Toyota 2015 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2015 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TOYOTA MOTOR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

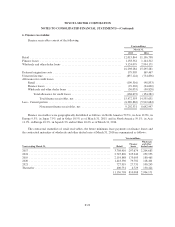

Finance lease receivables portfolio segment -

Toyota calculates allowance for credit losses to cover probable losses on finance lease receivables by

applying reserve rates to such receivables. Reserve rates are calculated mainly by historical loss experience,

current economic events and conditions and other pertinent factors such as used car markets.

Wholesale and other dealer loan receivables portfolio segment -

Toyota calculates allowance for credit losses to cover probable losses on wholesale and other dealer loan

receivables by applying reserve rates to such receivables. Reserve rates are calculated mainly by financial

conditions of the dealers, terms of collateral setting, current economic events and conditions and other pertinent

factors.

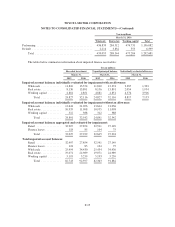

Toyota establishes specific reserves to cover the estimated losses on individually impaired receivables

within the wholesale and other dealer loan receivables portfolio segment. Specific reserves on impaired

receivables are determined by the present value of expected future cash flows or the fair value of collateral when

it is probable that such receivables will be unable to be fully collected. The fair value of the underlying collateral

is used if the receivable is collateral-dependent. The receivable is determined collateral-dependent if the

repayment of the loan is expected to be provided by the underlying collateral. For the receivables in which the

fair value of the underlying collateral was in excess of the outstanding balance, no allowance was provided.

Troubled debt restructurings in the retail receivables and finance lease receivables portfolio segments are

specifically identified as impaired and aggregated with their respective portfolio segments when determining the

allowance for credit losses. Impaired loans in the retail receivables and finance lease receivables portfolio

segments are insignificant for individual evaluation and Toyota has determined that allowance for credit losses

for each of the retail receivables and finance lease receivables portfolio segments would not be materially

different if they had been individually evaluated for impairment.

Specific reserves on impaired receivables within the wholesale and other dealer loan receivables portfolio

segment are recorded by an increase to the allowance for credit losses based on the related measurement of

impairment. Related collateral, if recoverable, is repossessed and sold and the account balance is written-off.

Any shortfall between proceeds received and the carrying cost of repossessed collateral is charged to the

allowance. Recoveries are reversed from the allowance for credit losses.

Allowance for residual value losses -

Toyota is exposed to risk of loss on the disposition of off-lease vehicles to the extent that sales proceeds are

not sufficient to cover the carrying value of the leased asset at lease termination. Toyota maintains an allowance

to cover probable estimated losses related to unguaranteed residual values on its owned portfolio. The allowance

is evaluated considering projected vehicle return rates and projected loss severity. Factors considered in the

determination of projected return rates and loss severity include historical and market information on used

vehicle sales, trends in lease returns and new car markets, and general economic conditions. Management

evaluates the foregoing factors, develops several potential loss scenarios, and reviews allowance levels to

determine whether reserves are considered adequate to cover the probable range of losses.

The allowance for residual value losses is maintained in amounts considered by Toyota to be appropriate in

relation to the estimated losses on its owned portfolio. Upon disposal of the assets, the allowance for residual

losses is adjusted for the difference between the net book value and the proceeds from sale.

F-15