Toyota 2015 Annual Report Download - page 198

Download and view the complete annual report

Please find page 198 of the 2015 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

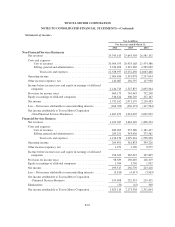

TOYOTA MOTOR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

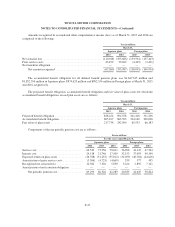

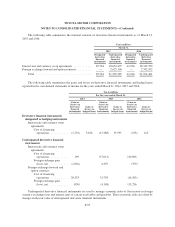

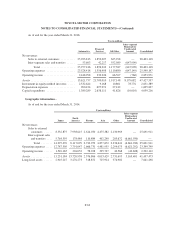

Yen in millions

March 31, 2016

Estimated fair value

Carrying amount Level 1 Level 2 Level 3 Total

Assets (Liabilities)

Cash and cash equivalents ....... 2,939,428 2,023,744 915,684 — 2,939,428

Time deposits ................. 1,032,034 — 1,032,034 — 1,032,034

Total finance receivables, net ..... 13,525,997 — — 13,597,910 13,597,910

Other receivables .............. 451,406 — — 451,406 451,406

Short-term borrowings .......... (4,698,134) — (4,698,134) — (4,698,134)

Long-term debt including the

current portion .............. (13,573,517) — (11,882,343) (1,900,953) (13,783,296)

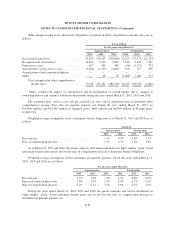

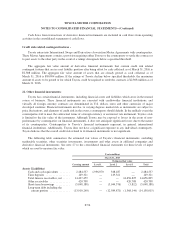

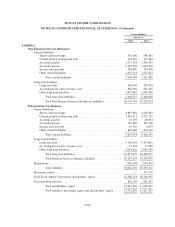

Cash and cash equivalents and time deposits -

In the normal course of business, substantially all cash and cash equivalents and time deposits are highly

liquid and are carried at amounts which approximate fair value due to its short duration. Cash equivalents and

time deposits include negotiable certificate of deposit measured at fair value on a recurring basis. Where money

market funds produce a daily net asset value in an active market, this value is used to determine the fair value of

the fund investment, and the investment is classified in Level 1. All other types of cash and cash equivalents and

time deposits are classified in Level 2.

Finance receivables, net -

The fair values of finance receivables are estimated by discounting expected cash flows to present value

using internal assumptions, including prepayment speeds, expected credit losses and collateral value. Certain

impaired finance receivables are measured at fair value on a nonrecurring basis based on collateral values.

As unobservable inputs are utilized, finance receivables are classified in Level 3.

Other receivables -

Other receivables are short-term receivables. These receivables are carried at amounts which approximate

fair value, and the difference between the carrying amount and the fair value is not material. These receivables

are classified in Level 3.

Short-term borrowings and long-term debt -

The fair values of short-term borrowings and long-term debt including the current portion, except for

secured loans provided by securitization transactions using special-purpose entities, are estimated based on the

discounted amounts of future cash flows using Toyota’s current borrowing rates for similar liabilities. As these

inputs are observable, these debts are classified in Level 2.

The fair values of the secured loans provided by securitization transactions are estimated based on current

market rates and credit spreads for debt with similar maturities. Internal assumptions including prepayment

speeds and expected credit losses are used to estimate the timing of cash flows to be paid on the underlying

securitized assets. As these valuations utilize unobservable inputs, the secured loans are classified in Level 3. See

note 11 to the consolidated financial statements for information regarding the secured loans.

F-57