Sara Lee 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

third-party offers received for the business and involved a number

of judgments including estimates of the fair value of the property

and amortizable intangible assets of the business. As a result of the

evaluation, the corporation recognized a $125 goodwill impairment

charge with no tax benefit. In June 2006, the corporation entered

into a definitive agreement to sell this business to Smithfield Foods,

and in August 2006, the transaction closed.

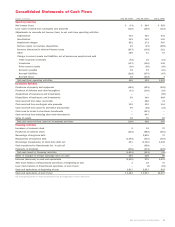

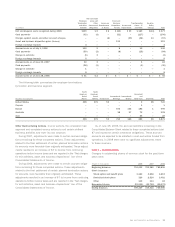

Note 4 – Discontinued Operations

In 2008, the corporation disposed of its Mexican meats operations. At

the end of 2007, as part of the corporation’s transformation plan, eight

businesses have been disposed of. The results of these businesses

have been reported as discontinued operations. The amounts in the

tables below reflect the operating results of the businesses reported

as discontinued operations. The impact of the impairments discussed

in Note 3 to the Consolidated Financial Statements, “Impairment

Charges”, is included in these operating results. Gains and losses

related to the disposal of these discontinued operations are excluded

from the following tables; however, they are discussed further below.

Pretax

Income Income

Net Sales (Loss) (Loss)

2008

European Branded Apparel $«««««««– $««(15) $««(15)

Mexican Meats 23811

Total $÷«238 $««(14) $««(14)

2007

European Meats $«««114 $«««««7 $«««««3

Branded Apparel Americas/Asia 787 85 59

Mexican Meats 296 (10) (14)

Total $1,197 $«««82 $«««48

2006

Direct Selling $«««202 $«««14 $«««54

U.S. Retail Coffee 122 (46) (39)

European Branded Apparel 641 (186) (153)

European Nuts and Snacks 5483

U.K. Apparel 437 (69) (71)

U.S. Meat Snacks 25 (14) (9)

European Meats 1,114 (57) (41)

Branded Apparel Americas/Asia 4,484 491 379

Mexican Meats 2853–

Total $7,364 $«144 $«123

Results of Discontinued Operations Net sales of discontinued

operations were $238 in 2008, $1,197 in 2007 and $7,364 in 2006;

a full year of results for the Mexican meats business was not included

in 2008 as the business was sold in the third quarter of 2008; and

a full year of results for the European Meats and Branded Apparel

Americas/Asia businesses was not included in 2007 as each of the

businesses was sold in the first quarter of that fiscal year. The 2006

results also did not include a full year of results as the corporation

completed the sale of the remaining discontinued operations during

that year.

The corporation reported income (loss) from discontinued

operations of $(14) in 2008, $48 in 2007 and $123 in 2006. In

2008, the corporation recognized a $15 charge related to the settle-

ment of a pension plan in the U.K. associated with the European

Branded Apparel business, which was sold in 2006. The corporation

recognized after tax impairment charges of $338 in 2006, which

reduced income from discontinued operations and are more fully

described in Note 3 to the Consolidated Financial Statements,

“Impairment Charges.”

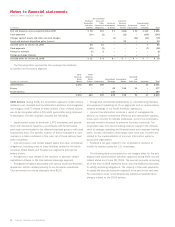

Gain (Loss) on the Sale of Discontinued Operations The gains

(losses) recognized in 2008, 2007 and 2006 are summarized in the

following tables. A further discussion of each disposition follows.

Pretax Tax

Gain (Loss) (Charge)/ After Tax

on Sale Benefit Gain (Loss)

2008

Mexican Meats $«(23) $««««(1) $«(24)

2007

European Meats $««18 $««««(1) $««17

Branded Apparel Americas/Asia (23) 6 (17)

Philippines portion of European

Branded Apparel 8(2) 6

Other 2810

Total $««««5 $«««11 $««16

2006

Direct Selling $327 $(107) $220

U.S. Retail Coffee 5(2) 3

European Branded Apparel 45 41 86

European Nuts and Snacks 66 4 70

U.K. Apparel 22 – 22

U.S. Meat Snacks 1(1) –

Total $466 $««(65) $401

Business Sold in 2008

Mexican Meats

In March 2008, the corporation completed the

disposition of its investment in its Mexican meats operation as it

wanted to more closely focus on its core brands in the U.S. The

corporation recognized a pretax loss of $23 and an after tax loss

of $24. A total of $55 million of cash proceeds was received from

the disposition of the business. The Mexican meats operation had

been reported in the North American Retail Meats segment.

Businesses Sold in 2007

European Meats

In June 2006, the corporation entered into a

definitive agreement to sell its European Meats business. The

transaction closed in August 2006 after receiving European regulatory

approval and the corporation recognized a pretax and after tax gain

of $18 and $17, respectively. The capital gain related to this transac-

tion was offset by capital losses on other disposition transactions.

A total of $337 of cash proceeds was received from the disposition

of the business and an additional $238 was received from the

repayment of an obligation to the corporation, which was included

in the net assets sold.

The sale agreement provided for working capital and other

customary postclosing adjustments relating to the assets transferred.

The final resolution of these items may impact the gain recognized.

The corporation has not had any significant continuing involvement

in the business after the disposal date and does not expect any

material direct cash inflows or outflows with the sold entity.

Sara Lee Corporation and Subsidiaries 53