Toyota 2015 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2015 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TOYOTA MOTOR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

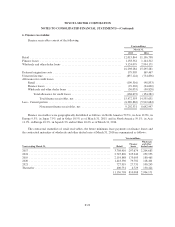

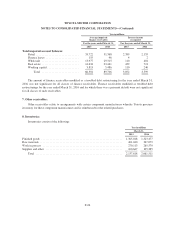

Inventories -

Inventories are valued at cost, not in excess of market, cost being determined on the “average-cost” basis,

except for the cost of finished products carried by certain subsidiary companies which is determined on the

“specific identification” basis or “last-in, first-out” (“LIFO”) basis. Inventories valued on the LIFO basis totaled

¥402,180 million and ¥382,660 million at March 31, 2015 and 2016, respectively. Had the “first-in, first-out”

basis been used for those companies using the LIFO basis, inventories would have been ¥39,165 million and

¥13,297 million higher than reported at March 31, 2015 and 2016, respectively.

Property, plant and equipment -

Property, plant and equipment are stated at cost. Major renewals and improvements are capitalized; minor

replacements, maintenance and repairs are charged to current operations. Depreciation of property, plant and

equipment is mainly computed on the declining-balance method for the parent company and Japanese

subsidiaries and on the straight-line method for foreign subsidiary companies at rates based on estimated useful

lives of the respective assets according to general class, type of construction and use. The estimated useful lives

range from 2 to 65 years for buildings and from 2 to 20 years for machinery and equipment.

Vehicles and equipment on operating leases to third parties are originated by dealers and acquired by certain

consolidated subsidiaries. Such subsidiaries are also the lessors of certain property that they acquire directly.

Vehicles and equipment on operating leases are depreciated primarily on a straight-line method over the lease

term, generally from 2 to 5 years, to the estimated residual value. Incremental direct costs incurred in connection

with the acquisition of operating lease contracts are capitalized and amortized on a straight-line method over the

lease term.

Long-lived assets -

Toyota reviews its long-lived assets for impairment whenever events or changes in circumstances indicate

that the carrying amount of an asset group may not be recoverable. An impairment loss would be recognized

when the carrying amount of an asset group exceeds the estimated undiscounted cash flows expected to result

from the use of the asset and its eventual disposition. The amount of the impairment loss to be recorded is

calculated by the excess of the carrying value of the asset group over its fair value. Fair value is determined

mainly using a discounted cash flow valuation method.

Goodwill and intangible assets -

Goodwill is not material to Toyota’s consolidated balance sheets.

Intangible assets consist mainly of software. Intangible assets with a definite life are amortized on a

straight-line basis with estimated useful lives mainly of 5 years. Intangible assets with an indefinite life are tested

for impairment whenever events or circumstances indicate that a carrying amount of an asset (asset group) may

not be recoverable.

An impairment loss would be recognized when the carrying amount of an asset exceeds the estimated

undiscounted cash flows used in determining the fair value of the asset. The amount of the impairment loss to be

recorded is generally determined by the difference between the fair value of the asset using a discounted cash

flow valuation method and the current book value.

Employee benefit obligations -

Toyota has both defined benefit and defined contribution plans for employees’ retirement benefits.

Retirement benefit obligations are measured by actuarial calculations in accordance with U.S.GAAP. The funded

F-16