Toyota 2015 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2015 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TOYOTA MOTOR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Cash flows from transactions of derivative financial instruments are included in cash flows from operating

activities in the consolidated statements of cash flows.

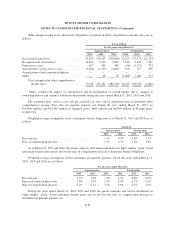

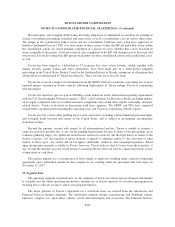

Credit risk related contingent features -

Toyota enters into International Swaps and Derivatives Association Master Agreements with counterparties.

These Master Agreements contain a provision requiring either Toyota or the counterparty to settle the contract or

to post assets to the other party in the event of a ratings downgrade below a specified threshold.

The aggregate fair value amount of derivative financial instruments that contain credit risk related

contingent features that are in a net liability position after being offset by cash collateral as of March 31, 2016 is

¥2,308 million. The aggregate fair value amount of assets that are already posted as cash collateral as of

March 31, 2016 is ¥80,904 million. If the ratings of Toyota decline below specified thresholds, the maximum

amount of assets to be posted or for which Toyota could be required to settle the contracts is ¥2,308 million as of

March 31, 2016.

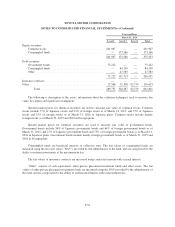

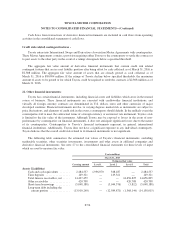

22. Other financial instruments:

Toyota has certain financial instruments, including financial assets and liabilities which arose in the normal

course of business. These financial instruments are executed with creditworthy financial institutions, and

virtually all foreign currency contracts are denominated in U.S. dollars, euros and other currencies of major

developed countries. Financial instruments involve, to varying degrees, market risk as instruments are subject to

price fluctuations, and elements of credit risk in the event a counterparty should default. In the unlikely event the

counterparties fail to meet the contractual terms of a foreign currency or an interest rate instrument, Toyota’s risk

is limited to the fair value of the instrument. Although Toyota may be exposed to losses in the event of non-

performance by counterparties on financial instruments, it does not anticipate significant losses due to the nature

of its counterparties. Counterparties to Toyota’s financial instruments represent, in general, international

financial institutions. Additionally, Toyota does not have a significant exposure to any individual counterparty.

Toyota believes that the overall credit risk related to its financial instruments is not significant.

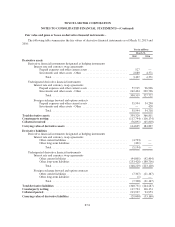

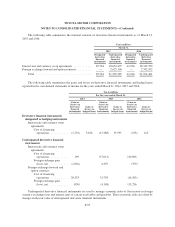

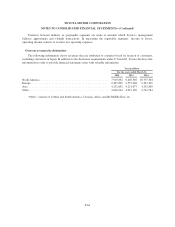

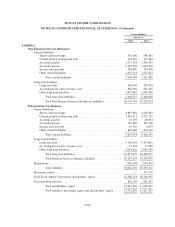

The following table summarizes the estimated fair values of Toyota’s financial instruments, excluding

marketable securities, other securities investments, investments and other assets in affiliated companies and

derivative financial instruments. See note 27 to the consolidated financial statements for three levels of input

which are used to measure fair value.

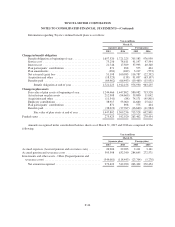

Yen in millions

March 31, 2015

Estimated fair value

Carrying amount Level 1 Level 2 Level 3 Total

Assets (Liabilities)

Cash and cash equivalents ....... 2,284,557 1,936,070 348,487 — 2,284,557

Time deposits ................. 149,321 — 149,321 — 149,321

Total finance receivables, net ..... 14,437,459 — — 14,656,825 14,656,825

Other receivables .............. 420,708 — — 420,708 420,708

Short-term borrowings .......... (5,048,188) — (5,044,376) (3,812) (5,048,188)

Long-term debt including the

current portion .............. (13,910,240) — (12,589,871) (1,568,144) (14,158,015)

F-56