Sara Lee 2008 Annual Report Download - page 19

Download and view the complete annual report

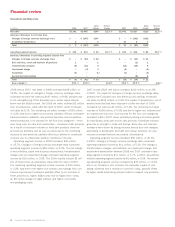

Please find page 19 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.•Finalization of Tax Reviews and Audits – During 2007, the

corporation recorded net adjustments to reduce its tax contingency

reserves related to uncertain tax positions by approximately $110 mil-

lion. The adjustments resulted in a tax benefit for the corporation.

Approximately $80 million of the reserve reduction related to the

finalization of federal, state and foreign examinations, including

the federal income tax examinations covering the corporation’s tax

years 2003 and 2004. The remaining $30 million of reserve reduc-

tions related to the lapsing of the statute of limitations in two

foreign jurisdictions.

•Receipt of Contingent Sales Proceeds – The corporation

recognized a tax benefit of $42 million related to its receipt of

non-taxable contingent sales proceeds pursuant to the sale terms

of its European cut tobacco business in 1999. The corporation will

continue to recognize a tax rate reduction related to contingent

sales proceeds received during the agreement term, which is

effective through July 2009.

•Goodwill Impairment – In 2007, the corporation’s tax rate

increased by 7.8% as a result of recognizing $95 million of non-

deductible goodwill impairments.

•Valuation Allowance – After considering the lower profit

expectations of a Brazilian coffee operation, the corporation concluded

that it was necessary to increase the valuation allowances on cer-

tain deferred tax asset balances related to Brazilian net operating

loss carryforwards, as the corporation does not believe that it will

be able to utilize these tax benefits. This adjustment resulted in

a $27 million tax charge for 2007.

•Foreign Earnings – The corporation’s global mix of earnings, the

tax characteristics of the corporation’s income, and the benefit from

certain foreign jurisdictions having lower tax rates also reduced the

corporation’s tax expense during 2007.

In 2006, the corporation recognized tax expense of $158 million,

or an effective tax rate of 83.6%, as the corporation recognized a

$529 million tax charge to repatriate to the U.S. approximately

$1.7 billion of cash related to current and prior year earnings of

certain foreign subsidiaries previously deemed to be permanently

invested. Of the $529 million charge, $291 million relates to earn-

ings of prior years. This charge was partially offset by a $332 million

credit related to the favorable outcome of certain foreign tax audits

and reviews that were completed during 2006 and a $36 million

benefit due to a change in a valuation allowance.

Sara Lee Corporation and Subsidiaries 17

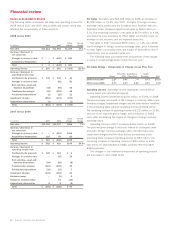

In 2008, the corporation recognized tax expense on continuing

operations of $201 million, or an effective tax rate of 125.6%.

The significant components impacting the corporation’s effective

tax rate are as follows:

•Goodwill Impairment – The corporation’s tax rate increased by

173.5% as a result of recognizing $790 million of non-deductible

goodwill impairments during the year.

•Remittance of Foreign Earnings – The corporation incurred a tax

charge of $118 million related to the repatriation of earnings from

certain foreign subsidiaries. This charge increased the effective

rate by 74.0%.

•Finalization of Tax Reviews and Audits – A $96 million benefit

resulted from the completion of tax audits and the expiration of

statutes of limitations in France, Morocco, the Netherlands, the

Philippines and various state and local jurisdictions. Of this amount,

$40 million related to the completion of tax audits and $56 million

related to the expiration of statutes of limitations.

•Receipt of Contingent Sales Proceeds – The corporation

recognized a tax benefit of $46 million related to its receipt of

non-taxable contingent sales proceeds pursuant to the sale terms

of its European cut tobacco business in 1999. The corporation will

continue to recognize a tax rate reduction related to contingent sales

proceeds received during the agreement term, which is effective

through July 2009.

•Valuation Allowance – A $19 million benefit relates to the net

reversal of valuation allowances, primarily on German deferred tax

assets. The corporation determined that a valuation allowance was

no longer necessary due to the recent projected profitability of the

German operations. This benefit was partially offset by the establish-

ment of valuation allowances for certain state deferred tax assets in

which the corporation does not anticipate future realization.

•Foreign Earnings – The corporation’s global mix of earnings, the

tax characteristics of the corporation’s income, and the benefit from

certain foreign jurisdictions that have lower tax rates also reduced

the corporation’s tax expense during 2008.

In 2007, the corporation recognized a tax benefit on continuing

operations of $11 million, or a negative effective tax rate of (2.6)%.

The significant components impacting the corporation’s effective

tax rate are as follows:

•Remittance of Foreign Earnings – In 2007, the corporation

incurred a tax charge of $194 million related to the repatriation

of earnings from certain foreign subsidiaries.

•Sale of Capital Assets – The corporation sold the shares of

a subsidiary in the first quarter of 2007, which resulted in a

$169 million tax benefit.