Sara Lee 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to financial statements

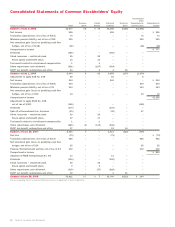

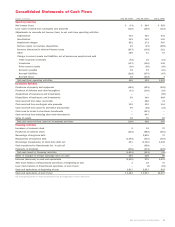

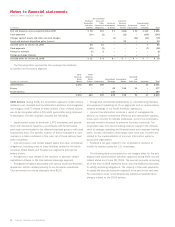

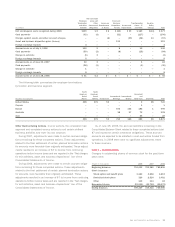

Dollars in millions except per share data

Household and Body Care

The corporation owns and operates a

manufacturing plant in Zimbabwe. In 2007, changes in local govern-

mental regulations in Zimbabwe included severe foreign exchange

restrictions which inhibit the corporation from declaring dividends and

repatriating earnings from the local operation. Based on these severe

foreign exchange restrictions and general economic uncertainty in

this economy, the corporation has considered the investment in the

local business impaired, recognized a pretax and after tax impairment

charge in the third quarter of 2007 for $4, and deconsolidated the

business at the end of the third quarter of 2007. The remaining

investment in these operations will be recorded as a cost basis

investment and has a value of less than $1.

In conjunction with the 2007 annual impairment review of goodwill

and indefinite lived intangible assets, the corporation concluded

that the fair value of certain Household and Body Care trademarks

exceeded their carrying value. However, sales for these trademarks,

having a carrying value of $99, had been declining. Based on these

sales declines, the corporation decided to begin amortizing these

trademarks over periods ranging from 5 to 20 years.

2006 Impairment Charges Recognized in Continuing Operations

North American Retail and International Bakery Trademarks

As part

of the transformation plan, the operating management of the bakery

business was changed at the start of 2006 and new long-range plans

were developed for the U.S. and European businesses in preparation

for the start of 2007. In order to improve the efficiency and profitabil-

ity of the U.S. operations, it was decided to eliminate certain regional

brands, reduce the marketing, advertising and promotion spending

behind other regional brands, and place more resources behind those

brands with greater penetration of the domestic market. A greater

portion of future research and development spending would also

be focused on these larger brands. Similar decisions were made

regarding the European business. These decisions impacted the

anticipated future sales and cash flows of certain brands. All trade-

marks of the corporation’s bakery operations have been subject to

amortization and the corporation conducted an impairment review of

the trademarks impacted by these decisions. A third-party appraisal

was used to determine the fair value of the trademarks considered

to be impaired. The fair value of the trademarks was determined using

the royalty savings method and pretax impairment charges of $179

and $14 were recognized in 2006 in the North American Retail Bakery

and International Bakery segments, respectively. The after tax impact

of these impairment charges is $111 and $9, respectively.

Impairment Charges Recognized in Discontinued Operations

After announcing its intent to dispose of certain businesses, the

corporation assessed the reporting and recoverability of these oper-

ations in each quarter through the date of sale. Several significant

charges were recognized in 2006 and reported on the line labeled

“Net (loss) income from discontinued operations, net of tax (benefit)

expense” of the Consolidated Statements of Income. Note 2 to the

Consolidated Financial Statements describes the accounting policies

and significant judgments related to planned business dispositions.

The following is a description of the discontinued operations that

incurred impairment charges.

European Branded Apparel

This business was initially marketed for

sale in 2005 and, as part of this process, the corporation recognized a

pretax impairment charge of $305 in 2005 related to goodwill ($182)

and indefinite-lived trademarks ($123). In 2006, the corporation’s

board of directors authorized management to negotiate and enter

into a definitive agreement to sell this business, and the corporation

entered into an exclusive negotiating period with a prospective buyer.

Utilizing the agreed upon sale price, the corporation conducted an

impairment review of the business and recognized an additional pretax

impairment charge of $179 in the first quarter of 2006 within dis-

continued operations. The after tax impact of the impairment charge

was $132. The sale of this business closed in the third quarter

of 2006.

U.S. Retail Coffee

In 2005, the corporation initiated steps to dispose

of certain assets used to manufacture and market roast and ground

coffee products in the U.S. retail coffee channel and recognized a

pretax impairment charge of $45 related to manufacturing assets

($13) and trademarks ($32). In 2006, the corporation announced

that it had entered into an agreement to sell the U.S. Retail Coffee

business for $83. As a result of allocating the goodwill to the U.S.

Retail Coffee business to be sold, and utilizing the agreed upon selling

price of the business, the corporation recognized an impairment charge

of $44 in 2006 to record the impairment of $29 of goodwill and $15

of other long-lived assets. No tax benefit was recognized on the

goodwill impairment and a $5 tax benefit was recognized on the other

long-lived assets. The U.S. Retail Coffee business was sold in

December 2005.

U.K. Apparel

In 2006, the corporation classified as held for disposal

the U.K. Apparel business, which was comprised of the Courtaulds

operations and several Sri Lankan ventures that supplied a portion

of the Courtaulds inventory needs. The corporation recognized a $34

impairment charge to write down the value of the Courtaulds business

to its fair value after discussions with potential buyers indicated that

the fair value of the Courtalds business was less than its carrying

value. There was no tax benefit associated with the impairment. In

June 2006, the corporation closed on the sales of the Courtaulds

business and the Sri Lankan ventures.

U.S. Meat Snacks

In 2006, the U.S. Meat Snacks business was

marketed for sale and a sale agreement was entered into which indi-

cated that the fair value of the business was less than the carrying

value of the business. Goodwill associated with this business was

evaluated for impairment in accordance with SFAS No. 142 and

the corporation recognized a goodwill impairment charge of $12

pretax and $8 after tax. In June 2006, the sale of this business

was completed.

European Meats

During 2006, the corporation marketed its European

Meats business for sale and received several non-binding offers

from prospective buyers. Based on indications of fair value from

these offers, the carrying value of the business, including the related

portion of the cumulative translation adjustment, was determined to

exceed its fair value and the corporation evaluated the recoverability

of the long-lived assets. The measurement process utilized the

52 Sara Lee Corporation and Subsidiaries