Toyota 2015 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2015 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TOYOTA MOTOR CORPORATION

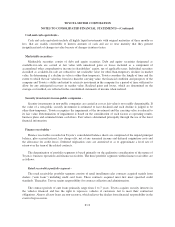

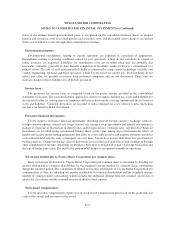

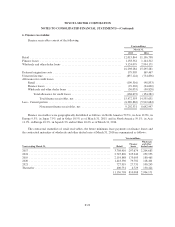

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Toyota classifies retail receivables portfolio segment into one class based on common risk characteristics

associated with the underlying finance receivables, the similarity of the credit risks, and the quantitative

materiality.

Finance lease receivables portfolio segment -

Toyota acquires new vehicle lease contracts originated primarily through dealers. The contract periods of

these primarily range from 2 to 5 years. Lease contracts acquired must first meet specified credit standards after

which Toyota assumes ownership of the leased vehicle. Toyota is responsible for contract collection and

administration during the lease period.

Toyota is generally permitted to take possession of the vehicle upon a default by the lessee. The residual

value is estimated at the time the vehicle is first leased. Vehicles returned to Toyota at the end of their leases are

sold by auction.

Toyota classifies finance lease receivables portfolio segment into one class based on common risk

characteristics associated with the underlying finance receivables and the similarity of the credit risks.

Wholesale and other dealer loan receivables portfolio segment -

Toyota provides wholesale financing to qualified dealers to finance inventories. Toyota acquires security

interests in vehicles financed at wholesale. In cases where additional security interests would be required, Toyota

takes dealership assets or personal assets, or both, as additional security. If a dealer defaults, Toyota has the right

to liquidate any assets acquired and seek legal remedies.

Toyota also makes term loans to dealers for business acquisitions, facilities refurbishment, real estate

purchases and working capital requirements. These loans are typically secured with liens on real estate, other

dealership assets and/or personal assets of the dealers.

Toyota classifies wholesale and other dealer loan receivables portfolio segment into three classes of

wholesale, real estate and working capital, based on the risk characteristics associated with the underlying

finance receivables.

A receivable account balance is considered impaired when, based on current information and events, it is

probable that Toyota will be unable to collect all amounts due according to the terms of the contract. Factors such

as payment history, compliance with terms and conditions of the underlying loan agreement and other subjective

factors related to the financial stability of the borrower are considered when determining whether a loan is

impaired. Impaired finance receivables include certain nonaccrual receivables for which a specific reserve has

been assessed. An account modified as a troubled debt restructuring is considered to be impaired. A troubled debt

restructuring occurs when an account is modified through a concession to a borrower experiencing financial

difficulty.

All classes of wholesale and other dealer loan receivables portfolio segment are placed on nonaccrual status

when full payment of principal or interest is in doubt, or when principal or interest is 90 days or more

contractually past due, whichever occurs first. Collateral dependent loans are placed on nonaccrual status if

collateral is insufficient to cover principal and interest. Interest accrued but not collected at the date a receivable

is placed on nonaccrual status is reversed against interest income. In addition, the amortization of net deferred

fees is suspended.

F-13