Sara Lee 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to financial statements

Dollars in millions except per share data

Mark-to-Market Hedge

A derivative that is not declared as a hedge

in one of the categories above is accounted for under mark-to-market

accounting and referred to as a mark-to-market hedge. Changes in

the fair value of the derivative declared as a mark-to-market hedge

are recognized in the Consolidated Statements of Income to act

as an economic hedge against changes in the values of another

item or transaction. Forward exchange contracts are recorded as

mark-to-market hedges when the hedged item is a recorded asset

or liability that is revalued in each accounting period, in accordance

with SFAS No. 52, “Foreign Currency Translation.” For derivatives

designated as mark-to-market hedges, changes in their fair value are

reported in earnings in either the “Cost of sales” or “Selling, general

and administrative expenses” lines of the Consolidated Statements

of Income where the underlying transaction that is being hedged

is recorded.

Cash Flow Presentation

The settlement of derivative contracts

related to the purchase of inventory, commodities or other hedged

items that utilize hedge accounting are reported in the Consolidated

Statements of Cash Flows as an operating cash flow, while those

derivatives that utilize the mark-to-market hedge accounting model

are reported in investing activities. Fixed to floating rate swaps are

reported as a component of interest expense and therefore are

reported in cash flow from operating activities similar to how cash

interest payments are reported. The portion of the gain or loss on

a cross currency fixed to fixed swap that offsets the change in the

value of interest expense is recognized in cash flow from operations,

while the gain or loss on the swap that is offsetting the change

in value of the debt is classified as a financing activity in the

Consolidated Statement of Cash Flows.

Self-Insurance Reserves The corporation purchases third-party

insurance for workers’ compensation, automobile and product and

general liability claims that exceed a certain level. The corporation

is responsible for the payment of claims under these insured limits.

The undiscounted obligation associated with these claims is accrued

based on estimates obtained from consulting actuaries. Historical

loss development factors are utilized to project the future development

of incurred losses, and these amounts are adjusted based upon

actual claim experience and settlements. Accrued reserves, excluding

any amounts covered by insurance, were $202 and $187 as of

June 28, 2008 and June 30, 2007, respectively.

Business Acquisitions All business acquisitions have been accounted

for under the purchase method. Cash, the fair value of other assets

distributed, securities issued unconditionally and amounts of con-

sideration that are determinable at the date of acquisition are included

in determining the cost of an acquired business. Consideration that

is issued or issuable at the expiration of a contingency period, or

that is held in escrow pending the outcome of a contingency, is not

recorded as a liability or shown as an outstanding security unless

the outcome of the contingency is determinable.

Substantially all consideration associated with business acquisi-

tions involves the payment of cash. These amounts are disclosed

in the Consolidated Statements of Cash Flows.

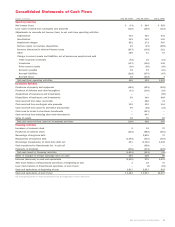

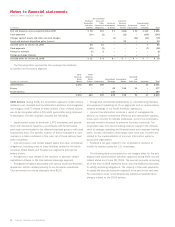

Note 3 – Impairment Charges

The corporation has recognized impairment charges related to its

operations in 2008, 2007 and 2006 and the significant impairments

are recorded in “Impairment charges” in the Consolidated Statements

of Income. The impact of these charges, is summarized in the

following tables:

Pretax

Impairment After Tax

Charge Tax Benefit Charge

2008

Continuing operations

North American Retail Meats $÷(20) $«÷«8 $÷(12)

Foodservice (431) 16 (415)

International Bakery (400) – (400)

Total impairments 2008 $(851) $««24 $(827)

2007

Continuing operations

North American Retail Meats $÷(34) $««12 $÷(22)

North American Retail Bakery (16) 6 (10)

International Beverage (118) 9 (109)

Household and Body Care (4) – (4)

Total impairments 2007 $(172) $««27 $(145)

2006

Continuing operations

North American Retail Bakery $(179) $÷68 $(111)

International Bakery (14) 5 (9)

Continuing operations subtotal (193) 73 (120)

Discontinued operations

European Branded Apparel (179) 47 (132)

U.S. Retail Coffee (44) 5 (39)

U.K. Apparel (34) – (34)

U.S. Meat Snacks (12) 4 (8)

European Meats (125) – (125)

Discontinued operations subtotal (394) 56 (338)

Total impairments 2006 $(587) $129 $(458)

The following is a discussion of each impairment charge.

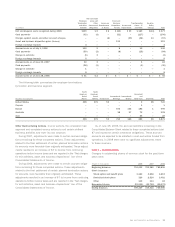

2008 Impairment Charges Recognized in Continuing Operations

North American Retail Meats Property and Trademarks

During

the fourth quarter of 2008, management determined that a North

American retail meats facility will be disposed due to its high cost

structure and reduced demand for the products produced at the

facility. Based on estimates of cash flows to be generated through

the date of disposition, the corporation concluded that it was nec-

essary to recognize an impairment charge of $20, of which $7 and

$13 are related to property and trademarks, respectively. The after

tax impact of this impairment charge is $12.

Foodservice and International Bakery Goodwill

The corporation

tests goodwill and intangible assets not subject to amortization for

impairments in the second quarter of each fiscal year and whenever

a significant event occurs or circumstances change that would more

likely than not reduce the fair value of these intangible assets. In

the second quarter of fiscal 2008, this review was performed and,

although the test did not indicate any reporting units may be impaired,

two reporting units – North American Foodservice Bakery and Spanish

50 Sara Lee Corporation and Subsidiaries