Sara Lee 2008 Annual Report Download - page 51

Download and view the complete annual report

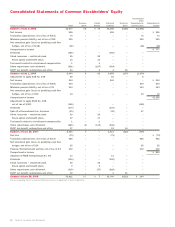

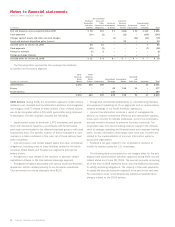

Please find page 51 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.underfunded status should be recognized as a liability. As part

of the initial recognition of the funded status, any transitional

asset/(liability), prior service cost (credit) or actuarial (gain)/loss

that had not yet been recognized as a component of net periodic

cost was recognized in the accumulated other comprehensive income

section of the Consolidated Statements of Common Stockholders’

Equity, net of tax. Accumulated other comprehensive income will

be adjusted as these amounts are subsequently recognized as a

component of net periodic benefit costs in future periods.

The method of calculating net periodic benefit cost under SFAS

158 is the same as under existing practices. SFAS 158 prescribes

additional disclosure requirements including the classification of the

current and noncurrent components of plan liabilities, as well as the

disclosure of amounts included in Accumulated Other Comprehensive

Income (Loss) that will be recognized as a component of net periodic

benefit cost in the following year.

The recognition of the funded status requirement and certain

disclosure provisions of SFAS 158 were effective for the corporation

as of the end of 2007. Retrospective application of SFAS 158 was

not permitted. The initial incremental recognition of the funded status

under SFAS 158 that was reflected upon adoption in the Accumulated

Other Comprehensive Loss section of Common Stockholders’ Equity

was an after tax charge to equity of $168.

SFAS 158 also requires the consistent measurement of plan assets

and benefit obligations as of the date of the fiscal year end statement

of financial position. This provision is effective for the corporation

in 2009. As the corporation currently uses a plan measurement date

of March 31 for all of its benefit plans, the adoption of this portion

of the standard will require a change in the plan measurement date

to fiscal year end.

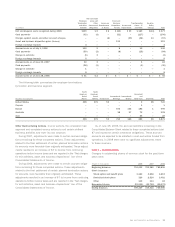

Financial Instruments The corporation uses financial instruments,

including forward exchange, options, futures and swap contracts,

to manage its exposures to movements in interest rates, foreign

exchange rates and commodity prices. The use of these financial

instruments modifies the exposure of these risks with the intent

to reduce the risk or cost to the corporation. The corporation does

not use derivatives for trading purposes and is not a party to

leveraged derivatives.

The corporation uses either hedge accounting or mark-to-market

accounting for its derivative instruments. In 2007, the corporation

adopted a policy to use mark-to-market accounting for foreign currency

derivatives due to the high cost of using hedge accounting and

maintaining hedge documentation.

Under hedge accounting, the corporation formally documents its

hedge relationships, including identification of the hedging instruments

and the hedged items, as well as its risk management objectives

and strategies for undertaking the hedge transaction. This process

includes linking derivatives that are designated as hedges of specific

assets, liabilities, firm commitments or forecasted transactions.

The corporation also formally assesses, both at inception and at least

quarterly thereafter, whether the derivatives that are used in hedging

transactions are highly effective in offsetting changes in either the

fair value or cash flows of the hedged item. If it is determined that

a derivative ceases to be a highly effective hedge, or if the anticipated

transaction is no longer likely to occur, the corporation discontinues

hedge accounting and any deferred gains or losses are recorded

in the “Selling, general and administrative expenses” line in the

Consolidated Statements of Income.

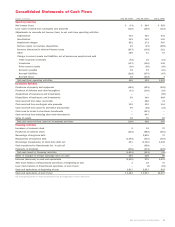

Derivatives are recorded in the Consolidated Balance Sheets at

fair value in other assets and other liabilities. The fair value is based

upon either market quotes for actively traded instruments or inde-

pendent bids for non-exchange-traded instruments.

On the date the derivative is entered into, the corporation

designates the derivative as one of the following types of hedging

instruments and accounts for the derivative as follows:

Fair Value Hedge

A hedge of a recognized asset or liability or an

unrecognized firm commitment is declared as a fair value hedge.

For fair value hedges, both the effective and ineffective portions

of the changes in the fair value of the derivative, along with the

gain or loss on the hedged item that is attributable to the hedged

risk, are recorded in earnings and reported in the Consolidated

Statements of Income on the same line as the hedged item.

Cash Flow Hedge

A hedge of a forecasted transaction or of the

variability of cash flows to be received or paid related to a recognized

asset or liability is declared as a cash flow hedge. The effective

portion of the change in the fair value of a derivative that is declared

as a cash flow hedge is recorded in accumulated other comprehensive

income. When the hedged item impacts the income statement, the

gain or loss included in accumulated other comprehensive income is

reported on the same line in the Consolidated Statements of Income

as the hedged item to match the gain or loss on the derivative to

the loss or gain on the hedged item. In addition, both the fair value

of changes excluded from the corporation’s effectiveness assess-

ments and the ineffective portion of the changes in the fair value

of derivatives used as cash flow hedges are reported in the “Selling,

general and administrative expenses” line in the Consolidated

Statements of Income.

Net Investment Hedge

A hedge of a net investment in a foreign

operation is declared as a net investment hedge. The effective portion

of the change in the fair value of derivatives, based upon spot rates,

used as a net investment hedge of a foreign operation is recorded

in the cumulative translation adjustment account within common

stockholders’ equity. The ineffective portion of the change in the fair

value of a derivative or non-derivative instrument designated as a

net investment hedge is recorded in “Selling, general and adminis-

trative expenses,” or “Interest expense,” if the hedging instrument

is a swap, in the Consolidated Statements of Income. Non-U.S.

dollar financing transactions are accounted for as net investment

hedges when the hedged item is a long-term investment in the

corresponding foreign currency.

Sara Lee Corporation and Subsidiaries 49