Western Union 2010 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2010 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

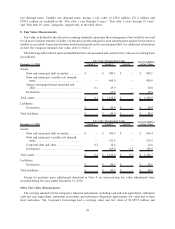

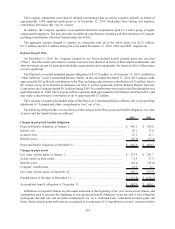

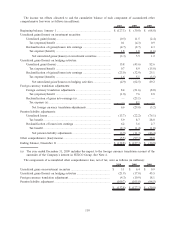

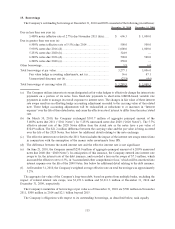

The following tables provide summaries of changes in the fair value of the Trust’s Level 3 financial assets (in

millions):

For the year ended December 31, 2010

Private equity

securities

Beginning balance, January 1, 2010 ......................................................................................... $ 2.0

Actual return on plan assets:

Relating to assets still held at the reporting date ................................................................ (0.4)

Relating to assets sold during the period ........................................................................... 0.2

Net purchases and sales ........................................................................................................... (0.5)

Ending balance, December 31, 2010 ........................................................................................ $ 1.3

For the year ended December 31, 2009

Asset-backed

securities

Private equity

securities Total

Beginning balance, January 1, 2009 ........................................... $ 9.8 $ 2.8 $ 12.6

Actual return on plan assets:

Relating to assets still held at the reporting date .................. 1.0 (0.8) 0.2

Relating to assets sold during the period ............................. 0.2 — 0.2

Net purchases and sales............................................................. (2.3) — (2.3)

Transfers out of Level 3 (a) ....................................................... (8.7) — (8.7)

Ending balance, December 31, 2009 .......................................... $ — $ 2.0 $ 2.0

(a) Market liquidity for these assets has significantly improved since 2008 resulting in improved price

transparency.

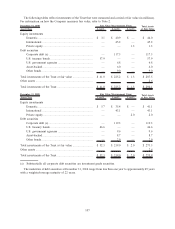

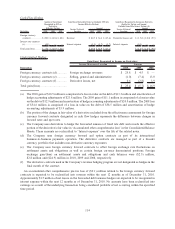

The estimated undiscounted future benefit payments are expected to be $41.4 million in 2011, $40.2 million in

2012, $38.8 million in 2013, $37.3 million in 2014, $35.8 million in 2015 and $154.2 million in 2016 through 2020.

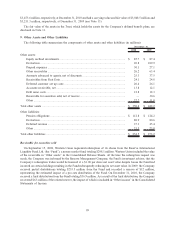

12. Operating Lease Commitments

The Company leases certain real properties for use as customer service centers and administrative and sales

offices. The Company also leases data communications terminals, computers and office equipment. Certain of

these leases contain renewal options and escalation provisions. Total rent expense under operating leases, net of

sublease income, was $34.7 million, $34.0 million and $39.7 million during the years ended December 31, 2010,

2009 and 2008, respectively.

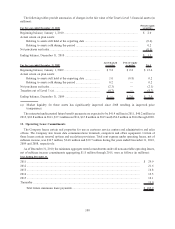

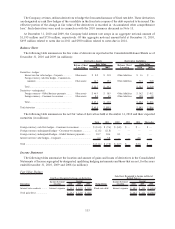

As of December 31, 2010, the minimum aggregate rental commitments under all noncancelable operating leases,

net of sublease income commitments aggregating $1.8 million through 2015, were as follows (in millions):

Year Ending December 31,

2011 ......................................................................................................................................... $ 29.9

2012 ......................................................................................................................................... 21.6

2013 ......................................................................................................................................... 16.8

2014 ......................................................................................................................................... 12.5

2015 ......................................................................................................................................... 10.1

Thereafter ................................................................................................................................. 15.0

Total future minimum lease payments.................................................................................. $ 105.9

108