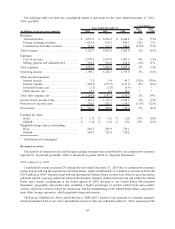

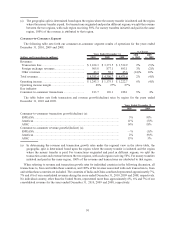

Results of Operations

The following discussion of our consolidated results of operations and segment results refers to the year ended

December 31, 2010 compared to the same period in 2009 and the year ended December 31, 2009 compared to the

same period in 2008. The results of operations should be read in conjunction with the discussion of our segment

results of operations, which provide more detailed discussions concerning certain components of the consolidated

statements of income. All significant intercompany accounts and transactions between our Company’s segments

have been eliminated.

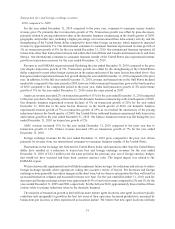

We incurred expenses of $59.5 million for the year ended December 31, 2010 for restructuring and related

activities, which have not been allocated to segments. No restructuring and related expenses were recognized in the

corresponding period in 2009 and we incurred expenses of $82.9 million for the year ended December 31, 2008.

While these items are identifiable to our segments, they are not included in the measurement of segment operating

profit provided to the chief operating decision maker (“CODM”) for purposes of assessing segment performance

and decision making with respect to resource allocation. For additional information on restructuring and related

activities refer to “Operating expenses overview.”

During the year ended December 31, 2009, we recorded a $71.0 million settlement accrual, which was not

allocated to the segments. While this item was identifiable to our consumer-to-consumer segment, it was not

included in the measurement of segment operating profit provided to the CODM for purposes of assessing segment

performance and decision making with respect to resource allocation. For additional information on the settlement

accrual, refer to “Selling, general and administrative” expenses.

43