Toyota 2015 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2015 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TOYOTA MOTOR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

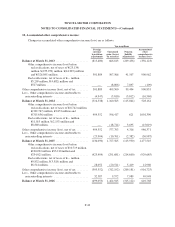

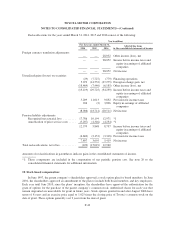

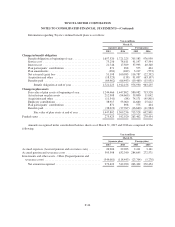

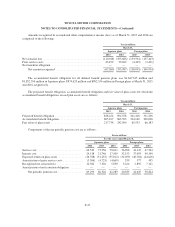

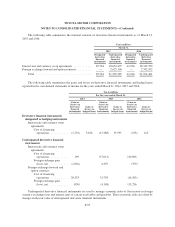

Other changes in plan assets and benefit obligations recognized in other comprehensive income (loss) are as

follows:

Yen in millions

For the years ended March 31,

Japanese plans Foreign plans

2014 2015 2016 2014 2015 2016

Net actuarial gain (loss) ...................... 71,890 130,455 (290,664) 52,253 (97,772) (11,242)

Recognized net actuarial loss .................. 12,562 7,302 5,850 5,224 2,892 7,121

Prior service costs ........................... 427 381 489 (96) (3,217) 573

Amortization of prior service costs .............. (5,566) (4,723) (4,669) 359 377 435

Amortization of net transition obligation ......... — — — — — —

Other ..................................... — 46 76 (7,605) 7,564 272

Total recognized in other comprehensive

income (loss) ......................... 79,313 133,461 (288,918) 50,135 (90,156) (2,841)

“Other” includes the impact of consolidation and deconsolidation of certain entities due to changes in

ownership interest and currency translation adjustments during the years ended March 31, 2014, 2015 and 2016.

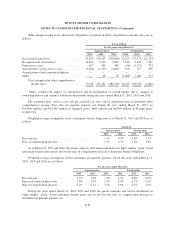

The estimated prior service costs and net actuarial loss that will be amortized from accumulated other

comprehensive income (loss) into net periodic pension cost during the year ending March 31, 2017 are

¥(4,600) million and ¥14,500 million in Japanese plans, ¥400 million and ¥6,400 million in Foreign plans,

respectively.

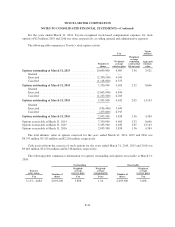

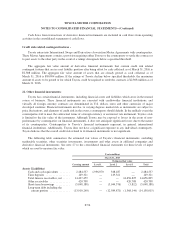

Weighted-average assumptions used to determine benefit obligations as of March 31, 2015 and 2016 are as

follows:

March 31,

Japanese plans Foreign plans

2015 2016 2015 2016

Discount rate .......................................... 1.1% 0.5% 4.0% 4.2%

Rate of compensation increase ............................ 2.5% 2.7% 4.4% 3.9%

As of March 31, 2015 and 2016, the parent company and certain subsidiaries in Japan employ “point” based

retirement benefit plans and do not use the rates of compensation increase to determine benefit obligations.

Weighted-average assumptions used to determine net periodic pension cost for the years ended March 31,

2014, 2015 and 2016 are as follows:

For the years ended March 31,

Japanese plans Foreign plans

2014 2015 2016 2014 2015 2016

Discount rate ...................... 1.7% 1.4% 1.1% 4.5% 4.8% 4.0%

Expected return on plan assets ......... 2.6% 2.5% 2.5% 6.9% 6.7% 6.3%

Rate of compensation increase ......... 2.2% 2.1% 2.5% 4.6% 4.5% 4.4%

During the years ended March 31, 2014, 2015 and 2016, the parent company and certain subsidiaries in

Japan employ “point” based retirement benefit plans and do not use the rates of compensation increase to

determine net periodic pension cost.

F-48