Sara Lee 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to financial statements

Dollars in millions except per share data

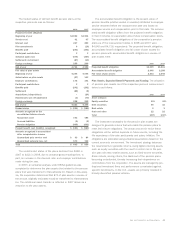

Outside the U.S., the investment objectives are similar, subject

to local regulations. In some countries, a higher percentage alloca-

tion to fixed-income securities is required. The responsibility for the

investment strategies typically lies with a board that may include

up to 50% of members elected by employees and retirees. During

2007, a greater amount of assets of certain plans in the U.K. were

invested in cash and other securities as the assets were being

transitioned into investments that better match the inflation and

interest characteristics of the respective pension liabilities. In

2008, these assets are invested in fixed income investments and

related derivative contracts, which are long term in nature. These

assets are included in the debt securities asset category.

Pension assets at the 2008 and 2007 measurement dates do

not include any direct investment in the corporation’s debt or equity

securities. The allocation of plan assets in 2008 generally reflects

the anticipated future allocation of plan assets.

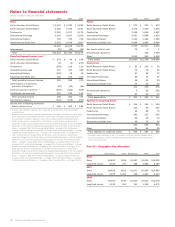

Substantially all pension benefit payments are made from

assets of the pension plans. Using foreign currency exchange rates

as of June 28, 2008 and expected future service, it is anticipated

that the future benefit payments will be as follows: $245 in 2009,

$242 in 2010, $252 in 2011, $264 in 2012, $272 in 2013 and

$1,486 from 2014 to 2018.

At the present time, the corporation expects to contribute $196

of cash to its pension plans in 2009. During 2006, the corporation

entered into an agreement to fully fund certain U.K. pension

obligations by 2015. The anticipated 2009 contributions reflect

the amounts agreed upon with the trustees of these U.K. plans.

Subsequent to 2015, the corporation has agreed to keep the U.K.

plans fully funded in accordance with certain local funding stan-

dards. The exact amount of cash contributions made to pension

plans in any year is dependent upon a number of factors including

minimum funding requirements in the jurisdictions in which the

company operates, the tax deductibility of amounts funded and

arrangements made with the trustees of certain foreign plans.

Defined Contribution Plans The corporation sponsors defined con-

tribution plans, which cover certain salaried and hourly employees.

The corporation’s cost is determined by the amount of contributions

it makes to these plans. The amounts charged to expense for con-

tributions made to these defined contribution plans totaled $43 in

2008, $38 in 2007 and $33 in 2006.

Multi-employer Plans The corporation participates in multi-employer

plans that provide defined benefits to certain employees covered by

collective bargaining agreements. Such plans are usually adminis-

tered by a board of trustees composed of the management of the

participating companies and labor representatives. The net pension

cost of these plans is equal to the annual contribution determined

in accordance with the provisions of negotiated labor contracts. These

contributions were $48 in 2008, $47 in 2007 and $45 in 2006.

Assets contributed to such plans are not segregated or otherwise

restricted to provide benefits only to the employees of the corporation.

The future cost of these plans is dependent on a number of factors

including the funded status of the plans and the ability of the other

participating companies to meet ongoing funding obligations.

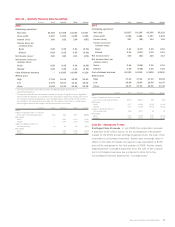

Note 20 – Postretirement Health-Care and Life-Insurance Plans

The corporation provides health-care and life-insurance benefits

to certain retired employees and their covered dependents and

beneficiaries. Generally, employees who have attained age 55 and

have rendered 10 or more years of service are eligible for these

postretirement benefits. Certain retirees are required to contribute

to plans in order to maintain coverage.

On June 30, 2007, the corporation adopted certain of the

provisions of Statement of Financial Accounting Standards

No. 158, “Employers’ Accounting for Defined Benefit Pension and

Other Postretirement Plans (SFAS 158).” See Note 2 – “Summary

of Significant Accounting Policies” for additional information regard-

ing the impact of the adoption of SFAS 158 and the related

disclosure requirements.

Measurement Date and Assumptions A March 31 measurement

date is utilized to value plan assets and obligations for the corpora-

tion’s postretirement health-care and life-insurance plans.

The weighted average actuarial assumptions used in measuring

the net periodic benefit cost and plan obligations for the three

years ending June 28, 2008 were:

2008 2007 2006

Net periodic benefit cost

Discount rate 5.7% 5.5% 5.1%

Plan obligations

Discount rate 6.4 5.7 5.5

Health-care cost trend assumed

for the next year 9.5 9.5 8.6

Rate to which the cost trend is

assumed to decline 5.5 5.5 5.3

Year that rate reaches the

ultimate trend rate 2015 2015 2010

In determining the discount rate, the corporation utilizes the

yield on high-quality fixed-income investments that have an AA bond

rating that matches the average duration of the plan obligations.

Assumed health-care trend rates are based on historical experience

and management’s expectations of future cost increases. A one-

percentage-point change in assumed health-care cost trend rates

would have the following effects:

One One

Percentage Percentage

Point Point

Increase Decrease

Effect on total service and interest components $÷2 $÷(2)

Effect on postretirement benefit obligation 22 (16)

70 Sara Lee Corporation and Subsidiaries