Sara Lee 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

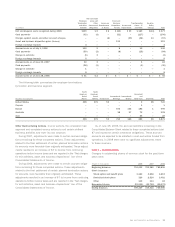

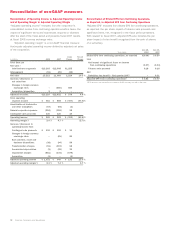

The funded status of defined benefit pension plans at the

respective year-ends was as follows:

2008 2007

Projected benefit obligation

Beginning of year $4,926 $4,904

Service cost 91 97

Interest cost 267 253

Plan amendments 6 (10)

Benefits paid (241) (201)

Participant contributions 33

Actuarial (gain) loss (476) (367)

Settlement/curtailment (87) (13)

Foreign exchange 255 260

End of year 4,744 4,926

Fair value of plan assets

Beginning of year 4,346 4,094

Actual return on plan assets (27) 143

Employer contributions 175 191

Participant contributions 33

Benefits paid (241) (201)

Settlement (88) (8)

Acquisitions/(dispositions) – (24)

Hanesbrands spin off adjustment (3) (70)

Foreign exchange 258 218

End of year 4,423 4,346

Funded status $÷(321) $÷(580)

Amounts recognized on the

consolidated balance sheets

Noncurrent asset $93 $84

Accrued liabilities (9) (2)

Pension obligation (405) (662)

Prepaid benefit cost (liability) recognized $÷(321) ÷÷$÷(580)

Amounts recognized in accumulated

other comprehensive income

Unamortized prior service cost $÷÷«93 $÷÷«84

Unamortized actuarial loss, net 570 746

Total $÷«663 $÷«830

The underfunded status of the plans declined from $580 in

2007 to $321 in 2008, due to actuarial gains resulting from, in

part, an increase in the discount rate; and employer contributions

made during the year.

In 2007, an actuarial analysis under ERISA guidelines was

completed to determine the plan assets that related to the pension

plans that were transferred to Hanesbrands Inc. Based on this analy-

sis, the corporation determined that $70 of plan assets in excess of

the amount originally estimated would be transferred to Hanesbrands

Inc. This additional asset transfer is reflected in 2007 above as a

reduction to the plan assets.

The accumulated benefit obligation is the present value of

pension benefits (whether vested or unvested) attributed to employee

service rendered before the measurement date and based on

employee service and compensation prior to that date. The accumu-

lated benefit obligation differs from the projected benefit obligation

in that it includes no assumption about future compensation levels.

The accumulated benefit obligations of the corporation’s pension

plans as of the measurement dates in 2008 and 2007 were

$4,543 and $4,716, respectively. The projected benefit obligation,

accumulated benefit obligation and fair value of plan assets for

pension plans with accumulated benefit obligations in excess of

plan assets were:

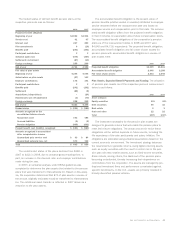

2008 2007

Projected benefit obligation $3,009 $3,261

Accumulated benefit obligation 2,945 3,188

Fair value of plan assets 2,603 2,598

Plan Assets, Expected Benefit Payments and Funding The allocation

of pension plan assets as of the respective year-end measurement

dates is as follows:

2008 2007

Asset category

Equity securities 40% 43%

Debt securities 46 32

Real estate 23

Cash and other 12 22

Total 100% 100%

The investment strategies for the pension plan assets are

designed to generate returns that will enable the pension plans to

meet their future obligations. The actual amount for which these

obligations will be settled depends on future events, including the

life expectancy of the plan participants and salary inflation. The

obligations are estimated using actuarial assumptions based on the

current economic environment. The investment strategy balances

the requirements to generate returns, using higher-returning assets

such as equity securities with the need to control risk in the pen-

sion plan with less volatile assets, such as fixed-income securities.

Risks include, among others, the likelihood of the pension plans

becoming underfunded, thereby increasing their dependence on

contributions from the corporation. The assets are managed by pro-

fessional investment firms and performance is evaluated against

specific benchmarks. In the U.S., assets are primarily invested in

broadly diversified passive vehicles.

Sara Lee Corporation and Subsidiaries 69