Sara Lee 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to financial statements

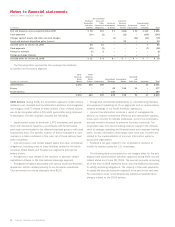

Dollars in millions except per share data

The following is a reconciliation of net income (loss) to net income

(loss) per share – basic and diluted – for the years ended June 28,

2008, June 30, 2007 and July 1, 2006:

Shares in millions 2008 2007 2006

Income (loss) from continuing operations $«««(41) $«440 $«««31

Income (loss) from discontinued operations (14) 48 123

Gain (loss) on sale of discontinued operations (24) 16 401

Net income (loss) $«««(79) $«504 $«555

Average shares outstanding – basic 715 741 766

Dilutive effect of stock option

and stock award plans –22

Diluted shares outstanding 715 743 768

Income (loss) from continuing

operations per share

Basic $(0.06) $0.59 $0.04

Diluted $(0.06) $0.59 $0.04

Net income (loss) from discontinued

operations per share

Basic $(0.05) $0.09 $0.68

Diluted $(0.05) $0.09 $0.68

Net income (loss) per share

Basic $(0.11) $0.68 $0.72

Diluted $(0.11) $0.68 $0.72

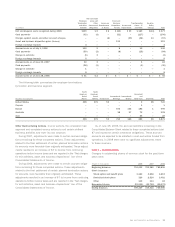

Note 12 – Long-Term Debt

The composition of the corporation’s long-term debt, which includes

capital lease obligations, is summarized in the following table:

Maturity Date 2008 2007

Senior debt – fixed rate

6.125% notes 2008 $«««««««– $«««806

6.0% – 6.95% medium-term notes 2008 – 227

2.75% notes 2008 – 300

7.05% – 7.40% notes 2008 – 75

6.5% notes 2009 150 150

7.26% – 7.71% notes 2010 25 25

6.25% notes 2012 1,110 1,110

3.875% notes 2013 500 500

10% zero coupon notes 2014 11 10

10% – 14.25% zero coupon notes 2015 50 44

6.125% notes 2033 500 500

Total senior debt 2,346 3,747

Senior debt – variable rate

Euro denominated – euro interbank offered

rate (EURIBOR) plus .10% 2009 394 336

Total senior debt 2,740 4,083

Obligations under capital lease 61 68

Other debt 103 64

Total debt 2,904 4,215

Unamortized discounts (6) (7)

Hedged debt adjustment to fair value 10 (11)

Total long-term debt 2,908 4,197

Less current portion 568 1,427

$2,340 $2,770

Payments required on long-term debt during the years ending 2009

through 2013 are $568, $52, $20, $1,128 and $517, respectively.

The corporation made cash interest payments of $249, $266 and

$311 in 2008, 2007 and 2006, respectively.

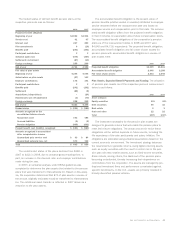

Note 13 – Leases

The corporation leases certain facilities, equipment and vehicles under

agreements that are classified as either operating or capital leases.

The building leases have original terms that range from 10 to 15

years, while the equipment and vehicle leases have terms of generally

less than seven years. The gross book value of capital lease assets

included in property at June 28, 2008 and June 30, 2007 was $118

and $138, respectively. The net book value of capital lease assets

included in property at June 28, 2008 and June 30, 2007 was $61

and $68, respectively.

Future minimum payments, by year and in the aggregate, under

capital leases and noncancelable operating leases having an origi-

nal term greater than one year at June 28, 2008 were as follows:

Capital Operating

Leases Leases

2009 $16 $116

2010 19 76

2011 16 53

2012 10 33

2013 526

Thereafter 4 102

Total minimum lease payments 70 $406

Amounts representing interest (9)

Present value of net minimum payments 61

Current portion 12

Noncurrent portion $49

Depreciation expense of capital lease assets was $20 in 2008,

$27 in 2007 and $26 in 2006. Rental expense under operating

leases was $146 in 2008, $130 in 2007 and $135 in 2006.

Contingent Lease Obligation The corporation is contingently liable

for leases on property operated by others. At June 28, 2008, the

maximum potential amount of future payments the corporation could

be required to make, if all of the current operators default on the

rental arrangements, is $172. The minimum annual rentals under

these leases are $29 in 2009, $27 in 2010, $23 in 2011, $18 in

2012, $14 in 2013 and $61 thereafter. The two largest components

of these amounts relate to a number of retail store leases operated

by Coach, Inc. and certain leases related to the corporation’s U.K.

Apparel operations that have been sold. Coach, Inc. is contractually

obligated to provide the corporation, on an annual basis, with a

standby letter of credit approximately equal to the next year’s rental

obligations. The letter of credit in place at the close of 2008 was $13.

This obligation to provide a letter of credit expires when the corpo-

ration’s contingent lease obligation is substantially extinguished.

The corporation has not recognized a liability for the contingent

obligation on the Coach, Inc. leases.

62 Sara Lee Corporation and Subsidiaries