Sara Lee 2008 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Sara Lee Corporation and Subsidiaries 15

Total selling, general and administrative expenses in 2007

increased $168 million, or 4.5%. Changes in foreign currency

exchange rates, primarily in the European euro, increased SG&A

expenses by $120 million, or 3.3%. The remaining increase in

SG&A expenses was $48 million, or 1.2%. Measured as a percent

of sales, SG&A expenses decreased from 33.4% in 2006 to 32.6%

in 2007. SG&A expenses as a percent of sales declined in each

of the business segments with the exception of North American

Retail Meats and International Beverage.

Total SG&A expenses reported in 2008 by the business segments

increased by $229 million, or 6.6%, over 2007 primarily due to the

impact of changes in foreign currency exchange rates, higher distri-

bution costs driven by higher fuel costs, and the impact of inflation

on wages and employee benefit costs, partially offset by the bene-

fits of cost savings initiatives and lower costs associated with the

corporation’s transformation program.

Amortization of intangibles increased by $3 million in 2008

versus 2007. General corporate expenses, which are not allocated

to the individual business segments, decreased by $98 million, due

to a reduction in business transformation costs, lower pension and

other benefit plan costs, and the non-recurrence of costs related

to corporate hedging programs.

Total SG&A expenses reported in 2007 by the business

segments increased by $129 million, or 3.8%, over 2006, primarily

due to the impact of changes in foreign currency exchange rates,

higher media advertising and promotion expenditures and higher

distribution and selling costs partially offset by the benefits of cost

savings initiatives and lower costs associated with the corporation’s

transformation program.

Amortization of intangibles increased by $6 million in 2007.

General corporate expenses increased by $33 million, or 10.3%,

primarily due to unfavorable foreign currency results, partially offset

by lower transformation expenses and a decrease in corporate

office and administrative expenses.

As previously noted, reported SG&A reflects amounts recognized

for actions associated with the corporation’s ongoing business

transformation program and other significant amounts. These

amounts include the following:

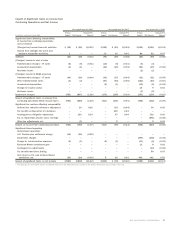

In millions 2008 2007 2006

Transformation costs – IT $40 $÷42 $÷32

Transformation costs – other 3 67 122

Accelerated depreciation –110

Hurricane losses – – 3

Change in vacation policy – – (14)

Total $43 $110 $153

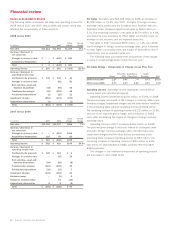

Gross Margin The gross margin, which represents net sales less cost

of sales, increased by $445 million in 2008, driven by the favorable

impact of changes in currency exchange rates, price increases to

offset higher commodity costs, higher unit volumes, and savings

from continuous improvement programs, partially offset by higher

commodity costs and higher labor costs due to inflationary pressures.

The gross margin percent declined from 38.5% in 2007 to 38.3%

in 2008. The gross margin percent declined in each business seg-

ment with the exception of North American Retail Meats. The gross

margin percent was negatively impacted by higher commodity costs

and inflation, which was partially offset by price increases.

The gross margin in 2007 increased by $295 million due to

the favorable impact of changes in currency exchange rates, sales

price increases, savings from continuous improvement programs

and an improved product mix partially offset by higher commodity

and energy costs.

The gross margin percent declined from 38.6% in 2006 to

38.5% in 2007. The gross margin percent declined in each business

segment except North American Retail Bakery, primarily due to the

impact of higher commodity and energy costs and competitive

market conditions.

Selling, General and Administrative Expenses

In millions 2008 2007 2006

SG&A expenses in the business

segment results

Media advertising and promotion $÷«594 $÷«567 $÷«531

Other 3,124 2,922 2,829

Total business segments 3,718 3,489 3,360

Amortization of identifiable intangibles 67 64 58

General corporate expenses 254 352 319

Total $4,039 $3,905 $3,737

Total selling, general and administrative (SG&A) expenses in

2008 increased $134 million, or 3.4%. Changes in foreign currency

exchange rates, primarily in the European euro, increased SG&A

expenses by $213 million, or 5.3%. The remaining decrease in

SG&A expenses was $79 million, or 1.9%. Measured as a percent

of sales, SG&A expenses decreased from 32.6% in 2007 to 30.6%

in 2008. SG&A expenses as a percent of sales declined in each

of the business segments. The results reflect the favorable impact

of savings from continuous improvement initiatives, a $67 million

reduction in transformation related costs and lower general

corporate expenses.