Western Union 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

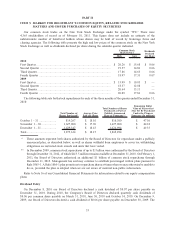

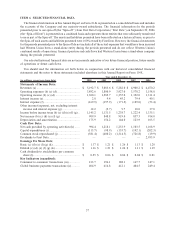

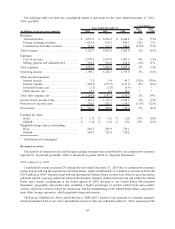

2010 2009 2008 2007 2006

As of December 31,

Balance Sheet Data:

Settlement assets ................................ $ 2,635.2 $ 2,389.1 $ 1,207.5 $ 1,319.2 $ 1,284.2

Total assets ........................................ 7,929.2 7,353.4 5,578.3 5,784.2 5,321.1

Settlement obligations......................... 2,635.2 2,389.1 1,207.5 1,319.2 1,282.5

Total borrowings (o) ........................... 3,289.9 3,048.5 3,143.5 3,338.0 3,323.5

Total liabilities ................................... 7,346.5 6,999.9 5,586.4 5,733.5 5,635.9

Total stockholders’

equity/(deficiency) (o)..................... 582.7 353.5 (8.1) 50.7 (314.8)

(a) Revenue for the years ended December 31, 2010 and 2009 included $111.0 million and $30.8 million,

respectively, of revenue related to the Custom House acquisition in September 2009, which has subsequently

been rebranded to “Western Union Business Solutions.”

(b) Our stock-based compensation expense in 2007 included a charge of $22.3 million related to the vesting of the

remaining converted unvested Western Union stock-based awards upon the completion of the acquisition of

First Data on September 24, 2007 by an affiliate of Kohlberg Kravis Roberts & Co.

(c) Operating expenses for the year ended December 31, 2010 included $59.5 million of restructuring and related

expenses associated with a restructuring plan designed to reduce overall headcount and migrate positions from

various facilities, primarily within the United States and Europe, to regional operating centers. Operating

expenses for the year ended December 31, 2008 included $82.9 million of restructuring and related expenses

associated with the closure of our facilities in Missouri and Texas and other reorganization plans. No

restructuring and related expenses were incurred during 2009, 2007, or 2006.

(d) Operating expenses for the year ended December 31, 2009 included an accrual of $71.0 million resulting from

an agreement and settlement, which resolved all outstanding legal issues and claims with the State of Arizona

and required us to fund a multi-state not-for-profit organization promoting safety and security along the

United States and Mexico border, in which California, Texas and New Mexico have participated with Arizona.

The settlement agreement was signed on February 11, 2010.

(e) Interest income is attributed primarily to cash balances and loans made to several agents. In 2009 and 2008,

our interest income was impacted by a decline in interest rates. On the Spin-off Date, we received cash in

connection with the settlement of intercompany notes with First Data (net of certain other payments made to

First Data) which significantly increased our international cash balances.

(f) Interest expense primarily relates to debt incurred in connection with the Spin-off from First Data and the

refinancing of such debt. Interest expense has been significantly higher since September 29, 2006 due to

higher borrowings balances.

(g) In 2009, given the increased uncertainty, at that time, surrounding the numerous third-party legal claims

associated with our receivable from the Reserve International Liquidity Fund, Ltd., we reserved $12 million

representing the estimated impact of a pro-rata distribution. In 2010, we recorded a recovery of this reserve of

$6 million due to the final settlement of this receivable. During the year ended December 31, 2006, the pre-tax

derivative loss on forward contracts was $21.2 million, as we did not have any forward contracts that qualified

as hedges, prior to the Spin-off. Since the Spin-off, we have entered into foreign currency forward contracts

that qualified for cash-flow hedge accounting. The year ended December 31, 2006 also included interest

income, net, recognized on notes receivable from First Data, including the impact of foreign exchange

translation of the underlying notes of $45.8 million. Notes receivable from First Data affiliates and related

foreign currency swap agreements were settled in cash in connection with the Spin-off.

(h) Net cash provided by operating activities decreased during the year ended December 31, 2010, primarily due

to a $250 million refundable tax deposit made relating to potential United States federal tax liabilities,

including those arising from our 2003 international restructuring, which have been previously accrued in our

financial statements. By making this deposit, we have limited the further accrual of interest charges with

respect to such potential tax liabilities, to the extent of the deposit. Also impacting net cash provided by

38