Sara Lee 2008 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial review

the corporation recognized pretax impairment charges of $394 million

related to the discontinued operations. Further details regarding

these charges can be found in Note 4 to the Consolidated Financial

Statements, “Discontinued Operations.”

Gain on Sale of Discontinued Operations

The corporation

completed the disposition of its Mexican meats business in March

2008 and recognized a pretax and after tax loss of $23 million and

$24 million, respectively. In 2007, the corporation completed the

disposition of the European Meats and Branded Apparel Americas/

Asia businesses and completed certain postclosing adjustments

related to the completed transactions and recognized a pretax and

after tax gain of $5 million and $16 million, respectively. The corpo-

ration completed the sales of the remaining businesses reported as

discontinued operations during 2006 and recognized a pretax and

after tax gain of $466 million and $401 million, respectively. Further

details regarding these transactions are included in Note 4 to the

Consolidated Financial Statements, “Discontinued Operations.”

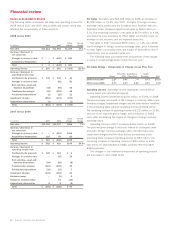

Consolidated Net Income and Diluted Earnings per Share (EPS)

The net loss was $79 million in 2008 as compared to net income

of $504 million reported in 2007. The decrease in net income was

due to the $827 million of after tax impairment charges, which were

$682 million higher than the prior year. Diluted EPS decreased from

$0.68 in 2007 to a loss of $0.11 in 2008.

Net income of $504 million in 2007 was $51 million, or 9.4%,

lower than reported in 2006. The decline in net income was primarily

due to the $460 million decline in results related to the discontinued

operations partially offset by the $409 million increase in income

from continuing operations. Diluted EPS decreased from $0.72 in

2006 to $0.68 in 2007, a decline of 5.6%.

Operating Results by Business Segment

The corporation’s structure is currently organized around six business

segments, which are described below.

North American Retail Meats

sells a variety of packaged meat

products to retail customers in North America. Products include

hot dogs and corn dogs, breakfast sausages and sandwiches,

smoked and dinner sausages, premium deli and luncheon meats,

bacon and cooked hams. The major brands include

Hillshire Farm,

Ball Park, Jimmy Dean, Sara Lee, Bryan, State Fair

and

Kahn’s.

18 Sara Lee Corporation and Subsidiaries

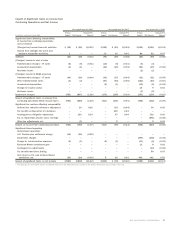

Income (Loss) from Continuing Operations and Diluted Earnings per

Share (EPS) from Continuing Operations The loss from continuing

operations in 2008 was $41 million, which was $481 million lower

than the prior year. Income from continuing operations in 2007 was

$440 million, which was $409 million higher than 2006.

Diluted EPS from continuing operations was a loss of $0.06

in 2008 versus income of $0.59 in 2007 and $0.04 in 2006. The

diluted EPS from continuing operations in each succeeding year

was favorably impacted by lower average shares outstanding as

the corporation has been repurchasing shares of its common stock

as part of an ongoing share repurchase program. The corporation

repurchased 20 million shares, 42 million shares and 30 million

shares of common stock during 2008, 2007 and 2006, respectively.

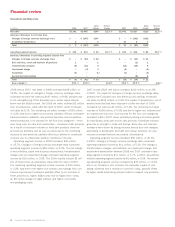

Discontinued Operations The results of the corporation’s Direct

Selling, U.S. Retail Coffee, European Branded Apparel, European

Nuts and Snacks, U.K. Apparel, U.S. Meat Snacks, European Meats,

Branded Apparel Americas/Asia and Mexican meats businesses

have been classified as discontinued operations. The following

summarizes the results of the discontinued operations for 2008,

2007 and 2006:

In millions 2008 2007 2006

Income (loss) from discontinued

operations before income taxes $(14) $«82 $144

Income tax benefit (expense) on

income from discontinued operations – (34) (21)

Gain (loss) on disposition

of discontinued operations (23) 5 466

Income tax (expense) benefit on

disposition of discontinued operations (1) 11 (65)

Net income (loss) from

discontinued operations $(38) $«64 $524

Income from Discontinued Operations before Income Taxes

The decline in income from operations before income taxes in each

succeeding year is primarily the result of the timing of the dispositions.

The Mexican meats business was sold in March of 2008, while the

European Meats business and Branded Apparel Americas/Asia

businesses were disposed of in the early part of 2007. The remaining

businesses being reported as discontinued operations were disposed

of in 2006. The operating results in 2008 also include a $15 million

charge related to the settlement of a pension plan in the U.K. asso-

ciated with the European Branded Apparel business. During 2006,