Sara Lee 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the working capital of the business declined through the date of

sale and a gain was recognized. The tax benefit recognized on the

transaction resulted from a capital loss that the corporation was able

to carry back against a capital gain recognized in a prior transaction.

The definitive sale agreement provided for the sale of certain opera-

tions in the Philippines which were sold in 2007 and discussed above

under the heading “Businesses Sold in 2007”.

Under the terms of the transaction, the corporation can receive

additional cash proceeds if the buyer receives cash distributions as a

result of certain events such as the sale of the business, the payment

of dividends or redemption of capital or loans. Distributions of available

cash from the sold business will be made in the following order:

•The buyer will first receive any amounts owed as a result

of working capital and other purchase price adjustments.

•After the purchase price adjustments are satisfied, the corporation

will receive 49% of the next 200 million euros of cash distributions.

•If additional cash is distributed, the corporation may receive

between 15% and 25% of these amounts.

If any amounts are received, they will be recognized in income

when the cash is received. The corporation has no continuing

involvement in the business after the date of sale and does not

expect any material direct cash inflows or outflows with the sold entity.

Under the terms of the sale agreement, the corporation retained

certain of the pension obligations of this business. As a result of an

agreement reached with the trustees of a retained plan at the time

of sale, it was agreed that annuities would be purchased to settle

the related obligations. In 2008 the corporation recognized a $15

non-cash charge related to the final settlement of this pension obli-

gation which was recorded in discontinued operations.

European Nuts and Snacks

During the second quarter of 2006,

the corporation entered into a definitive agreement to sell its

European Nuts and Snacks business for 130 million euros and the

corporation closed this transaction in June 2006. The Nuts and

Snacks business in the Netherlands is separately reported and its

operations and cash flows are identifiable. As a result, this component

of the business is reported as a discontinued operation. The Nuts

and Snacks operations in France and Belgium are integrated into the

corporation’s other operations in these countries and share common

distribution, sales and administrative functions. Since the operations

and cash flows of these businesses could not be clearly distinguished

from the retained businesses, the operating results of the businesses

continue to be included in continuing operations. As a result of this

business being reported in both discontinued and continuing opera-

tions, the gain on the sale of business is also reported in discontinued

and continuing operations. The sale of the Nuts and Snacks business

in the Netherlands generated a pretax and after tax gain of $66 and

$70, respectively, and is reported in discontinued operations. An

additional pretax and after tax gain of $41 and $27, respectively,

related to the French and Belgian operations is recognized in

continuing operations.

The sale agreement provided for working capital and other

customary postclosing adjustments relating to the assets transferred.

The corporation has not had any significant continuing involvement

in this business after it was sold and does not expect to have any

material direct cash inflows or outflows with the sold entity.

U.K. Apparel

The U.K. Apparel business was sold in June 2006 in

two transactions, with one buyer purchasing certain manufacturing

operations in Sri Lanka and a separate buyer purchasing the

Courtaulds operations centered in the U.K. The corporation recognized

a pretax and after tax gain of $22 from selling the U.K. Apparel

operations which was primarily related to the sale of the Sri Lankan

operations. The gain on these sales was not subject to tax.

The sale agreement provided for working capital and other

customary postclosing adjustments relating to the assets transferred.

Under the terms of the sale agreement, the corporation retained

certain pension obligations associated with the U.K. Apparel business

that was sold. The corporation has not had any significant continuing

involvement in this business after it was sold and does not expect to

have any material direct cash inflows or outflows with the sold entity.

U.S. Meat Snacks

In March 2006, the corporation entered into a

definitive agreement to sell its U.S. Meat Snacks business for $9.

In June 2006, the corporation closed this transaction and recognized

a pretax gain of $1 that was primarily offset by taxes. The corporation

has no continuing involvement in the business after the date of sale

and does not expect any material direct cash inflows or outflows

with the sold entity.

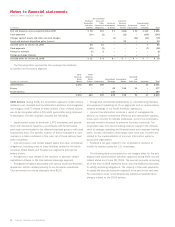

Discontinued Operations Cash Flows The corporation’s discontinued

operations impacted the cash flows of the corporation as summarized

in the table below.

2008 2007 2006

Discontinued operations impact on

Cash from operating activities $10 $«88 $«860

Cash from investing activities (8) (47) (339)

Cash from financing activities (5) (56) (550)

Net cash impact of discontinued operations $«(3) $(15) $««(29)

Cash balance of discontinued operations

At start of period $««3 $«18 $«««47

At end of period –318

Decrease in cash of discontinued operations $«(3) $(15) $««(29)

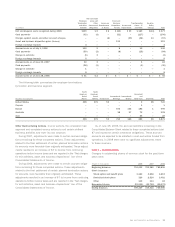

Note 5 – Exit, Disposal and Transformation Activities

The company announced a transformation plan in February 2005

designed to improve performance and better position the company

for long-term growth. The plan involved significant changes in the

company’s organizational structure, portfolio changes involving the

disposition of a significant portion of the corporation’s business,

and a number of actions to improve operational efficiency. As part

of its ongoing efforts to improve its operational performance, the

corporation initiated additional actions in 2008 and recognized

certain trailing costs related to transformation actions initiated in

earlier years, including the impact of certain activities that were

completed for amounts more favorable than previously estimated.

Sara Lee Corporation and Subsidiaries 55