Sara Lee 2008 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial review

16 Sara Lee Corporation and Subsidiaries

Impairment Charges During 2008, the corporation recognized

an $851 million non-cash charge primarily for the impairment of

goodwill associated with the North American foodservice bakery

and Spanish bakery operations and writedowns of certain other

assets in North America. Both operations are not expected to gen-

erate sufficient profitability to support the goodwill balances. In 2007

and 2006, impairment charges of $172 million and $193 million,

respectively, were recognized and represent charges for the impair-

ment of goodwill, intangible assets, fixed assets, and investments

held by the corporation. These charges impacted each of the corpo-

ration’s business segments. Additional details regarding these

impairment charges are discussed in Note 3 to the Consolidated

Financial Statements, titled “Impairment Charges.”

Receipt of Contingent Sale Proceeds Under the terms of the sale

agreement for its cut tobacco business, the corporation will receive

annual cash payments of 95 million euros through July 2009, contin-

gent on tobacco continuing to be a legal product in the Netherlands,

Germany and Belgium. The U.S. dollar amounts received in 2008,

2007 and 2006 upon the expiration of the contingency were $130

million, $120 million and $114 million, respectively, based upon

respective foreign currency exchange rates on the date of receipt.

These amounts were recognized in the corporation’s earnings when

received and the payments increased diluted earnings per share

from continuing operations in 2008, 2007 and 2006 by $0.18,

$0.16 and $0.15, respectively.

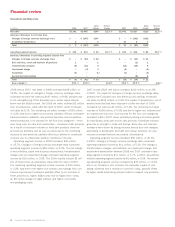

Net Interest Expense Net interest expense decreased by $33 million

in 2008 to $100 million. The decrease was a result of a $74 million

decline in interest expense due to lower average debt levels, which

more than offset a $41 million reduction in interest income result-

ing from a decline in cash and cash equivalents, a portion of which

was used to repay debt. Net interest expense in 2007 was $94 mil-

lion lower than 2006 due to lower debt levels and higher interest

income partially offset by higher average interest rates.

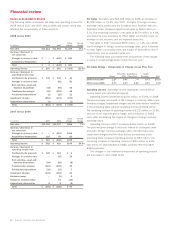

Income Tax Expense The effective tax rate on continuing operations

in 2008, 2007 and 2006 was impacted by a number of significant

items that are shown in the reconciliation of the corporation’s effective

tax rate to the U.S. statutory rate in Note 21 to the Consolidated

Financial Statements. Additional information regarding income

taxes can be found in “Significant Accounting Policies and Critical

Estimates” within Management’s Discussion and Analysis.

2008 2007 2006

Continuing operations

Income before income taxes $÷«160 $429 $«189

Income tax expense (benefit) 201 (11) 158

Effective tax rates 125.6% (2.6) % 83.6%

Transformation costs, including accelerated depreciation, in 2008

were down $67 million from 2007 due to a reduction in costs asso-

ciated with the corporation’s decision to centralize the management

of its North American and European operations, which resulted in

costs being incurred in 2007 for employee relocation, recruitment

and retention bonuses in order to maintain business continuity.

These cost reductions were partially offset by $15 million of computer

software amortization expense related to systems that were put

into use in 2008.

The reduction in costs from 2006 to 2007 was driven primarily

by lower employee costs related to relocation, recruitment and

retention bonuses resulting from the centralization of the North

American and European operations.

Exit Activities, Asset and Business Dispositions Exit activities,

asset and business dispositions are as follows:

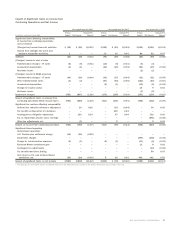

In millions 2008 2007 2006

Charges for (income from) exit activities

Severance $31 $«93 $159

Exit of leased and owned facilities 51314

Other 3–(7)

Asset and business dispositions (1) (12) (80)

$38 $«94 $««86

The net charges recognized in 2008 are $56 million lower than

the prior year primarily due to a $62 million reduction in employee

termination costs as well as lower charges related to the exit of

certain non-cancelable lease and other contractual obligations,

partially offset by an $11 million reduction in income related to

asset and business dispositions. Costs in 2007 were higher than

in 2006 because the corporation had implemented extensive

restructuring plans to terminate employees in all our North

American segments and the International Beverage segment.

In 2007, the corporation also recognized costs to exit leased space

in connection with the relocation of the corporation’s headquarters

to Downers Grove, Illinois. The decline in income from asset and

business dispositions from 2006 to 2007 is due to a nonrecurring

gain of $119 million in 2006 related to the sale of working capital

of a European rice product line, certain European skin care and

sunscreen assets, certain assets related to the French and Belgian

nuts and snacks business and certain other asset dispositions,

which was partially offset by a $39 million charge to prepare

businesses for disposition.