Sara Lee 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

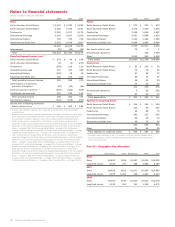

Notes to financial statements

Dollars in millions except per share data

64 Sara Lee Corporation and Subsidiaries

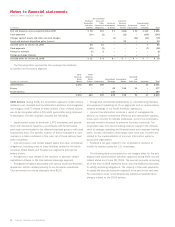

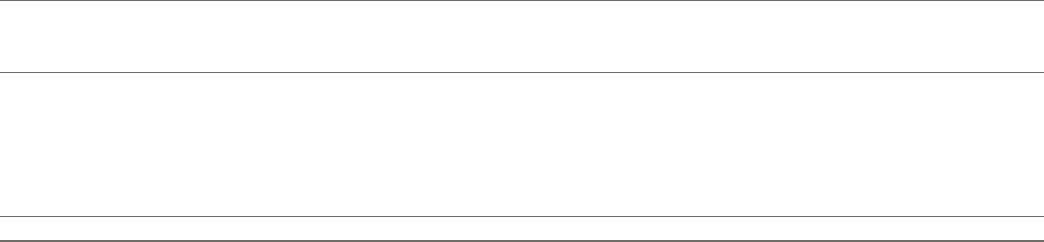

The goodwill reported in continuing operations associated with

each business segment and the changes in those amounts during

2008 and 2007 are as follows:

North

North American Household

American Retail International International and

Retail Meats Bakery Foodservice Beverage Bakery Body Care Total

Net book value at July 1, 2006 $92 $294 $«954 $272 $«622 $517 $2,751

Impairment – – – (92) – – (92)

Foreign exchange/other – – –13 –2639

Net book value at June 30, 2007 92 294 954 193 622 543 2,698

Impairments – – (382) – (400) – (782)

Reclass to net assets held for sale – – (19) – – – (19)

Reallocation – 3 48 – (51) – –

Redenomination – – – 24 63 19 106

Foreign exchange/other – – – 46 110 64 220

Net book value at June 28, 2008 $92 $297 $«601 $263 $«344 $626 $2,223

In 2008, non-deductible goodwill of $382 and $400 was

impaired in the Foodservice Bakery and Bakery Spain reporting

units, respectively. These charges are more fully described in Note

3 to the Consolidated Financial Statements, “Impairment Charges.”

In 2007, non-deductible goodwill of $92 was impaired in the

International Beverage segment. Of this amount, $86 relates to the

Brazilian reporting unit and $6 relates to the Austrian reporting unit.

These charges are more fully described in Note 3 to the Consolidated

Financial Statements, “Impairment Charges.”

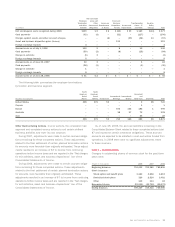

Note 16 – Contingencies and Commitments

Contingent Asset The corporation sold its European cut tobacco

business in 1999. Under the terms of that agreement, the corpo -

ration will receive an annual cash payment of 95 million euros if

tobacco continues to be a legal product in the Netherlands, Germany

and Belgium through July 15, 2009. The legal status of tobacco in

each country accounts for a portion of the total contingency with

the Netherlands accounting for 67%, Germany 22% and Belgium

11%. If tobacco ceases to be a legal product within any of these

countries, the corporation forfeits the receipt of all future amounts

related to that country. The contingencies associated with the 2008

and prior payments passed in the first quarter of each fiscal year

and the corporation received the annual payments. The 2008 annual

payment was equivalent to $130, the 2007 annual payment was

equivalent to $120 and the 2006 annual payment was equivalent

to $114 based upon the respective exchange rates on the dates of

receipt. These amounts were recognized in the corporation’s earn-

ings when received. The payments increased diluted earnings per

share by $0.18 in 2008, $0.16 in 2007 and $0.15 in 2006.

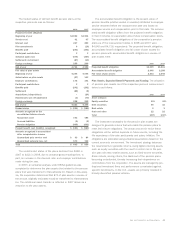

Contingent Liabilities The corporation is a party to various

pending legal proceedings, claims and environmental actions by

government agencies. In accordance with SFAS No. 5, “Accounting

for Contingencies,” the corporation records a provision with respect

to a claim, suit, investigation or proceeding when it is probable that

a liability has been incurred and the amount of the loss can reason-

ably be estimated. Any provisions are reviewed at least quarterly

and are adjusted to reflect the impact and status of settlements,

rulings, advice of counsel and other information pertinent to the

particular matter. The recorded liabilities for these items were not

material to the Consolidated Financial Statements of the corporation

in any of the years presented. Although the outcome of such items

cannot be determined with certainty, the corporation’s general coun-

sel and management are of the opinion that the final outcome of

these matters will not have a material adverse impact on the con-

solidated financial position, results of operations or liquidity.

Aris

Since 1995, three complaints have been filed on behalf

of employees of a former subsidiary of the corporation known as

Aris Philippines, Inc. (Aris) alleging unfair labor practices associated

with Aris’ termination of manufacturing operations in the Philippines.

Each of these three complaints includes allegations with the same

issues and facts. With regard to two of these complaints, Aris

prevailed in the administrative hearings held in the Philippines.

Although implicated in these complaints, the corporation was not

a party. The third complaint is a consolidation of cases filed in the

Republic of the Philippines, Department of Labor and Employment

and the National Labor Relations Commission (NLRC) from 1998

through July 1999 by individual complainants. On December 11,

1998, the third complaint was amended to name the corporation

as a party. The case is styled: Emelinda Mactlang, et al. v. Aris

Philippines, Inc., et al. In the underlying proceedings during 2006,

the arbitrator ruled against the corporation and awarded the plain-

tiffs $60 in damages and fees. The corporation appealed this

administrative ruling. On December 19, 2006, the NLRC issued a

ruling setting aside the arbitrator’s ruling, and remanded the case

to the arbitrator for further proceedings. The complainants and the

corporation have filed motions for reconsideration – the corporation

seeking a final judgment and outright dismissal of the case, instead

of a remand to the arbitrator; and complaints seeking to reinstate