Sara Lee 2008 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

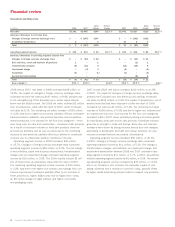

Financial Condition

The corporation’s cash flow statements include amounts related

to discontinued operations through the date of disposal. The

discontinued operations had a significant impact on the cash

flows from operating, investing and financing activities in 2007

and 2006.

Cash from Operating Activities The total cash generated from

operating activities was $606 million in 2008, $492 million in

2007 and $1,265 million in 2006.

The cash from operating activities generated by continuing

and discontinued operations is summarized in the following table:

2008 2007 2006

Cash from operating activities

Continuing operations $596 $404 $÷«405

Discontinued operations 10 88 860

Total $606 $492 $1,265

The increase in cash from operating activities of $114 million

in 2008 was due to an increase in earnings, after adjusting for the

non-cash impairment and other charges, partially offset by an increase

in cash used to fund working capital requirements.

Changes in current assets and liabilities resulted in the usage

of $507 million of cash in 2008, $527 million in 2007 and $44 mil-

lion in 2006. In 2008, the primary changes in working capital which

impacted cash flow from operations were:

•Accrued liabilities, other than income taxes, declined by

$318 million due to $194 million of cash contributions to pension

and postretirement plans and a reduction in accrued liabilities

resulting from cash expenditures exceeding expenses for various

operating expenses.

•Accrued taxes increased by $18 million primarily as a result of a

current tax provision of $468 million partially offset by $459 million

of cash tax payments.

•Cash was used to fund a $117 million increase in inventories

and a $92 million increase in accounts receivable during the year

due in part to the general growth in the business, as well as higher

commodity costs with respect to inventories.

The most significant reason for the decline in cash from operating

activities from 2006 to 2007 was the disposition of a number of

businesses which are reported as discontinued operations. The

Branded Apparel Americas/Asia and the European Meats businesses,

which were disposed of in the first quarter of 2007, generated the

majority of the cash from operating activities related to discontin-

ued operations in 2007 and a significant portion of the 2006

amount as well.

In 2007, the primary changes in working capital which impacted

cash from operations were a $270 million decline in accrued liabilities

related to cash contributions to pension and postretirement plans and

various operating expenses. In addition, the corporation made cash

payments for income taxes of $378 million and used $106 million

to fund an increase in inventories, which was partially offset by a

$93 million increase in accounts payable. In 2006, the corporation

reduced inventories, generating $108 million of cash, which was

offset by $132 million of additional cash that was used to fund

various accrued liabilities and other current assets.

Cash from Investment Activities In 2008, $196 million of cash was

used in investment activities, while the corporation received $568 mil-

lion from investment activities in 2007 and $365 million in 2006.

Net cash (used in) generated from investment activities is split

between continuing and discontinued operations as follows:

2008 2007 2006

Cash from (used in) investment activities

Continuing operations $(188) $615 $«704

Discontinued operations (8) (47) (339)

Total $(196) $568 $«365

A significant amount of cash was received in 2007 and 2006 from

the disposition of businesses and assets as well as the cash received

from the collection of loans receivable related to prior business dis-

positions. In total, $223 million, $1,224 million and $1,101 million

were received in 2008, 2007 and 2006, respectively.

During 2008, the corporation completed the disposition of its

meat operations in Mexico and received $55 million. It also received

95 million euros or $130 million in contingent proceeds from the

previous sale of the corporation’s tobacco product line. The increase

versus the prior year was due to a change in foreign currency

exchange rates.

During 2007, the corporation completed the disposition of

Hanesbrands and the European Meats businesses. The net assets

of businesses disposed of included certain intercompany loans

payable which were paid shortly after the businesses were disposed

of. The corporation received $688 million of cash in total from the

settlement of these notes receivable – $450 million of cash received

was related to the Hanesbrands disposition and $238 million was

related to the European Meats disposition. The corporation also

received $346 million in proceeds primarily related to the disposition

of the European Meats business and received 95 million euros

or $120 million in contingent proceeds from the sale of the

corporation’s tobacco product line.

Sara Lee Corporation and Subsidiaries 27