Sara Lee 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

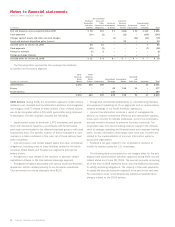

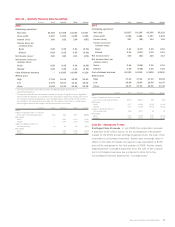

The following table summarizes by major currency the contractual

amounts of the corporation’s forward exchange contracts used in

continuing operations in U.S. dollars. The bought amounts represent

the net U.S. dollar equivalent of commitments to purchase foreign

currencies, and the sold amounts represent the net U.S. dollar

equivalent of commitments to sell foreign currencies. The foreign

currency amounts have been translated into a U.S. dollar equivalent

value using the exchange rate at the reporting date. Forward

exchange contracts mature at the anticipated cash requirement

date of the hedged transaction, generally within one year.

2008 2007 2006

Foreign currency – bought (sold)

European euro $«122 $÷«16 $÷88

British pound (180) (151) (66)

Brazilian real 43 26 4

Danish krone 50 48 (8)

Hungarian forint 329 255 188

Russian ruble (38) (47) (14)

Australian dollar 111 (36) 2

Other (21) (65) (18)

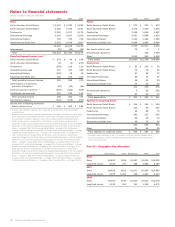

The corporation held foreign exchange option contracts to

reduce the foreign exchange fluctuations on anticipated purchase

transactions. The following table summarizes the notional amount

of option contracts relating to continuing operations to sell foreign

currency, in U.S. dollars:

2008 2007 2006

Foreign currency sold

European euro $– $8 $547

Australian dollar –9–

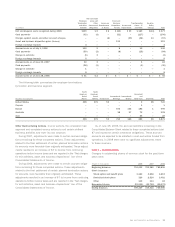

The following table summarizes the net derivative gains or

losses deferred into accumulated other comprehensive income and

reclassified to earnings in 2008, 2007 and 2006:

2008 2007 2006

Net accumulated derivative gain (loss)

deferred at beginning of year $÷(4) $(42) $(14)

Deferral of net derivative gain (loss) in

accumulated other comprehensive income (27) 29 (38)

Spin off of Hanesbrands –4–

Reclassification of net derivative (gain) loss

to income 52 5 10

Net accumulated derivative gain (loss)

at end of year $«21 $÷(4) $(42)

At June 28, 2008, the maximum maturity date of any cash flow

hedge was 5.0 years (principally two currency swaps that mature in

2012 and 2013), excluding any forward exchange, option or swap

contracts related to the payment of variable interest on existing

financial instruments. The corporation expects to reclassify into

earnings during the next 12 months net gains from accumulated

other comprehensive income of $14 at the time the underlying

hedged transactions are realized. In 2008, 2007 and 2006, hedge

ineffectiveness was insignificant. In 2008, 2007 and 2006, deriva-

tive losses excluded from the assessment of effectiveness, and

gains or losses resulting from the disqualification of hedge account-

ing are insignificant in each of these periods.

Non-U.S. Dollar Financing Transactions The corporation uses

non-U.S. dollar financing transactions as net investment hedges of

long-term investments in the corresponding foreign currency. Hedges

that meet the effectiveness requirements are accounted for under

net investment hedging rules. For 2008, 2007 and 2006, a net loss

of $378, $77 and $70, respectively, arising from effective hedges

of net investments has been reflected in the cumulative translation

adjustment account within common stockholders’ equity.

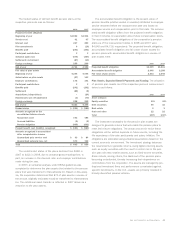

Fair Values The carrying amounts of cash and equivalents, trade

accounts receivable, notes payable and accounts payable approxi-

mated fair value as of June 28, 2008 and June 30, 2007. The fair

value of the remaining financial instruments recognized in continuing

operations on the Consolidated Balance Sheets of the corporation

at the respective year-ends were:

2008 2007

Long-term debt, including current portion $2,929 $4,161

Interest rate swaps 10 (18)

Currency swaps (311) (216)

Foreign currency forwards and options 77

Commodity forwards and options 33 7

The fair value of the corporation’s long-term debt, including the

current portion, is estimated using discounted cash flows based

on the corporation’s current incremental borrowing rates for similar

types of borrowing arrangements. The fair value of interest rate and

currency swaps is determined based upon externally developed pricing

models, using financial market data obtained from swap dealers. The

fair value of foreign currency and commodity forwards and options

is based upon information obtained from third-party institutions.

Sara Lee Corporation and Subsidiaries 67