Sara Lee 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

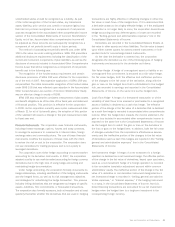

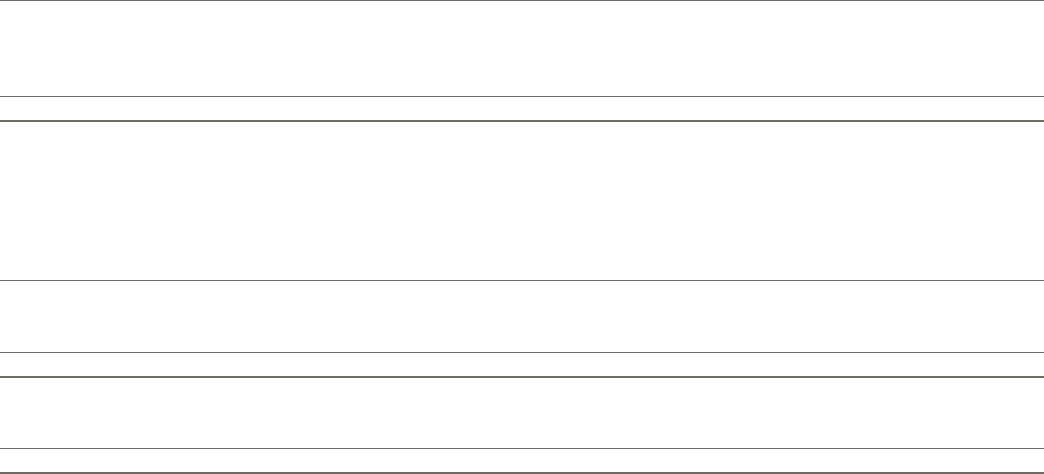

Non-cancelable

Employee Lease and Asset and

Termination Other Business Transformation

and Other Contractual Disposition Accelerated Costs – IT

In millions Benefits Obligations Actions Depreciation and Other Total

Exit and disposal costs recognized during 2008 $36 $3 $(1) $«1 $«51 $«90

Charges against assets and other non-cash charges – – – (1) (16) (17)

Asset and business disposition gains (losses) ––1––1

Cash payments (7) – – – (33) (40)

Accrued costs as of June 28, 2008 $29 $3 $«– $«– $«««2 $«34

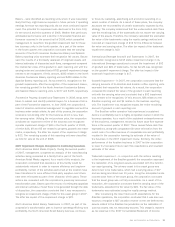

The following table summarizes the employee terminations

by location and business segment.

North North

American American Household

Retail Retail International International and

Number of employees Meats Bakery Foodservice Beverage Bakery Body Care Corporate Total

United States 26632167–––88553

Europe –––123––24

Australia ––––26––26

266 32 167 1 49 – 88 603

As of June 28, 2008

Actions completed 59 25 122 – 27 – 10 243

Actions remaining 207 7 45 1 22 – 78 360

266 32 167 1 49 – 88 603

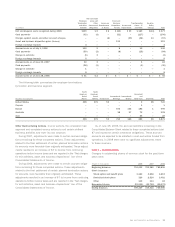

2007 Actions During 2007, the corporation approved certain actions

related to exit, disposal and transformation activities and recognized

net charges of $251 related to these actions. Each of these actions

was to be completed within a 12-month period after being approved.

During 2008, certain of these actions were completed for amounts

that differed from those originally estimated. A description of these

activities includes the following:

•Implemented a plan to terminate 2,512 employees and provide

them with severance benefits in accordance with benefit plans pre-

viously communicated to the affected employee group or with local

employment laws. The specific location of these employees is sum-

marized in a table contained in this note. Of the 2,512 targeted

employees, 37 have not yet been terminated. A majority of these

actions are expected to be completed by the first quarter of 2009.

•Incurred costs to exit certain leased space and other contractual

obligations, including those costs related to the relocation of the

corporation’s headquarters to Downers Grove, Illinois.

•Recognized a loss related to the decision to abandon certain

capitalized software in the International Beverage segment.

•Recognized net gains associated with the disposal of several

asset groupings, the largest of which was a net $19 gain related

to the disposition of two Household and Body Care facilities offset

by charges related to various disposition costs primarily associated

with the spin off of the Branded Apparel business. Total proceeds

from these disposals were $31.

•Recognized accelerated depreciation primarily on domestic meat

processing facilities and equipment. All of the facilities were closed

by the end of 2007.

•Incurred transformation costs as a result of management’s

decision to centralize the management of its North American and

European operations. Costs were incurred to relocate employees,

recruit new employees, and pay retention bonuses to preserve

business continuity. The corporation also incurred consulting costs

to assist in the development of strategic operating and financial

plans and employee training. Certain information technology costs

were also incurred and related to the implementation of common

information systems across the organization.

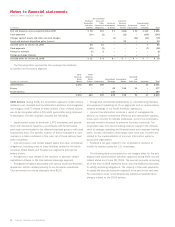

The following table summarizes the net charges taken for the exit,

disposal and transformation activities approved during 2007 and the

related status as of June 28, 2008. The accrued amounts remaining

as of the end of 2008 represent those cash expenditures necessary

to satisfy remaining obligations. The majority of the cash payments

to satisfy the accrued costs are expected to be paid in the next year.

The corporation does not anticipate any additional material future

charges related to the 2007 actions.

Sara Lee Corporation and Subsidiaries 57