Sara Lee 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

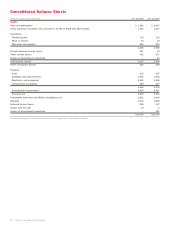

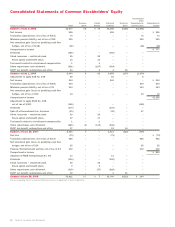

the presentation of dividends, retained earnings and total equity.

The impact of this revision on the relevant lines in the balance

sheet and common stockholders’ equity statement (as adjusted

for discontinued operations) is summarized below:

As Reported As Adjusted

Total common stockholders’ equity July 2, 2005 $2,732 $2,577

Retained earnings July 2, 2005 4,361 4,206

Dividends 2006 611 456

Dividends 2007 298 370

Balance at June 30, 2007

Accounts payable 1,055 1,127

Total current liabilities 4,301 4,388

Retained earnings 3,485 3,413

Total common stockholders’ equity 2,615 2,543

Accounting Changes – Adoption of Staff Accounting Bulletin No. 108

In September 2006, the SEC issued Staff Accounting Bulletin

No. 108, “Considering the Effects of Prior Year Misstatements When

Quantifying Misstatements in Current Year Financial Statements”

(SAB 108). SAB 108 provides interpretive guidance on how the effects

of the carryover or reversal of prior year misstatements should be

considered in quantifying a current year misstatement for the purpose

of a materiality assessment. SAB 108 requires that misstatements

be measured under the dual approach which requires that errors

be evaluated under the rollover method and the iron curtain method.

Under the rollover method, the amount of the error in the current

period is evaluated against current period income, including the

reversing effects of prior year misstatements. Under the iron curtain

method, the error is quantified by evaluating the total error in the

balance sheet as of the end of the current period. The corporation

adopted SAB 108 in the fourth quarter of 2007 and recognized a

$58 adjustment upon adoption.

Note 2 – Summary of Significant Accounting Policies

The Consolidated Financial Statements include the accounts of the

corporation and its controlled subsidiary companies, which in general

are majority owned. The Consolidated Financial Statements also

include the accounts of variable interest entities (VIEs) for which

the corporation is deemed the primary beneficiary, as defined by

the Financial Accounting Standards Board’s Interpretation No. 46(R)

(FIN 46(R)) and related interpretations, but the VIEs are not material.

The results of companies acquired or disposed of during the year are

included in the Consolidated Financial Statements from the effective

date of acquisition, or up to the date of disposal. All significant

intercompany balances and transactions have been eliminated in

consolidation. Gains and losses resulting from the issuance of

common stock by a subsidiary of the corporation are recognized

in earnings as realized.

Foreign Currency Translation Foreign-currency-denominated assets

and liabilities are translated into U.S. dollars at exchange rates

existing at the respective balance sheet dates. Translation adjust-

ments resulting from fluctuations in exchange rates are recorded

as a separate component of other comprehensive income within

common stockholders’ equity. The corporation translates the results

of operations of its foreign subsidiaries at the average exchange rates

during the respective periods. Gains and losses resulting from foreign

currency transactions, the amounts of which are not material, are

included in net income.

Sales Recognition and Incentives The corporation recognizes sales

when they are realized or realizable and earned. The corporation

considers revenue realized or realizable and earned when persuasive

evidence of an arrangement exists, delivery of products has occurred,

the sales price charged is fixed or determinable, and collectibility is

reasonably assured. For the corporation, this generally means that we

recognize sales when title to and risk of loss of our products pass to

our resellers or other customers. In particular, title usually transfers

upon receipt of our product at our customers’ locations, or upon ship-

ment, as determined by the specific sales terms of the transactions.

Sales are recognized as the net amount to be received after

deducting estimated amounts for sales incentives, trade allowances

and product returns. The corporation estimates trade allowances and

product returns based on historical results taking into consideration

the customer, transaction and specifics of each arrangement. The

corporation provides a variety of sales incentives to resellers and

consumers of its products, and the policies regarding the recognition

and display of these incentives within the Consolidated Statements

of Income are as follows:

Discounts, Coupons and Rebates

The cost of these incentives is

recognized at the later of the date at which the related sale is rec-

ognized or the date at which the incentive is offered. The cost of these

incentives is estimated using a number of factors, including historical

utilization and redemption rates. Substantially all cash incentives of

this type are included in the determination of net sales. Incentives

offered in the form of free product are included in the determination

of cost of sales.

Slotting Fees

Certain retailers require the payment of slotting fees

in order to obtain space for the corporation’s products on the retailer’s

store shelves. The cost of these fees is recognized at the earlier of

the date cash is paid or a liability to the retailer is created. These

amounts are included in the determination of net sales.

Volume-Based Incentives

These incentives typically involve rebates

or refunds of a specified amount of cash only if the reseller reaches

a specified level of sales. Under incentive programs of this nature,

the corporation estimates the incentive and allocates a portion

of the incentive to reduce each underlying sales transaction with

the customer.

Cooperative Advertising

Under these arrangements, the corporation

agrees to reimburse the reseller for a portion of the costs incurred

by the reseller to advertise and promote certain of the corporation’s

products. The corporation recognizes the cost of cooperative adver-

tising programs in the period in which the advertising and promotional

activity first takes place. The costs of these incentives are generally

included in the determination of net sales.

Sara Lee Corporation and Subsidiaries 45