Sara Lee 2008 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Sara Lee Corporation and Subsidiaries 21

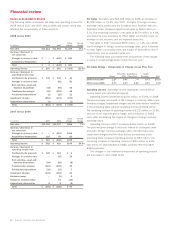

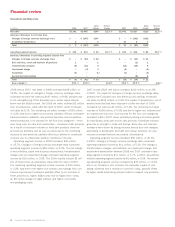

2007 versus 2006

Net sales in 2007 increased by $96 million, or

4.2% over 2006. The increase in net sales was due to higher retail

unit volumes and a favorable product mix. Unit volumes increased

3.6% as compared to 2006, driven by a 4.0% increase in retail unit

volumes due to higher volumes for breakfast sandwiches, lunch com-

bos, ultra thin slice meats, hot dogs and smoked sausages and a

1.9% increase in commodity meats. The favorable mix was due to

a shift to higher value added products.

Operating segment income declined by $42 million, or 31.6%, in

2007. The net impact of the amounts identified in the table above

reduced operating segment income by $64 million. The remaining

operating segment income increase of $22 million, or 11.6%, was

due to the favorable impact of higher volumes, an improved product

mix, savings from continuous improvement programs and a reduction

in pension, postretirement and other benefit plan costs, which were

partially offset by higher commodity costs, higher media advertising

and promotion expenses to support new product introductions, and

higher distribution and administrative costs due to the impact of

inflation on labor and other costs.

2008 versus 2007

Net sales in 2008 increased by $69 million,

or 3.0%, due to a 6.5% increase in the net sales of retail meats,

which resulted from higher volumes and positive pricing actions to

offset the higher commodity and other raw material costs. The strong

improvement in retail meats sales was partially offset by a 32.6%

decline in the net sales of non-retail commodity meats, due to an

unfavorable shift in sales mix. Unit volumes in the North American

Retail Meats segment increased 2.1% with an 8.7% increase in non-

retail commodity unit volumes and a 0.6% increase in unit volumes

for retail products. In 2007, the corporation completed the shutdown

of its pork slaughtering and meat production facility that supplied prod-

ucts to both the retail and commodity categories. Exiting this facility

had a negative impact on volumes in the retail products category

in 2008 as some processed products from the slaughter operation

were sold in the retail products category in prior years. Excluding the

impact of the exit of these product categories, unit volumes in the

retail products category were up 3.7%. The increased unit volumes

in this retail category were driven by growth in hot dogs, cooked break-

fast sausages, and sliced luncheon meats. For non-retail commodities,

exiting the production facility had the impact of increasing unit volumes

as whole hogs are now being sold to another meat processor, result-

ing in an increase in non-retail commodity unit volumes for the year,

but lower overall non-retail commodity meat revenues due to the low

sales price per unit for hogs.

Operating segment income increased by $81 million, or

87.2%, in 2008. The net impact of the change in exit activities,

asset and business dispositions, transformation charges, impair-

ment charges and accelerated depreciation increased operating

segment income by $79 million, or 86.4%. The remaining operating

segment income increase of $2 million, or 0.8%, was the result of

the volume improvements in certain product categories, an improved

product mix, savings from continuous improvement programs and

pricing actions partially offset by higher commodity, labor, fuel

and other manufacturing costs.

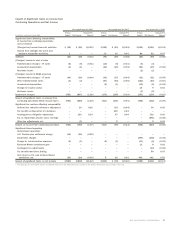

North American Retail Meats

Dollar Percent Dollar Percent

In millions 2008 2007 Change Change 2007 2006 Change Change

Net sales $2,424 $2,355 $69 3.0% $2,355 $2,259 $«96 4.2 %

Operating segment income $÷«175 $÷÷«94 $81 87.2% $÷÷«94 $÷«136 $(42) (31.6) %

Increase/(decrease) in operating segment income from

Exit activities, asset and business dispositions $÷÷(13) $÷÷(34) $21 $÷÷(34) $÷÷(15) $(19)

Transformation charges – (17) 17 (17) (21) 4

Impairment charge (20) (34) 14 (34) – (34)

Vacation accrual ––– –3(3)

Accelerated depreciation – (27) 27 (27) (15) (12)

Total $÷÷(33) $÷(112) $79 $÷(112) $÷÷(48) $(64)

Gross margin % 28.5 % 27.8 % 0.7% 27.8 % 28.2 % (0.4) %