Sara Lee 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

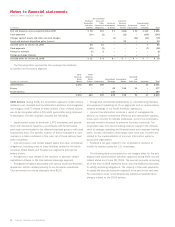

Notes to financial statements

Dollars in millions except per share data

Common stock dividends and dividend-per-share amounts declared

on outstanding shares of common stock were $298 and $0.42 in

2008, $368 and $0.50 in 2007 and $450 and $0.59 in 2006. The

corporation is incorporated in the state of Maryland and under those

laws repurchased shares are retired as repurchased.

Note 7 – Accumulated Other Comprehensive Income

The components of accumulated other comprehensive income

are as follows:

Net

Unrealized

Gain (Loss) Accumulated

Cumulative on Qualifying Pension Other

Translation Cash Flow Liability Comprehensive

Adjustment Hedges Adjustment Income

Balance at July 2, 2005 $(731) $(14) $(816) $(1,561)

Other comprehensive

income (loss) activity 70 (28) 180 222

Balance at July 1, 2006 (661) (42) (636) (1,339)

Spin off of Hanesbrands, Inc. 5 4 58 67

Adjustment to apply

SAB No. 108 5–– 5

Adjustment to initially apply

SFAS No. 158 – – (168) (168)

Disposition of European

Meat business 229 – – 229

Other comprehensive

income (loss) activity 275 34 143 452

Balance at June 30, 2007 (147) (4) (603) (754)

Goodwill redenomination 106 – – 106

Disposition of Mexican

Meat business 31 – – 31

Amortization of net actuarial

loss and prior service credit – – 27 27

Net actuarial gain

arising during the period – – 165 165

Other comprehensive

income (loss) activity 549 25 – 574

Balance at June 28, 2008 $««539 $««21 $(411) $««««149

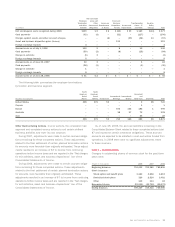

Note 8 – Stock-Based Compensation

The corporation has various stock option, employee stock purchase

and stock award plans. At June 28, 2008, 98.0 million shares were

available for future grant in the form of options, restricted shares

or stock appreciation rights out of 118.7 million shares originally

authorized.

Stock Options The exercise price of each stock option equals the

market price of the corporation’s stock on the date of grant. Options

can generally be exercised over a maximum term of 10 years. Options

granted up to and through 2006 generally vest ratably over three

years and expense is recognized in accordance with the provisions

of FASB Interpretation No. 28 (FIN 28). Options granted after 2006

cliff vest and expense is recognized on a straightline basis during

the vesting period. The fair value of each option grant is estimated

on the date of grant using the Black-Scholes option-pricing model

and the following weighted average assumptions:

2008 2007 2006

Weighted average

expected lives 8.0 years 6.1 years 6.1 years

Weighted average

risk-free interest rates 4.2% 4.8% 4.3%

Range of risk-free

interest rates 4.2% 4.7«–«4.9% 4.2«–«4.3%

Weighted average

expected volatility 24.3% 22.3% 26.2%

Range of

expected volatility 24.3% 21.5«–«22.4% 25.2«–«26.4%

Dividend yield 2.4% 2.8% 4.2%

The corporation uses historical volatility for a period of time

that is comparable to the expected life of the option to determine

volatility assumptions. In 2008 the corporation increased the

expected life of stock options to eight years. This estimate is

reasonable considering only senior executives receive stock options

and this group historically has held options for longer periods of

time compared to other employee groups.

A summary of the changes in stock options outstanding under

the corporation’s option plans during 2008 is presented below:

Weighted

Weighted Average

Average Remaining Aggregate

Exercise Contractual Intrinsic

Shares in thousands Shares Price Term (Years) Value

Options outstanding

at June 30, 2007 42,994 $18.65 3.2 $21

Granted 1,322 16.49 – –

Exercised (312) 14.40 – –

Canceled/expired (12,073) 19.66 – –

Options outstanding

at June 28, 2008 31,931 $18.20 3.2 $««–

Options exercisable

at June 28, 2008 27,665 $18.61 2.4 $««–

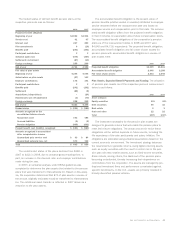

At June 30, 2007 and July 1, 2006, the number of options

exercisable was 38,987 and 54,323, respectively, with weighted

average exercise prices of $18.98 and $18.99, respectively. The

weighted average grant date fair value of options granted during

2008, 2007 and 2006 was $4.36, $3.23 and $4.01, respectively.

The total intrinsic value of options exercised during 2008, 2007

and 2006 was $1, $5 and $2, respectively. The fair value of options

that vested during both 2008 and 2007 was $3. The corporation

received cash from the exercise of stock options during 2008 of

$4. As of June 28, 2008, the corporation had $4 of total unrecog-

nized compensation expense related to stock option plans that

will be recognized over the weighted average period of 1.02 years.

60 Sara Lee Corporation and Subsidiaries