Sara Lee 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

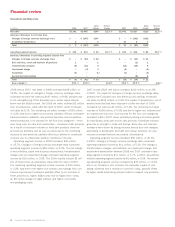

Financial review

Cash and Equivalents, Short-Term Investments and Cash Flow

The corporation’s cash balance of $1,284 million at the end

of 2008 was invested in interest-bearing bank deposits that are

redeemable on demand by the corporation. A significant portion

of cash and equivalents are held by the corporation’s subsidiaries

outside of the U.S. A portion of these balances will be used to

fund future working capital and other funding requirements.

The corporation has also recognized amounts for transformation

and other restructuring charges and at the end of 2008 recognized

a liability of approximately $110 million that relates primarily to

future severance and other lease and contractual payments. These

amounts will be paid when the obligation becomes due, and the

corporation expects a significant portion of these amounts will be

paid in 2009. The anticipated 2009 payments of cash taxes and

severance associated with previously recognized exit activities will

have a significant negative impact on cash from operating activities.

Dividend Annual dividend amounts paid per share by the corporation

were $0.41 in 2008, $0.50 in 2007, and $0.79 in 2006. Future

dividends are determined by the corporation’s Board of Directors

and are not guaranteed.

Credit Facilities and Ratings The corporation has a $1.85 billion

five-year revolving credit facility available which management considers

sufficient to satisfy its operating requirements. This facility expires

in December 2011 and the pricing under this facility is based upon

the corporation’s current credit rating. At June 28, 2008, the corpo-

ration had not borrowed under the facility and the facility does not

mature or terminate upon a credit rating downgrade. The facility

contains a number of typical covenants, which the corporation is

in compliance with, including a requirement to maintain an interest

coverage ratio of at least 2.0 to 1.0. The interest coverage ratio is

generally defined as a ratio of pretax income (excluding net interest

expense, any extraordinary or non-recurring non-cash charges or

gains), to net interest expense. For the 12 months ended June 28,

2008, the corporation’s interest coverage ratio was 11.2 to 1.0.

The corporation’s credit ratings by Standard & Poor’s, Moody’s

Investors Service and FitchRatings, as of June 28, 2008, were

as follows. Standard & Poor’s and Moody’s Investors Service have

the corporation’s long-term credit rating classified as having a

negative outlook.

Senior

Unsecured Short-term

Obligations Borrowings Outlook

Standard & Poor’s BBB+ A-2 Negative

Moody’s Baa1 P-2 Negative

FitchRatings BBB F-2 Stable

Changes in the corporation’s credit ratings result in changes in

the corporation’s borrowing costs. The corporation’s current short-

term credit rating allows it to participate in a commercial paper

market that has a number of potential investors and a historically

high degree of liquidity. A downgrade of the corporation’s short-term

credit rating would place the corporation in a commercial paper

market that would contain significantly less market liquidity than

it currently operates in with a rating of “A-2,” “P-2,” or “F-2.” This

would reduce the amount of commercial paper the corporation

could issue and raise its commercial paper borrowing cost. To the

extent that the corporation’s operating requirements were to exceed

its ability to issue commercial paper following a downgrade of its

short-term credit rating, the corporation has the ability to use avail-

able credit facilities to satisfy operating requirements, if necessary.

Off-Balance Sheet Arrangements The off-balance sheet

arrangements that are reasonably likely to have a current or future

effect on the corporation’s financial condition are lease transactions

for facilities, warehouses, office space, vehicles and machinery

and equipment.

Leases The corporation has numerous operating leases for

manufacturing facilities, warehouses, office space, vehicles and

machinery and equipment. Operating lease obligations are scheduled

to be paid as follows: $116 million in 2009, $76 million in 2010,

$53 million in 2011, $33 million in 2012, $26 million in 2013 and

$102 million thereafter. The corporation is also contingently liable

for certain long-term leases on property operated by others. These

leased properties relate to certain businesses that have been sold.

The corporation continues to be liable for the remaining terms of

the leases on these properties in the event that the owners of the

businesses are unable to satisfy the lease liability. The minimum

annual rentals under these leases are as follows: $29 million in

2009, $27 million in 2010, $23 million in 2011, $18 million in

2012, $14 million in 2013 and $61 million thereafter.

Future Contractual Obligations and Commitments During 2007,

the corporation exited a U.S. meat production plant that included

a hog slaughtering operation. Certain purchase contracts for the

purchase of live hogs at this facility were not exited or transferred

after the closure of the facility. These contracts, the majority of

which will expire by December 2009, represent the purchase of

approximately $158 million of hogs over the remaining life of the

contracts. Under the terms of these contracts, the corporation must

continue to purchase these live hogs and therefore, the corporation

has entered into a hog sales contract under which these hogs will be

sold to another slaughter operator. The corporation’s purchase price

of these hogs is generally based on the price of corn products, and

the corporation’s selling price for these hogs is generally based on

USDA posted hog prices. Divergent movements in these indices will

result in either gains or losses on these hog transactions. Expected

losses from the sale of these hogs are recognized when the loss is

probable of occurring. At the end of 2008, based on current market

pricing, the corporation deemed that it was not probable that material

future near-term losses would occur. The contractual commitment

for these purchases is included in the table below.

30 Sara Lee Corporation and Subsidiaries