Sara Lee 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to financial statements

Dollars in millions except per share data

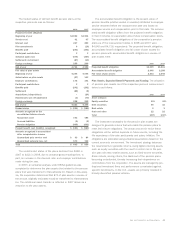

Concentrations of Credit Risk A large number of major international

financial institutions are counterparties to the corporation’s finan-

cial instruments. The corporation enters into financial instrument

agreements only with counterparties meeting very stringent credit

standards, limiting the amount of agreements or contracts it enters

into with any one party and, where legally available, executing master

netting agreements. These positions are continuously monitored.

While the corporation may be exposed to credit losses in the event

of nonperformance by these counterparties, it does not anticipate

material losses because of these control procedures.

Trade accounts receivable due from customers that the corporation

considers highly leveraged were $158 at June 28, 2008 and $109

at June 30, 2007. The financial position of these businesses has

been considered in determining allowances for doubtful accounts.

Note 19 – Defined Benefit Pension Plans

The corporation sponsors a number of U.S. and foreign pension plans

to provide retirement benefits to certain employees. The benefits

provided under these plans are based primarily on years of service

and compensation levels.

On June 30, 2007, the corporation adopted certain of the

provisions of Statement of Financial Accounting Standards

No. 158, “Employers’ Accounting for Defined Benefit Pension and

Other Postretirement Plans” (SFAS 158). See Note 2 – “Summary

of Significant Accounting Policies” for additional information

regarding the impact of the adoption of SFAS 158.

Measurement Date and Assumptions A March 31 measurement

date is utilized to value plan assets and obligations for all of the

corporation’s defined benefit pension plans. However, SFAS 158

requires entities to measure plan assets and benefit obligations as

of the date of its fiscal year-end statement of financial position for

fiscal years ending after December 15, 2008. As such, the company

expects to adopt the measurement date provision of SFAS 158 in

fiscal 2009. The impact of adopting the measurement date provision

of SFAS 158 will be recorded as an adjustment to beginning of year

retained earnings in 2009. The corporation does not believe the

impact will be material to the consolidated financial statements.

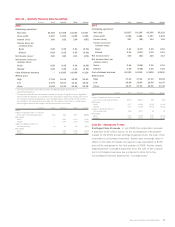

The weighted average actuarial assumptions used in measuring

the net periodic benefit cost and plan obligations of continuing oper-

ations for the three years ending June 28, 2008 were as follows:

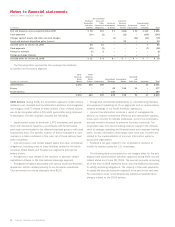

2008 2007 2006

Net periodic benefit cost

Discount rate 5.4% 5.1% 5.2%

Long-term rate of return on plan assets 6.7 6.8 6.4

Rate of compensation increase 3.8 3.9 3.9

Plan obligations

Discount rate 6.3% 5.4% 5.1%

Rate of compensation increase 3.7 3.8 3.9

In determining the discount rate, the corporation utilizes the

yield on high-quality fixed-income investments that have a AA bond

rating and match the average duration of the pension benefit pay-

ments. Salary increase assumptions are based upon historical

experience and anticipated future management actions. In deter-

mining the long-term rate of return on plan assets, the corporation

assumes that the historical long-term compound growth rates of

equity and fixed-income securities and other plan investments will

predict the future returns of similar investments in the plan portfo-

lio. Investment management and other fees paid out of plan assets

are factored into the determination of asset return assumptions.

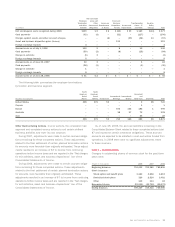

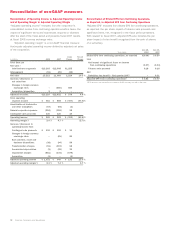

Net Periodic Benefit Cost and Funded Status The components of

the net periodic benefit cost for continuing operations were as follows:

2008 2007 2006

Components of defined benefit

net periodic benefit cost

Service cost $÷«91 $÷«97 $«104

Interest cost 267 253 230

Expected return on assets (293) (279) (226)

Amortization of

Prior service cost 882

Net actuarial loss 34 62 71

Net periodic benefit cost $«107 $«141 $«181

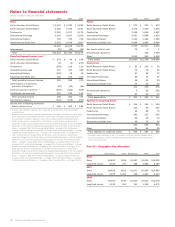

The corporation also recognized settlement losses of $16 in

2008, $15 of which related to the settlement of a pension plan in

the U.K. and is reported as part of discontinued operations. It also

recognized settlement, curtailment and termination losses of $12

in 2007 as a result of the termination of certain foreign employees

due to plant closures and employee terminations in the U.S. The

corporation had settlement and termination losses of $6 in 2006.

The amount of prior service cost and net actuarial loss that is

expected to be amortized from accumulated other comprehensive

income and reported as a component of net periodic benefit cost

during 2009 is $9 and $27, respectively.

The net periodic benefit cost of the corporation’s defined benefit

pension plans in 2008 was $34 lower than in 2007. The decline

was primarily due to a $28 reduction in amortization of net actuar-

ial losses due to net actuarial gains in the prior year, which reduced

the amount subject to amortization; and a $6 reduction in service

cost due to headcount reductions versus the prior year.

The net periodic benefit cost of the corporation’s defined benefit

pension plans in 2007 was $40 lower than in 2006. This was pri-

marily due to a $53 increase in the expected return on plan assets

in 2007 partially offset by higher interest expense. The greater asset

return resulted from the fact that plan assets at the start of 2007

were $741 greater than at the start of 2006, and the corporation

contributed $191 of cash to the plans during 2007.

68 Sara Lee Corporation and Subsidiaries