Toyota 2015 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2015 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TOYOTA MOTOR CORPORATION

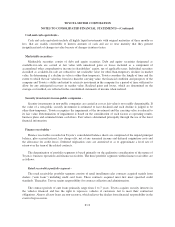

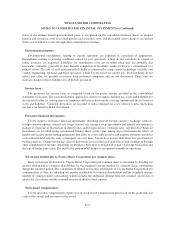

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Cash and cash equivalents -

Cash and cash equivalents include all highly liquid investments with original maturities of three months or

less, that are readily convertible to known amounts of cash and are so near maturity that they present

insignificant risk of changes in value because of changes in interest rates.

Marketable securities -

Marketable securities consist of debt and equity securities. Debt and equity securities designated as

available-for-sale are carried at fair value with unrealized gains or losses included as a component of

accumulated other comprehensive income in shareholders’ equity, net of applicable taxes. Individual securities

classified as available-for-sale are reduced to net realizable value for other-than-temporary declines in market

value. In determining if a decline in value is other-than-temporary, Toyota considers the length of time and the

extent to which the fair value has been less than the carrying value, the financial condition and prospects of the

company and Toyota’s ability and intent to retain its investment in the company for a period of time sufficient to

allow for any anticipated recovery in market value. Realized gains and losses, which are determined on the

average-cost method, are reflected in the consolidated statements of income when realized.

Security investments in non-public companies -

Security investments in non-public companies are carried at cost as fair value is not readily determinable. If

the value of a non-public security investment is estimated to have declined and such decline is judged to be

other-than-temporary, Toyota recognizes the impairment of the investment and the carrying value is reduced to

its fair value. Determination of impairment is based on the consideration of such factors as operating results,

business plans and estimated future cash flows. Fair value is determined principally through the use of the latest

financial information.

Finance receivables -

Finance receivables recorded on Toyota’s consolidated balance sheets are comprised of the unpaid principal

balance, plus accrued interest, less charge-offs, net of any unearned income and deferred origination costs and

the allowance for credit losses. Deferred origination costs are amortized so as to approximate a level rate of

return over the term of the related contracts.

The determination of portfolio segments is based primarily on the qualitative consideration of the nature of

Toyota’s business operations and finance receivables. The three portfolio segments within finance receivables are

as follows:

Retail receivables portfolio segment -

The retail receivables portfolio segment consists of retail installment sales contracts acquired mainly from

dealers (“auto loans”) including credit card loans. These contracts acquired must first meet specified credit

standards. Thereafter, Toyota retains responsibility for contract collection and administration.

The contract periods of auto loans primarily range from 2 to 7 years. Toyota acquires security interests in

the vehicles financed and has the right to repossess vehicles if customers fail to meet their contractual

obligations. Almost all auto loans are non-recourse, which relieves the dealers from financial responsibility in the

event of repossession.

F-12